I’m often asked “how big does my pension need to be?”, or words to that effect.

A simple question to which a simple but not very helpful answer is: It depends

Not helpful but true.

Think of it this way: if you enjoy the life of a professional footballer earning £250,000 a week and you expect to maintain your lifestyle after your career you are going to need a lot more pension and other wealth than a traveller who has little but wants for nothing.

Not only that but if your football career finishes when you are 30 you are looking at a retirement period of 60 odd years. 60 years that you will have to fund. And the various football broadcasters don’t need as many pundits as there are ex-pros so you are going to have to fund that lifestyle from your own money.

And regardless of the comparative wealth, I wonder who is happier, the multi-millionaire always trying to keep up with his or her peers, or someone such as John Treagood, a well-known feature of the East Devon landscape, who has spent the last 40 years shunning the modern world but wouldn’t change his freedom for anything.

If you are reading this it is more than likely your wealth is somewhere between that of a professional sportsman and a traveller but the cost of your lifestyle is uniquely yours. And, as such, the pension and other wealth you need to accrue will be different from your neighbour, colleagues, friends for family.

A Back of An Envelope Calculation

It is often said that financial planning is part science and part art: the technical and numerical aspects of it fit the science description but the creation of a plan to achieve your ideal lifestyle requires the right-hand side of the brain.

The combination of the two elements is why it makes it impossible to provide a one-size-fits-all answer to generic questions such as ‘how big does my pension need to be?’

However, as long as you know how much you spend each month you can get a ‘back of an envelope’ estimation of how much wealth you will need when you choose to retire. Follow the steps below:

- What is your current income before tax? For couples, you can use joint income if you share your finances.

- Deduct any savings that you are currently making as they will, in all probability, cease at retirement.

- Deduct any mortgage interest but only if you know your mortgage will be paid off by retirement.

- The resulting figure is your monthly cost of living before tax. We use pre-tax figures because, if the cost of your lifestyle requires an income that would be taxable based on today’s tax thresholds it is likely that you will pay tax to some degree in retirement.

- Multiply this figure by 12 to get your annual pre-tax cost of living.

- Next, we need to allow for the effect of inflation on living costs. The UK inflation rate has averaged 3.2% a year* for the past 35 years so we can use that has an assumption for future inflation.

- Increase your annual lifestyle cost from step 5 by inflation for the number of years until you intend to retire. For example, if you wish to retire in 10 years’ time the formula would be: annual expenditure (£) x 1.032 to the power 10.

- The result is what your future lifestyle cost is forecast to be when you wish to retire.

- Next, you have to work out how much capital you need to fund this annual expenditure without the risk of running out of money in retirement.

A standard annuity rate for a 60-year-old is currently 4.5%** so you can either use this figure for the next calculation but, if you would prefer not to be restricted by an annuity, you may choose to keep it invested. In which case, an accepted income from a portfolio to prevent it from running out in your lifetime is between 3% and 4% pa.

So, with your future annual lifestyle cost and your income rate you can work out how much capital you need to support the expenditure: You do this by dividing the expenditure figure by the income rate. For example, if our annual income requirement is £50,000 we divide it by 0.045 to give a required capital value of £1.11m if we intend to buy an annuity.

If you want more flexibility and control of your money and only withdraw capital at a safe rate of 3.5% pa the required capital increases to £1.43m

Let’s make it easier to follow by way of a worked example:

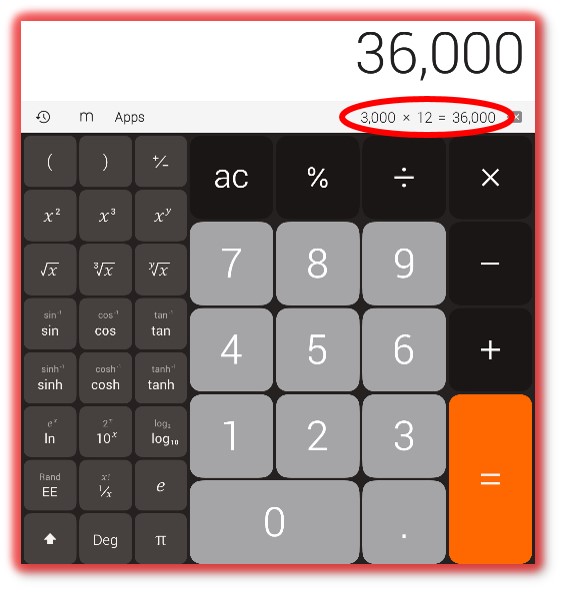

- Let’s say my monthly cost of living before tax is £3,000.

- We multiply this by 12 to get an annual cost of living of £36,000.

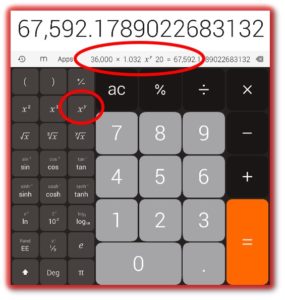

- I want to be able to retire in 20 years so we increase my annual cost of living by long-term inflation of 3.2% over 20yrs. The answer is £67,592 pa.

- Finally, we have to work out what capital sum is needed so that I can withdraw enough each year without risk of outliving my money. For this, we use a safe withdrawal rate of 3.5% and we divide £67,592 by 0.035.

- So, if my cost of living is £36,000, I will need a pot in 20yrs of £1.93m to maintain my standard of living for the rest of my life.

Please note that the figures are only used as an example and to act as a guide. They should not be relied upon as an exact formula to work out your own pension and wealth needs.

There are many variables that will affect the calculation such as:

- other sources of retirement income (state pension, company pensions or rental income),

- expenditure patterns during retirement.

- Actual inflation up to and during retirement.

- Investment returns during retirement if the fund is kept invested. The lower the investment returns the greater the rate of depletion will be if the same amount of income is withdrawn annually (or vice versa for higher investment returns).

- Annuity rates at retirement.

If you would like to see how the financial planning process can help make sure you have enough to live your ideal lifestyle in retirement contact me: www.neliganfinancial.co.uk/contact-us.

*EBI Portfolios Ltd Matrix Book Jan 2018

** Assureweb

Photo by Pete Nowicki on Unsplash