When we think about retirement risks, stock market crashes and inflation often come to mind. But one of the most significant and least understood risks is something called sequencing risk — the danger of stock market crashes occurring at the point of retirement.

This article explains what sequencing risk is, why it matters, and how you can protect against it, using the example of Tim and Tina, a ficitious couple on the brink of retirement.

Meet Tim and Tina

Tim and Tina are both turning 60 next year and plan to retire together. Tim is still working and earns £60,000, while Tina manages the household. Between them, they have a comfortable lifestyle that costs approximately £30,000 a year, a figure they hope to maintain for the rest of their lives, adjusted for inflation.

As is typical of couples their age, their pension wealth is in Tim’s name, invested in a medium-risk portfolio of 60% global equities and 40% bonds. Tina holds £50,000 in Premium Bonds, inherited from her mother. They both have full State Pensions and are hoping for a long retirement, possibly lasting 40 years or more, thanks to advancements in medicine and healthcare.

What is Sequencing Risk?

Sequencing risk (also called sequence of returns risk) refers to the risk of receiving poor investment returns at the beginning of retirement.

If your portfolio falls in value just as you begin withdrawing from it, the impact can be devastating. Each withdrawal locks in the loss, leaving less capital to recover when markets bounce back. Even if the average return over time is decent, the order of returns makes all the difference.

Three Scenarios, Three Very Different Outcomes

What follows is three projections under three different investment scenarios to illustrate the impact of sequencing risk:

1. No Market Crashes

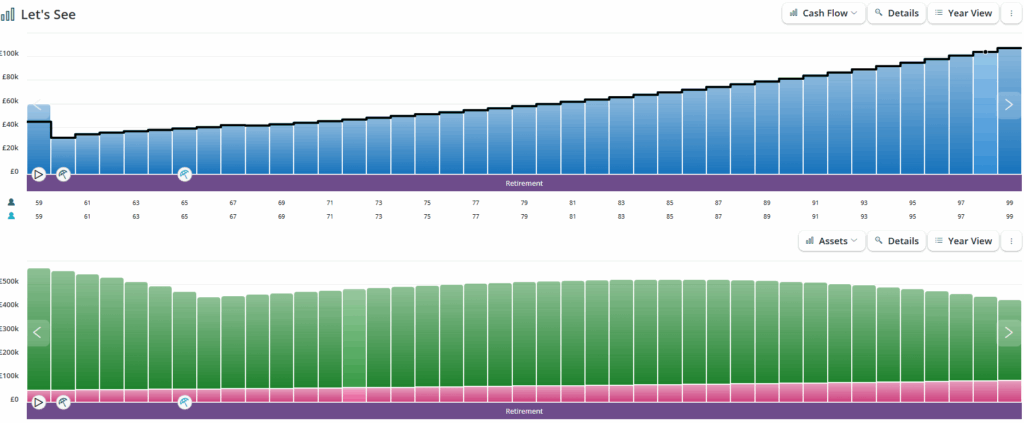

This scenario assumes a smooth, consistent return of 3.8% per year after charges. The charts below show the direction of their money; the blue chart represents the inflows of money over time. The lower chart shows the effect their income and expenditure has on the pension (green bars) and the Premium Bonds (pink bars).

Here, Tim and Tina never run out of money. The pension fund gradually declines, but their income needs are met all the way to age 100. The Premium Bonds are mainly left untouched. However, from a planning and advice perspective, it is entirely unrealistic; even if the average investment return is 3.8% pa, we know markets don’t go up in a straight line. It serves as a useful baseline when comparing it against the two other scenarios.

2. Crashes Every 10 Years (Starting in Year 6)

This model is more appropriate; it introduces a market crash every decade, after five years into retirement. Each crash follows a three-year pattern: -10.5% in the first year, -14.15% in the second, followed by a 30% recovery. This replicates the volatility of the markets between 2000 & 2003 when the tech bubble burst, 9/11 occurred, followed by the second Iraq war. It was a very uncertain time politically, socially and economically, and the markets reflected this.

Despite the volatility, the couple’s pension lasts nearly to the end of their retirement. Having several strong years at the beginning helps cushion the downturns later. However, there is still a risk of running out of money, or as a minimum, having to make unwanted lifestyle adjustments. Note, the Premium Bonds (pink) are there as an emergency fund, which would inevitably be spent too.

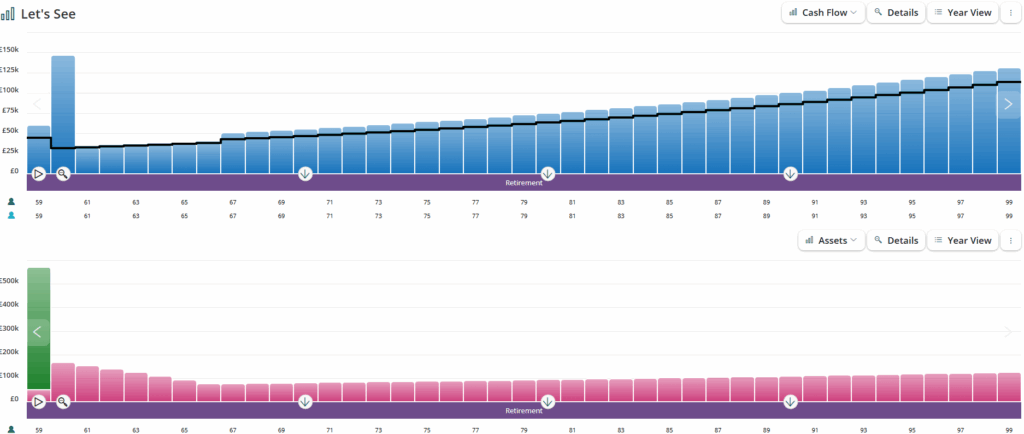

3. Crash at Retirement (Sequencing Risk Scenario)

But what if Tim and Tina are really unlucky with their timing? What if it coincides with a period of market falls, as has been experienced over the past five years with COVID, the Cost of Living crisis, and Trump’s Tariff announcement?

This is where things go wrong. The same crash pattern hits, but this time it starts in Tim’s first year of retirement. As a result, his pension fund runs out in his early 90s—much earlier than in the other crash scenario

This is sequencing risk in action. Even though average returns are the same, the timing of the losses shortens the pension’s lifespan.

How to Avoid Sequencing Risk

Several strategies can help reduce sequencing risk:

- 1. Build a Cash Buffer

Holding two to three years’ worth of spending in cash or near-cash assets can allow you to draw from this buffer during market downturns, instead of selling investments at a loss. Tina’s £50,000 in Premium Bonds, for example, could serve this purpose.

Using this buffer during bad years and replenishing it during good years can help stabilise the withdrawal pattern. Spending cash first in retirement also gives time for the pension fund to continue to grow unencumbered by withdrawals.

- 2. Flexible Spending

Consider adjusting your spending slightly in response to market performance. Reducing withdrawals during downturns and increasing them when markets are strong helps to preserve the pension fund. This flexible approach can add longevity to your investments without sacrificing your quality of life. It requires acceptance that adjustments have to be made in some years, but it may be a necessary case of “losing the battle to win the war”.

- 3. Diversification and Glide Paths

While Tim’s portfolio of 60% equities and 40% bonds is already diversified, it may be worth considering a “glide path” strategy; gradually shifting from higher-risk investments to lower-risk ones as retirement progresses.

However, you need to balance this carefully. Taking a too-conservative approach too early can limit growth and cause the fund to underperform over the long term—especially during withdrawals.

- 4. Use Guaranteed Income Where Possible

Both Tim and Tina have full State Pensions, which will provide a baseline of guaranteed income. Purchasing an annuity can further reduce the need to draw from market-based investments during volatile periods.

In an alternative plan, Tim uses his pension to buy an annuity at age 60. He takes 25% of the pot tax-free and uses the rest to buy an annuity paying £16,738 per year, rising by 3% annually. If Tim dies first, Tina will continue to receive the full annuity for the rest of her life.

You can see that there is more than enough income to meet their life needs, allowing for inflation. The income replaces the pension (green), and the provider converts the tax-free lump sum into cash to cover additional costs.

Why Annuities Eliminate Sequencing Risk

Annuities, unlike drawdown strategies, do not fluctuate with market returns. Here’s why they provide protection:

-

Fixed Income: Income is guaranteed regardless of investment performance.

-

No Portfolio Withdrawals: There’s no risk of selling investments at a loss.

-

Inflation-Proofing: Increases in income protect against rising costs.

-

Longevity Protection: Income lasts for life — no matter how long retirement lasts.

-

Spousal Protection: Tina is fully covered after Tim’s death.

In Tim and Tina’s annuity model, they have surplus income most years, and by age 99, still retain nearly £55,000 in liquid savings.

Are There Downsides to Annuities?

Yes, annuities aren’t suitable for everyone:

-

You give up access to the capital; there’s no going back once the annuity starts.

-

When the last survivor dies, the annuity provider keeps any unpaid income—unless a guaranteed period protects it.

-

Inflation protection reduces the starting income. For many people, the higher costs come during the active years of retirement, so a higher starting income may be preferable.

However, for those seeking stability and wanting to eliminate the risk of running out of money due to poor market timing, annuities offer valuable protection.

Blended Strategies

Tim and Tina could consider using part of the pension for an annuity (to cover essential costs) and leave the rest invested (for flexibility or to leave a legacy to children). This approach guarantees the essentials while still allowing room for growth.

Conclusion: The Right Income Strategy Matters

Tim and Tina’s situation shows just how damaging sequencing risk can be. Two identical portfolios with the same average return produced dramatically different outcomes depending on when losses occurred. Creating strategies to mitigate this risk is a crucial consideration in retirement planning.

If you’re unsure or would like to explore your retirement options, please do get in touch.

Please note that the scenario used in the example of Tim and Tina was kept simple to explain the relevance of sequencing risk. It didn’t allow for additional expenditure, forseen and unforeseen, such as emergencies, replacing cars, supporting children or later life care needs. It also didn’t consider the release of capital from property.