It used to be easy; you’d work all your career for one company, get to 60 or 65 then retire with a healthy final salary pension plus your State Pension. Your retirement income was taken care of.

Then, thanks to medical advances and a greater understanding of what is and isn’t good for us, we all started living longer. That’s great for living a rich and full retirement but not so great for the companies and the State which have to pay pensions for longer.

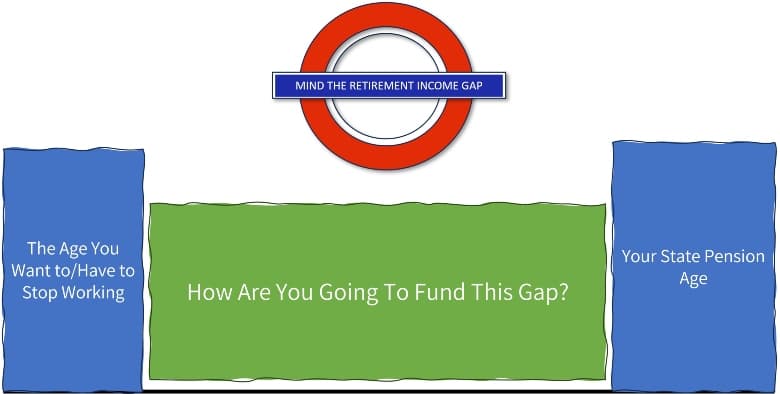

Something had to change. Two things had to change, actually: companies closed their generous final salary pensions and the Government pushed back the State pension age. Initially, this was in 2010, delaying the State pension age for women to 65 (much to the chagrin of WASPI women; it’s a State benefit, not a ‘pot’ with your name on it!). It was then phased to 66 between 2018 and 2020 and is planned to rise further to 67 from 2026 and then 68 from 2044.

The Retirement Income Gap

This means that today’s 64-year-olds are likely to have to wait until 66 before they can receive their State pension. If you are in your mid-40s you have another 23 years to wait. Leaving aside the question of whether it is possible to live on the State pension alone (currently, £10,600), how do you fund your lifestyle until your State pension age?

The obvious solution is that you have to keep working, but maybe you don’t want to. Perhaps you have had enough; there are lots of things that working and family life have prevented you from doing and you want to get on to them while you are fit and healthy.

Or maybe worse, you would carry on but can’t. Perhaps you are mentally or physically incapable of carrying on and either your partner, doctor or your employer is pressuring you to retire.

Filling The Gap

Assuming continuing to work isn’t an option, how do you go about filling the gap?

Hopefully, because you are reading this you aren’t relying on the State pension alone. You may have one or more of the following options available to you.

Old Company (Final Salary) Pensions

If you have been working long enough you may have deferred company pensions from earlier in your career. These promise to pay a guaranteed income for life, increasing in line with inflation. Additionally, they provide a tax-free lump sum and an income for a spouse or civil partner on death.

Depending upon the terms of the final salary pension, the retirement age is likely to be 60 or 65, though some, like the NHS and Teachers’ pension, have also increased the retirement age relating to more recent service.

If the retirement age coincides with your planned retirement age that will help reduce some of the gap. If, however, you will have to wait for it to commence, one option may be to receive it early. When final salary pensions are taken early a reduction to the income and lump sum is usually applied. It is not a straightforward decision, so you should not read this as advice but receiving a reduced income sooner may be worth it; not only will it help fill the gap before your State pension age, but it also transfers income from the scheme to you which reduces the risk of losing it when you die (or half of it if you have a surviving spouse or partner).

Savings

If you have saved diligently during your working life you may have accrued a meaningful pot of savings. Or, you may have received an inheritance or a windfall from elsewhere. Savings act as a beneficial source of lifestyle funding for two reasons: they are not subject to the same daily changes in value that investments are and they don’t increase in line with inflation so the value is eroded over time.

It is wise to maintain a minimum savings balance to ensure you can cover unforeseen costs: home or car repairs, bailing out children or medical expenses, but for the reasons mentioned in the paragraph above, it makes sense to use savings to fund an income gap. There is no hard and fast rule about how much to keep in savings for emergencies, and in retirement where there may be other assets to call on, an emergency fund can be lower than during working life when a lost income due to an accident or illness can have more serious financial repercussions.

Shares ISAs/Share Portfolio

After you have considered any deferred company pensions and savings, the next on the list is to use investments such as Share ISA, investment portfolios and single company shares that you may have acquired over time.

Single-company shares are inherently riskier than a portfolio invested in funds. You may benefit from a greater return compared to other assets but their value may also fall considerably. Reducing this exposure in retirement may be prudent and the proceeds can be used to fund an income shortfall. But, do be mindful of any capital gains tax liability, particularly for shares that have been held for many years, especially with the annual CGT allowance being only £6,000 in 2022/23 and falling to £3,000 after 6th April 2024.

Workplace/Private Pensions

If all other options have been used up or are unavailable, you have hopefully accrued personal pension plans either through your employer or privately. Personal pensions (including Stakeholder pensions and SIPPs) are intended to provide an income in retirement, so why am I suggesting leaving them until last?

Personal pensions have the unique benefit of being outside of your estate for inheritance tax purposes and, under current rules, if you die before 75, can be paid as a lump sum to a beneficiary free of any tax. Where possible, it is therefore worth leaving them to grow while other assets are used to fund the retirement income gap.

When you do need to access them you have several options: an annuity if you prefer the idea of a guaranteed income or income drawdown if you wish to have more flexibility on how and when you receive the income and you don’t wish the value to be lost on your death.

The ideas provided above are just that, ideas. Everyone’s situation is different but hopefully, it has helped you think about how you can retire on your terms and not have to work until your State pension age. If you would like to discuss your options in greater detail please do get in contact.