My daughter is learning to read and write. For a six-year-old, she seems to be doing pretty well and has a good grasp of one and two-syllable words. But, of course, it’s not easy when you are learning to read and she has a long way to go before she can do so fluently on her own.

When you have been reading for many decades you forget that you could never do it. The same can be said for kicking a ball, learning to ride a bike or playing a musical instrument. Indeed, any skill that you have learnt over a long period.

I remember learning to drive; a combination of a lack of skill, teenage angst and protective parents didn’t make a productive combination but with time (and a failed driving test) I went from knowing and hating that I couldn’t do something to eventually not having to think about what I was doing.

Small Practices Repeated Overtime

As Matthew Syed writes in his compelling book, Bounce, the mastery of a skill requires small practices repeated purposefully over time so that it becomes second nature. Once learnt you can’t go back to square one.

Small practices repeated over time are the keywords here. The commitment to doing the little, unglamorous things, over and over ad nauseam.

“Success is nothing more than a few simple disciplines, practiced every day.”―

If you want to be an Olympic champion or a best-selling writer you have to keep turning up, away from the spotlight and do the little things that nobody else wants to do. It’s what the War of Art writer, Steven Priestfield describes as ‘resistance’; overcoming the excuses for not doing the work. Doing the 1% that the 99% won’t do.

The same is true in nature. Trees grow over decades through the repeated effect of rain, sun and oxygen. Species evolve over millennia by the repeated reproduction of successful DNA sequences that can adapt to changing environments.

Good things happen slowly. The slow but positive creep of change in our world (literacy, emancipation, eradication of disease, freedom from poverty) didn’t come overnight but through the small, repeated actions of the dedicated. Nelson Mandela was an (understandably) angry, fearful political activist when he was imprisoned on Robben Island, 27 years later he was released as a man who had learned to forgive his prison guards and former political enemies so he could lead a nation to peace.

Good habits beget good habits. Discipline begets discipline. Compounding needs time.

And so it applies to our money.

Getting rich slowly is a more reliable route to wealth than the get-rich-quick options that attract our attention. This is true of the entrepreneur who keeps turning up in the early days when things are going against her and nobody knows she exists. It is true of the diligent saver who repeatedly puts small sums away each month at the cost of other more exciting ways of spending his money.

You may recall from your school days the difference between simple interest and compound interest. If those days are a distant blur here is a quick refresher:

- simple interest is the payment of interest on the original sum each year (if the original sum is £1,000 and the simple interest rate is 5% each year £50 will be added to the balance so after 10 years the total balance will be £1,500).

- Compound interest, on the other hand, is the payment of interest on the original sum and accruing interest. So, as in the example above, interest in the first year will still be 5% but in year two it will be 5% of £1,050; £52.50. Compounded over 10 years the £1,000 becomes £1,628. Over 25% more without any extra work or risk.

Your Money Needs Time

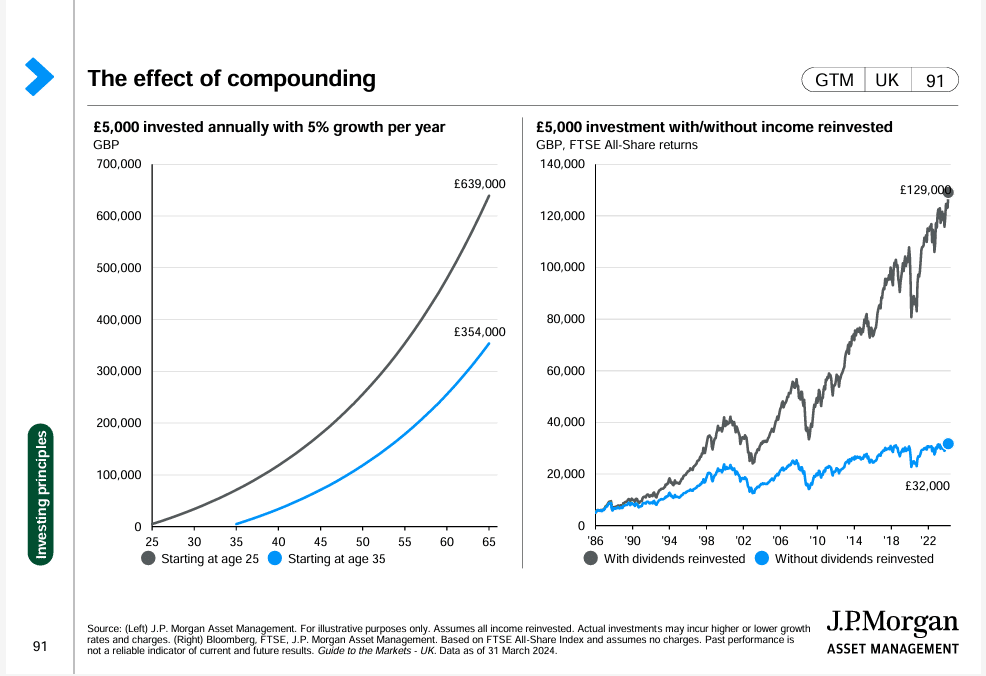

The slide below from JP Morgan shows on two charts the power of repeated actions and time. The first looks at the effect of compound interest on wealth over time. The second shows the compounding effect of re-investing dividend income to buy more shares over time.

The difference in both is staggering. £285,000 by saving ten years earlier and £97k by allowing the slow but steady effect of small income payments repeatedly being re-invested.

If you are reading this thinking “Why didn’t I start this years ago?!” Firstly, you are not alone, but it is better to get started late than never. If you are 50 now you may be looking at 10-15 years of work before you wish to retire, with a disciplined approach to investing you can still accrue a significant sum of capital.

Even if you are retired you may have multiple decades of drawing on your money to fund your lifestyle. The majesty of compound interest can provide the ballast to support you as long as you live.

Even the Geniuses Have to Wait To Get Rich

Warren Buffett is the greatest financial example of the power of repeated actions, time and compound interest. In most people’s eyes, he is the most successful investor of all time. His £80bn+ fortune isn’t gained through any get-rich-quick schemes. Rather it is by taking simple and sensible steps over time.

He started investing in his childhood and has kept on doing it ever since but he didn’t amass his first $1m until he was 30. His first $1bn came 20 years later. 99% of his wealth came after he was 50 and 78% after he was 66. Even the geniuses have to wait to get rich (or perhaps it’s the patience and discipline that makes them geniuses).

“My wealth has come from a combination of living in America, some lucky genes, and compound interest.” – Warren Buffett

I’m not saying that you too can build your wealth up to the sterling equivalent of $80bn by your late 80s! But who even needs that much?!

All you need to do is to acquire enough wealth to provide financial freedom and financial security. How much is enough is unique to you but with patience, discipline and a prudent approach financial success can be achievable.

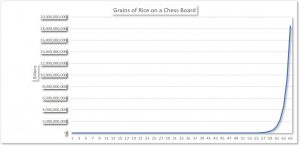

Some Rice Please Your Majesty

I’ll leave the final word on the power of compound interest to an Indian legend. A king challenged a visitor to a game of chess. If he won, the king offered any prize the visitor wished for; the visitor simply requested rice but placed very specifically on each square of the chessboard: 1 on the first square, two on the second, four on the third, and so on. Having lost the game the king was true to his word, but soon came to realise his folly: the exponential increase of doubling the rice on each square would have resulted in owing 18,000,000,000,000,000,000 grains of rice.

(click the image to enlarge)

That, in one visual, shows the effect of compound interest.

If you would like to know how you can benefit from the power of compound interest contact me.