If you have ever:

- set up your own business,

- started a diet

- Trained for an endurance event

- got married

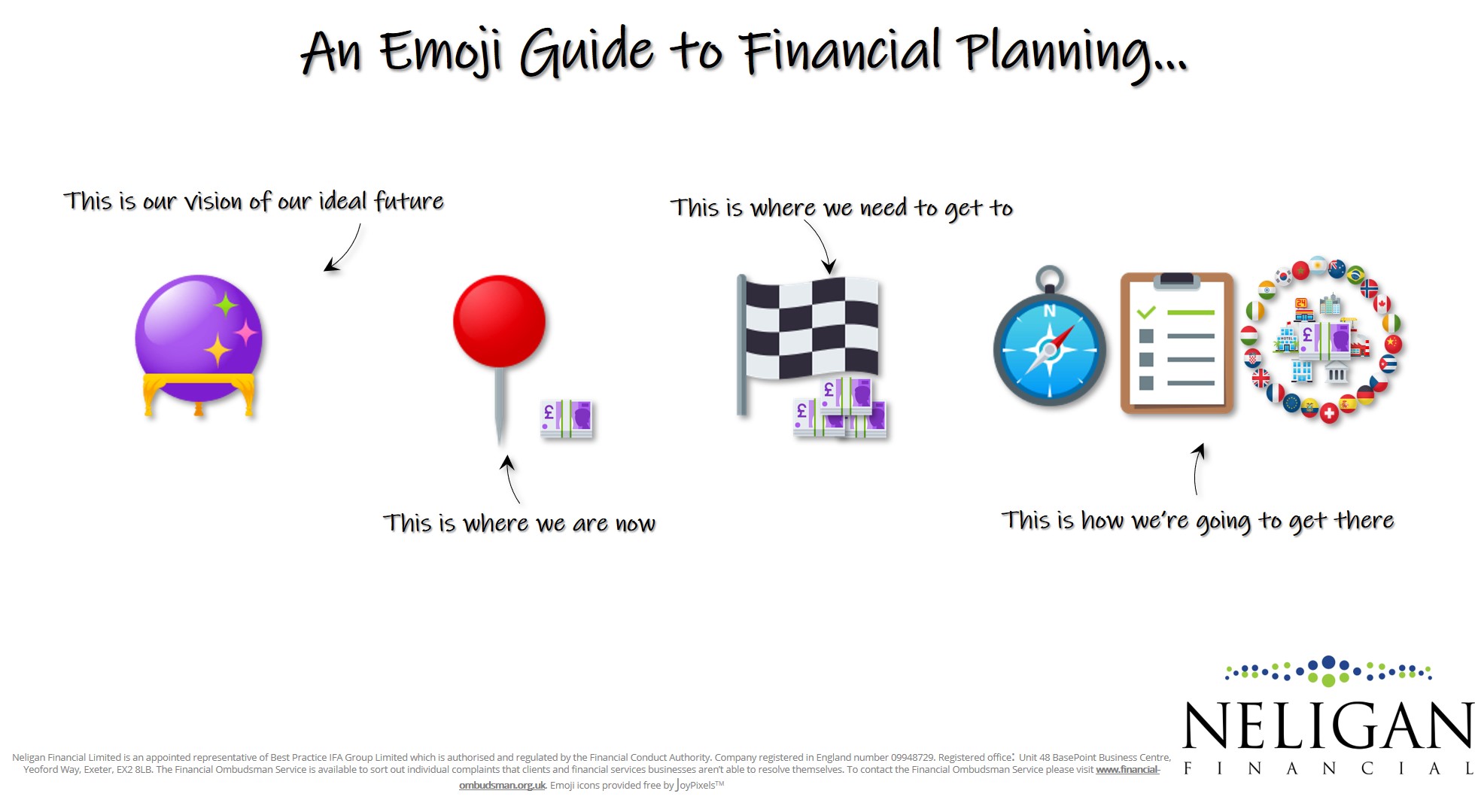

It will have involved an element of planning. You will have started with a vision of what you want to achieve, which, depending upon the task in hand would have been of varying complexity.

Once you have had a compelling vision you will have worked out by when you want to have it achieved and the steps you need to take to get you from your present reality to the desired future.

Your own personal future should be no different. If you haven’t taken time to create a compelling vision of what you want your future to look like it is a very worthwhile exercise to go through. Doing so will give more meaning to your money and its purpose (looking after your future self as well as your current self).

Once you have your desired future in your mind (even better on paper), you can then work out how much money you need in order to live that lifestyle. After all, you don’t want the future to become the present only to discover you don’t have the personal wealth to afford that desired lifestyle.

Once you know how much money you need you can then work out how you are going to build up that wealth. This is where the vision and plan are implemented and will, most likely, require you to invest in pensions and ISAs using a diversified portfolio of assets so that your money is working hard enough for you to maintain it’s long-term purchasing power.

Another important element of any planning is a feedback mechanism to make sure you remain on track. If you are trying to lose weight it will involve weekly weigh-ins. If you are growing a business it will require keeping a regular eye on cash flow, turnover, profit and performance to targets. Financial planning should be no different, it is a process rather than a one-off event during which time you regularly check-in to make sure your money is working hard enough so that you will have enough money when you need it by.

If you would like to see how financial planning can help you live your ideal future contact me: https://neliganfinancial.co.uk/contact-us/