When I ask clients and prospective clients why their money is important to them it is usually because it provides freedom and financial security. In other words, they want to be able to live their desired lifestyle knowing they are not going to run out of money.

Financial security is important, they say, because they don’t want to be reliant upon anyone else in the future. They don’t want to have to call on children (so that they are a burden) or the State (because who knows what will be available from the State in the future?).

So if you are thinking about your retirement, here are 12 actions you can take to make sure you will not have to rely on anyone else.

1. Work out how much you have and how long it may be reasonably expected to last.

Take the time to run an audit on your personal finances: what is the current value of savings, pension, ISAs and investment accounts? Do you have Premium Bonds or other savings you might have forgotten about?

As a rough calculation, allowing for inflation and prudent investment return assumptions, how long do you think the wealth you have accrued might last based upon your lifestyle costs (see point 3)? If it is less than 30 odd years you may find money might get tight in the future, particularly if you are drawing down capital from pensions and investments during stock market corrections.

2. Have a 2-3 years cash fund

It is always a sensible approach to have an emergency fund. That is cash you can call as and when unexpected costs arise: the boiler needs replacing, children need financial assistance or medical bills arise.

There is no hard and fast rule but in retirement, a sensible approach may be to have 2-3 years worth of expenditure available. This might seem like a lot of money and, when considering historic equity returns during bull and bear markets, there is evidence to say that even during the most severe corrections a high equity allocation to your wealth will grow at a greater rate over the long-term even allowing for withdrawals taken during market downturns.

However, this does not take into allowance human behaviour in the face of falling capital markets. If you feel like you may be liable to worry your wealth is taking too much of a hit during a stock market crash (and for many people, this is likely to be a reality despite what they may tell themselves before the event) having cash available to allow pension and investment wealth to recover free of withdrawals would be a prudent approach.

3. Take an appropriate amount of equity risk (probably more than you think)

Investment markets can be scary and unpredictable places but a truth self-evident is that over the course of time equity markets (shares) provide a greater return on capital compared to any other asset class.

With retirement being feasibly as long as your working life you are likely to need your wealth to grow sufficiently to meet your living costs over many decades.

There is no hard a fast rule to how much is an appropriate amount of shares to own in a portfolio but as long as you have the financial capacity and emotional resilience to survive short-term shocks the more shares you own the more future proof your wealth, and by extension, your ability to maintain your desired lifestyle.

4. Know your lifestyle costs

I’m often asked how much is an appropriate amount of wealth to have built up for retirement but as alluded to above in point 1 above it really depends upon the cost of your lifestyle. If you have the earnings of a Premier League footballer but have the expenses to match it you will need to have many millions in the bank if it is to last a long retirement. On the other hand, if you prefer the simple life the amount of wealth you need is likely to be quite modest.

5. Don’t Give Money Away Needlessly.

I’m not referring to charitable donations or money you may choose to give to others in need. What I’m referring to is paying more for everyday goods and services than you need to. Utilities, general insurances and many food items are commodities so it is pointless spending more than you need to. Take the time to review your contracts to make sure you are on the best deal and repeat the exercise when they renew. Here’s a good resource for it*

6. Don’t overspend. Budget and stick to it.

We tend to overspend when we don’t have a budget or when we don’t know what we actually spend our money on. This is especially the case in the Chip&PIN and One Click Ordering world which is ubiquitous now.

A helpful process to go through is to look at your expenditure and see what is actually valued and what is superfluous. I’ve previously compared it to the fats and proteins in your diet.

7. Be prepared to be flexible with your spending during market downturns

You may also need to make allowances during market falls and be flexible with your spending. If you are pushing the budget, particularly in the early years of retirement and it coincides with a stock market crash it may be prudent to reign the spending in during the following year to allow your portfolio to recover more quickly. This is also where the emergency fund in point 2 comes in.

8. Make allowances for predictable one-off costs (car, weddings, luxury holidays)

You probably have some expectations of larger one-off expectations at some point in the future but you don’t know precisely when that will be: you hope the children will get married and have kids of their own at some stage but, as the Supremes sang, “you can’t hurry love” (or babies).

You will probably have intentions to replace cars and, perhaps, have a larger holiday but both are vague in the time frame and budget.

Whatever you can foresee on the horizon you should make allowances for them in your cash flow planning so you can understand the implications on your overall wealth.

9. Make allowances for inflation

Inflation is the silent wealth destroyer over the long-term. A 2% increase in the cost of living over a year doesn’t feel like much but added together over time the cost of your lifestyle will most likely be a considerable strain on your financial resources.

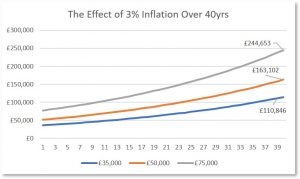

The chart below shows the effect of 3% pa inflation (the long-term average) on 3 different annual expenditure budgets (£35,000, £50,000 and £75,000 pa) over a 40-year retirement. Even a lower cost lifestyle is 3x more expensive in real terms after four decades.

10. Don’t panic in market downturns & Don’t Try to Second-Guess Markets

If you are investing for the long-term you must expect stock market crashes, they are an essential and inherent part of investing. It is simply not possible to have above inflation returns without a degree of risk.

It is how you react to market downturns that separate the successful investors from the unsuccessful. Those who try to time market movements or who get out when the going gets tough are the ones who learn the painful lessons and may never find the courage to invest again.

11. Exchange your pension in full or in part for a guaranteed income if you are nervous amount investing in stock markets

Annuities (a guaranteed income for life in exchange for an accrued pension) aren’t particularly popular income options for retirees. They are seen to be a gamble on life expectancy (they can’t be passed onto children) and the amount of income available is much lower than it was 10 plus year ago.

However, if you are a nervous investor exchange capital risk for a guaranteed income for the remainder of your life may be a sensible decision to take. This would especially be the case if you don’t have anyone you would wish to pass your pension wealth on to.

12. Give yourself time to build up sufficient wealth.

As time has a significant compounding effect on inflation, so it does for the ability to build up sufficient wealth to fund your ideal lifestyle. In simple terms, £100 saved a month with a 5% interest rate will grow to £15,757.

Increase the monthly saving to £500 a month and the balance after 10 years grows to £78,800.

And if you can eliminate non-essential expenditure and save £1,000 a month, after 10 years your future self will have an additional £157,000 with which to fund their ideal post-work lifestyle.

So retirement may feel like some time off but the more you can do now to take control the greater your freedom and security will be when the time comes.

If you would like to discuss how you can make sure you have sufficient wealth so that you don’t run out of money in retirement contact me.

*No affiliation and no responsibility is taken for the content of external websites.

Photo by Philip Veater on Unsplash