For most of us, all we really want is enough.

Enough to be able to live our ideal lifestyle without being at the beck and call of anyone. In other words, we are financially free and financially secure. We can do what we want, when we want.

I have written before about how you can work out approximately how much money you need to be able to retire and maintain your lifestyle. You can read it and work through the back-of-an-envelope calculation here.

But, how do you know if you are saving enough to have a big enough pot to retire with?

The rate of savings will have the greatest influence on how big your pension or ISA portfolio will grow over time.

Sure, investment returns are important and have a huge compounding benefit over the long term. But, having double-digit growth on a small portfolio will not have the same effect as lower growth on a portfolio that is being contributed to regularly.

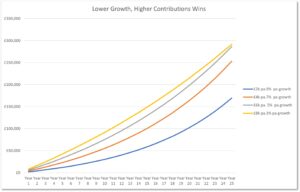

The chart below shows the difference in portfolio size for 4 different strategies:

- £2,0000 a year growing at 9% pa;

- £4,000 a year growing at 7% pa;

- £6,000 a year growing at 5% pa and,

- £8,000 a year growing at 3% pa.

You can see that despite the lower growth rates, the higher the contribution the greater the accumulated fund over time. You can’t control investment markets but you can control how much of your earnings you save.

Investment Returns Still Matter

I’m not saying that investment returns don’t make a difference or you shouldn’t take investment risk. History shows us that the more you invest in the global stock markets the more you will be rewarded by compound growth over the years. But, you need to be comfortable with significant falls in value for a period of time, possibly years before you witness any recovery.

A high savings rate with a higher risk tolerance will generate the highest long-term returns.

Set and Forget

By setting up a regular contribution to your pension, ISA or investment account each month you are automating the savings habit. It doesn’t really on your memory or inclination to put away money for your long-term benefit at times when money is a bit tighter. It is also likely that you soon don’t notice it is being put away. It will just be there, in the background, working hard at securing your financial freedom.

A regular savings habit also has another advantage; pound cost averaging.

Pound cost averaging sounds complicated but is simply the principle that when stock markets fall (which they will), your monthly contributions are buying the world’s greatest companies at a discount. And who doesn’t love a sale?

That means, when the markets recover (which they will), you will own more shares in the same companies which will have an even greater compounding benefit over time.

How Much Should You Be Saving?

A simple rule of thumb is saving at least 10% of your earnings and at least 50% of any pay rises will stand you in pretty good stead.

But let’s try and be more scientific. Let’s assume you have worked out how much you need in your pension pot to know you have enough. You can then work out how much you need to save to build up to that number.

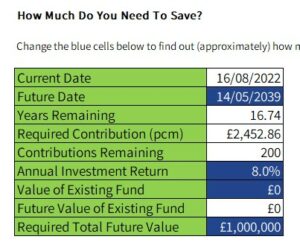

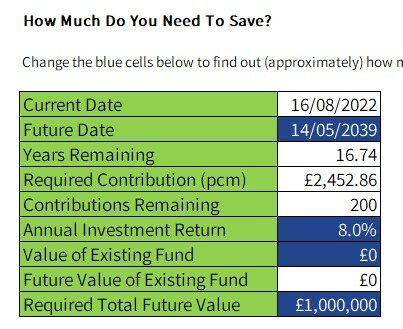

To save your grey matter I have produced a simple calculator to work out approximately how much you should be saving each month to reach your retirement savings goal. You can amend the retirement date, annual investment return, the value of your existing fund or the total future required value.

You can access the calculator by clicking on the image below:

The second tab allows you to see what your retirement savings pot may grow to based on how much you are able to contribute.

If you want to read more content like this each week sign up for my newsletter.

The form you have selected does not exist.