Over the years that I’ve been a financial planner, I have had many conversations with clients and prospective clients about their investment experiences. Most people will have some story about how they’ve been burnt by an investment, often it coincides with a significant stock market correction; the tech bubble bursting, the 2003 crash, the Credit Crunch are the ones that are most recent in people’s memories.

The response people take to such experiences is one of two:

- “I can’t take this, stock market investing is too risky. I’m getting out.”

- “Well this is unpleasant but I’m in this for the long run so I’m holding on.”

Like a scene from Jaws, the ones who get out are the ones who find it difficult to get back into the water again.

But unlike Jaws, the stock markets themselves are harmless. How can they be possibly be anything else? They don’t have cognitive function, they are simply an exchange for buyers and sellers of company shares. The value of which fluctuates on a daily basis according to the aggregate opinion of a fair price of any given share by all market participants.

The harm is done by those who decide they can’t be in the stock market any longer and turn a fall in value into an actual capital loss.

Sometimes the behaviour is driven by fear of losing more/all of their money but history shows us that market declines have never been anything more than temporary.

Or it may be that the need for capital coincided with a stock market correction. In which case the decision to invest in the first place was ill-considered or ill-advised. If you can’t afford to suffer short-term falls in value and are likely to need your money within a five-year timeframe then the investment markets aren’t for you.

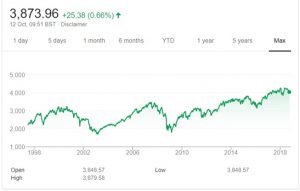

The chart below shows the returns of the FTSE All Share over the past 20 years. You can see the declines (ouch!) have tended to be short and sharp and followed by longer and greater recoveries. The index has doubled in value over the past 20 years despite all the bad news we have experienced from 9/11 and the ensuing Gulf War, multiple other geopolitical events and a major global banking crisis that led to a sovereign crisis.

So the patient and disciplined have been rewarded whilst the panic-stricken and pessimistic have been left to nurse their wounds and decide stock market investing isn’t for them.

Sadly, the Negative Nellies get burnt twice; if you don’t invest in shares your wealth loses value due to the silent creep of inflation. And, whilst the savvy investor’s money would have doubled (even without the effect of re-investing dividends) the saver’s cash would have nearly halved in real terms over the past twenty years.

But it isn’t always the fault of the individual investor. Sometimes (too often) they are ill-advised by less scrupulous money men who ‘advise’ investment products that are wholly appropriate.

That, however is nothing to do with stock market investing. As explained above, the stock markets can only reflect the aggregate views of all market participants and rise or fall accordingly.

Risk (as measured by volatility) are inextricably linked. If you want to benefit from the long-term returns of the stock markets you have to accept short-term corrections. Anyone who tells you it is possible to have higher returns with lower risk is the shark you need to escape from.

You might have also been burnt by company mismanagement (think Enron, RBS, Carillion) but that is problems at an individual company level that can be avoided by appropriate diversification.

Whatever your lifetime priorities it is likely there will be a need to invest capital in the stock markets to a greater or lesser degree. And, as such, stock market investing will be a rewarding experience pursuant to you achieving what matters most to you as long as:

- you accept that markets do fall but know they will recover.

- you only invest capital that won’t be needed in the short term.

- you believe that the future will be better than the past (because it has been so on all meaningful measures so far) and,

- you believe innovation and the entrepreneurial spirit of capitalism will make today’s companies (as a whole) better.