When I was young I remember having a book of sketches that, at first glance, appeared to be random scribbles. The subject was only clear when the observer was told what it is. The context was everything.

Take the images below. Have you got any idea what they are?

Unless you happened to have the same book, or you are particularly imaginative I expect they appear to be random lines. In fact, they are a worm’s eye view of someone looking through a magnifying glass, a man wearing a bow tie caught in a lift and a postman’s eye view of an angry dog.

Admittedly, they are fairly whimsical but hopefully you can see what I mean.

But what has this got to do with retirement planning?

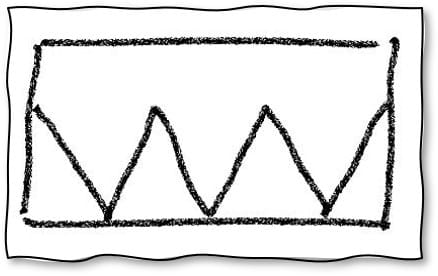

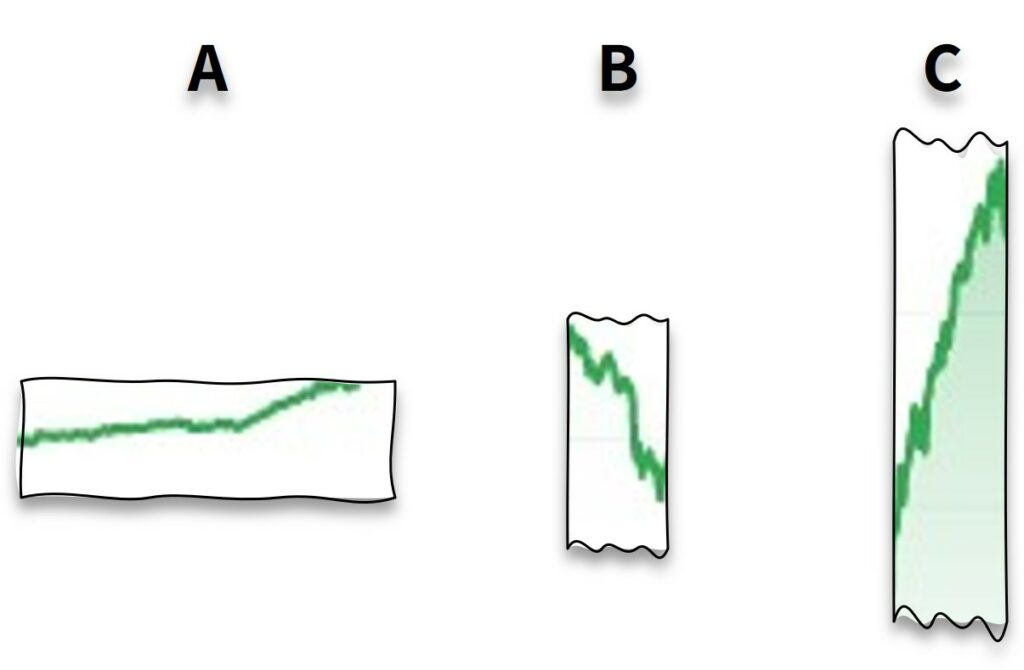

Context also matters in investing. People view the attractiveness of an investment based on the context from which they are looking. Take these three options for example. Which one do you prefer?

Most people will probably look at A with indifference. It’s flat lining; neither good nor bad. B on the other hand is going the wrong way, it looks like an investment that would lose you money. Whereas C looks like a good investment with an impressive upward trajectory.

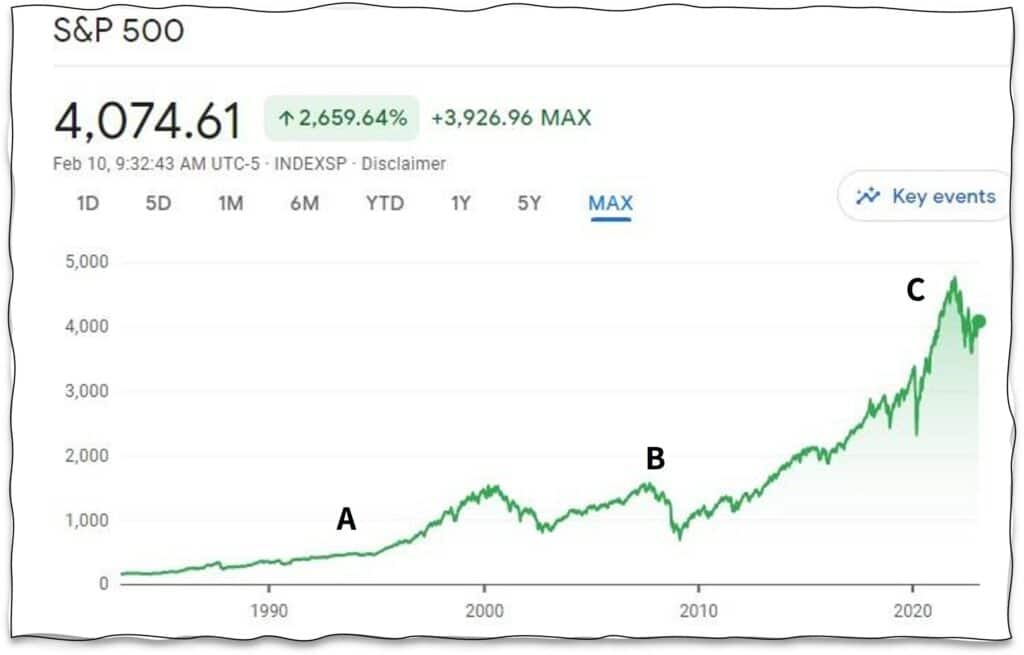

When you zoom out and look at the bigger picture you will see they are all the same investment, the S&P 500, the stock market made up of the 500 largest public companies in the US. They are snapshots of different points in time as shown below.

Our experiences influence our willingness to expose our money to investment markets. Those who start their investment journeys immediately prior to a stock market crash (option B) are often inhibited from doing so again. They tend to be “once bitten, twice shy”.

Those who start their journeys at the point of recovery (option C) and enjoy early success are more likely to remain bullish even during subsequent falls; they have positive experiences to draw upon.

The point you enter the stock markets is most likely to be dumb luck, coinciding with the time of your life you have surplus money to invest, you join your workplace pension scheme or perhaps inherit money. The negative experiences of our parents who suffered during previous market crashes also influence our views on investment risk.

By understanding the nature of stock markets; a long-term upward trend interspersed with periods of short-term losses, we are more likely to make informed decisions with our money. For the money that we will need in the short-term we will know that stock market investing may not be appropriate. For the money that we can leave for the long-term we will tolerate short-term losses in the knowledge that they are a blip on a longer-term growth trajectory.

The same context is needed when we intend to draw down from our pensions and investments to fund our retirement lifestyles. Knowing the volatile nature of the markets may guide us away from them if we can’t afford the losses. Conversely, if we can afford the losses, remaining invested in the markets can help our funds support our income needs and perhaps even leave enough to pass on to children.

If you liked this article you may also like this one in which I use the World Cup and a Betting Exchange to explain stock markets.

Source: Google Finance