A retirement pot of £1m is a target for many people. It might be that not much thought has gone into arriving at the figure, other than it being a nice round number and an aspirational target but it is at least a target to aim for.

Everybody’s starting position will be different; everyone will be working to a different retirement date, have a different amount saved and will receive different investment returns. Even so, it can still be helpful to have a guide.

Ignoring whether it is a suitable retirement pot to aim for, to work out how much you need to save each month to build up £1m, I used the ‘Am I Saving Enough’ calculator I built (to play around with it yourself get your copy here).To make the analysis simple I used some base assumptions:

- It is targeting a pot of £1m.

- The average annual investment return is 7% pa. This is consistent with an investor with a medium to high attitude to risk, actual returns may be lower in the future.

- The years to retirement are grouped into five-year periods, starting with five years to retirement and up to forty years to retirement.

- It is agnostic as to whether your existing pot is in savings, ISAs, pensions or a combination.

The Results

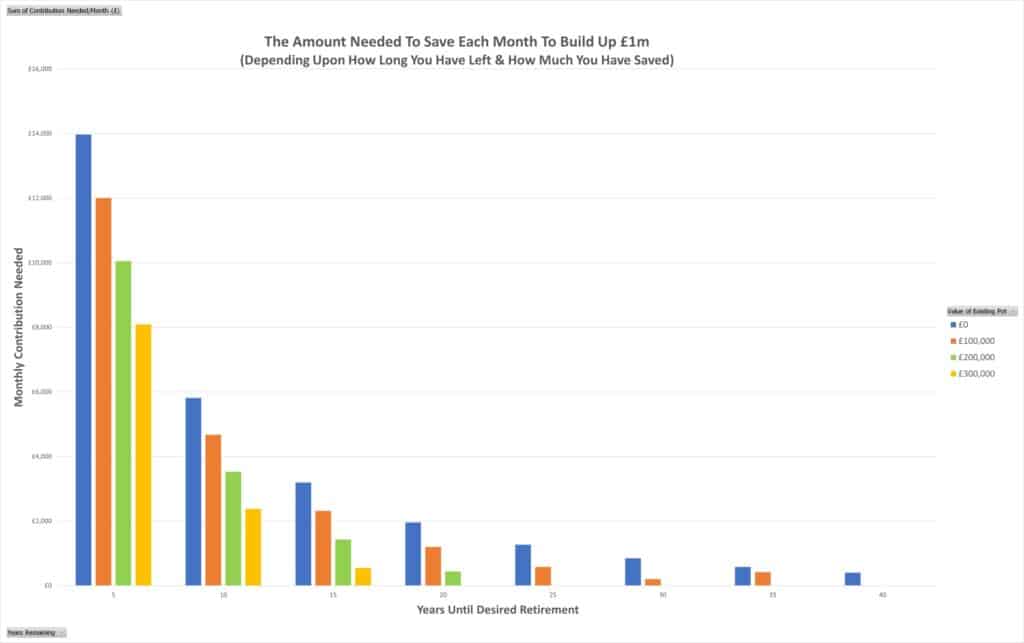

The chart below shows how much you need to save each month to build up £1m depending upon the current value of your pot and how long until you need to access it (click to enlarge).

The blue bars assume there is no current pot; the orange bars have a starting pot of £100,000; the green a pot of £200,000 and the yellow a £300,000 pot.

The key points are:

- Such is the power of compound interest, the longer you leave it the much more you have to pay each month to build up a pot of £1m.

- If you have not managed to save anything and you want to stop work in 5 years you need to save a whopping £14,000 a month.

- On the other hand, if you are young but have been a diligent saver and built up £100,000, if you did nothing else you would have £1m after 40 years (assuming a 7% return).

- If you are mid-way through your career and looking at another 20 years of working life, a pot of £200,000 will grow to £1m in that time with a 7% return.

- If you are heading towards retirement you require a pot in excess of £300,000 to accrue £1m within 20 years. With five years to go, you will still need to save over £8,000 a month.

- Looking at these figures another way, the more aggressive you can be with your retirement planning (and accepting you may have other priorities in your life, kids for example), the sooner you will be financially free. Being financially free is another way of saying you can do what you want when you want.

- If you are in the fortunate position of having enough time and a big enough pot to be on target to accrue £1m, don’t assume it is OK to stop. Continuing to contribute will bring forward your financial freedom date or give you even more security when you retire. It also protects you if investment returns are lower than expected.

Remember too, how much is enough for you to live on in retirement is unique to you. The greatest influence on having enough is the lifestyle you wish to live in retirement and how long you live for. The bigger those two numbers the bigger the retirement pot you need and/or the longer you need to work for. Naturally, the longer you work the more time you have to build up your pot, and the less time you have to take from it.

If you want to work out what this means for you in your situation, don’t forget to get your copy of the savings calculator. Important caveats do apply, notably, it is a simple calculator that does not take into account tax, changes to pension and investment regulations and the volatility inherent in investment markets. Please use it as a guide rather than a crystal ball.

What About Debt?

The calculator considers saving and investing; it doesn’t take into account reducing debt that you may have. The decision to reduce debt or save for the future depends upon your unique situation; for some, it may be more effective and preferable to reduce debt before they save for the future. For others, the reverse may be true.

I have written here about what to consider if you are unsure whether to reduce your mortgage or invest.