The Best Way To Discover What You Really Value

23.10.25

The Best Way To Discover What You Really Value

23.10.25

Setting up and establishing this business was hard, really hard. The early years were filled with doubts over where my first clients would come from and then the next, and…

The Best Way To Discover What You Really Value

23.10.25

The Best Way To Discover What You Really Value

23.10.25

Setting up and establishing this business was hard, really hard. The early years were filled with doubts over where my first clients would come from and then the next, and…

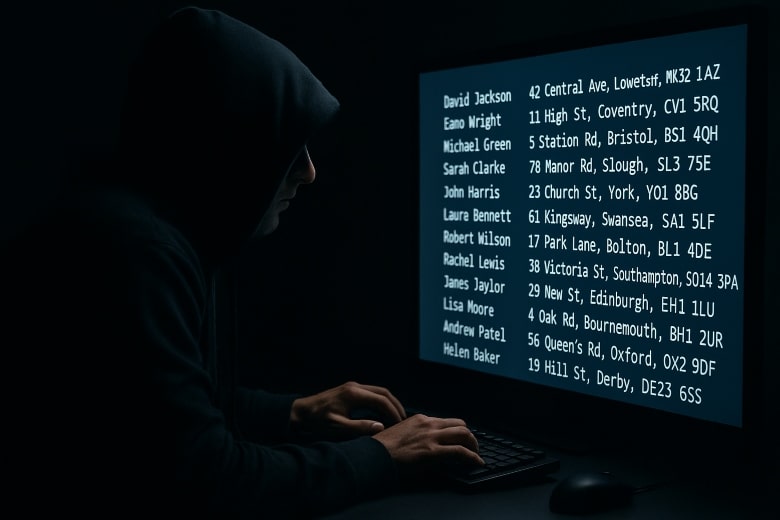

How to Protect Yourself from Financial Scams

17.09.25

How to Protect Yourself from Financial Scams

17.09.25

Financial scams are continuing their rise in the UK, and they affect people from all walks of life. For those starting or in retirement, the risks are greater because losses…

Sequencing Risk – Why The Timing of Stock Market Crashes Can Have A Big Impact On Your Retirement

11.09.25

Sequencing Risk – Why The Timing of Stock Market Crashes Can Have A Big Impact On Your Retirement

11.09.25

When we think about retirement risks, stock market crashes and inflation often come to mind. But one of the most significant and least understood risks is something called sequencing risk…

Are You Using Your Money in a Way That Makes You Happy?

12.05.25

Are You Using Your Money in a Way That Makes You Happy?

12.05.25

Have you ever gone through that exercise whether verbally with someone else or in your head, where you work out how you would spend a lottery win? My wife and…

Extravagance Is Subjective

08.04.25

Extravagance Is Subjective

08.04.25

My clients regularly tell me they’re “not extravagant” or they “live frugally”, which I can understand; they might live in a modest home, drive a sensible car, and holiday within…

12 Things To Do NOW To Not Run Out of Money in Retirement

25.03.25

12 Things To Do NOW To Not Run Out of Money in Retirement

25.03.25

When I ask clients and prospective clients why their money is important to them it is usually because it provides freedom and financial security. In other words, they want to…

It’s OK to Spend Savings in Retirement

18.03.25

It’s OK to Spend Savings in Retirement

18.03.25

Don’t worry, it’s OK to spend savings in retirement, but it does come with a caveat. If you have been diligent during your working life you will have built up…

Should You Sell Investments to Pay Off Your Mortgage? A Timing Dilemma

05.03.25

Should You Sell Investments to Pay Off Your Mortgage? A Timing Dilemma

05.03.25

Many mortgage holders find themselves in a familiar bind with mortgage rates rising and investments feeling the impact of global uncertainty. You’ve built up investments with the plan to clear…

Maximise Your State Pension Before 5 April 2025

04.03.25

Maximise Your State Pension Before 5 April 2025

04.03.25

A reminder for anyone who doesn’t currently qualify for the full State pension: if you have gaps in your National Insurance (NI) record between 6th April 2006 and 5th April…

“How Much Money Do I Need to Retire?”

25.02.25

“How Much Money Do I Need to Retire?”

25.02.25

I’m often asked “how big does my pension need to be?”, or words to that effect. A simple question to which a simple but not very helpful answer is: It…

If you want to talk to someone who will really listen, enter your details below to arrange a confidential chat.