Do you ever have that feeling that you should be making better financial decisions with your money but never have enough of it left at the end of the month to do anything with?

Perhaps you find you are living from payday to payday and your money just seems to go into some bottomless pit never to be seen again.

If that scenario resonates with you it’s probable that you have your priorities wrong or have just not figured them out yet. If you don’t know what is important to you then how can you be sure your money is being used appropriately? As the Cheshire Cat said to Alice when she asked: “Would you tell me, please, which way I ought to go from here?”

“That depends a good deal on where you want to get to,” said the Cat.”

What’s Important To You?

So the first step to budgeting is to work out what is important to you and what your long-term priorities are. You might find it helps writing them down to get the brain juices working:

- This is what is important to me…

- These are my priorities (within the next five years and long-term)…

- Money is important to me because…

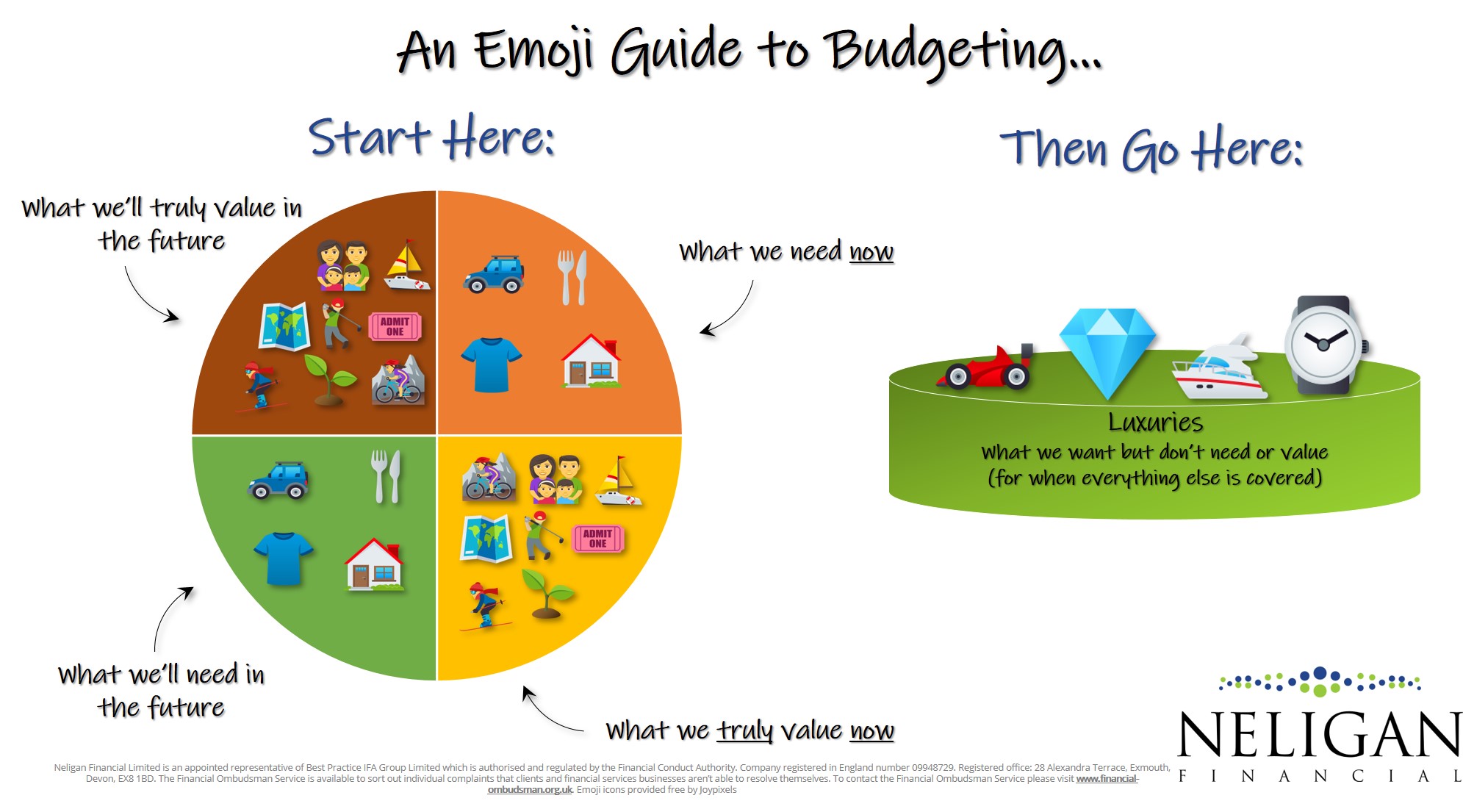

Thinking about why money is important to you, you can split this into two groups: those that are essential (the cost of running your home, putting food on your plate, clothes on your back and any other costs that are required for you to live your basic lifestyle) and those that are important but not essential to your immediate wellbeing. This group will be things that are important to you and aspects of your lifestyle that you really value because they make up who you are but they are not essential to your survival.

Where’s Your Money Going?

Once you have worked out (honestly) what is essential and what it is you truly value you can compare this to where your money actually goes on a monthly and yearly basis. It’s unlikely you’ll describe this as a fun exercise but whenever I have clients do it for me they admit to it being an enlightening and worthwhile (if not a little scary) exercise.

To complete this properly you’ll need to download your bank and credit card statements to a spreadsheet so that you can work out what you are spending on what items. Ideally, you’ll do this with a year’s worth of transactions but at the very least I’d be looking at it with transactions from at least three different times of the year: December to get the cost of the Christmas period and additional heating costs, the summer to get the cost of holidays (or winter/spring if you are skier or like to escape to the sun) and September/October when we tend to have fewer expenditures. Of course, you should adapt it to your more and less expensive times of the year.

What if Your Money Was Working Harder?

Having done that you can work out where your money is being spent between the ‘essential’, ‘non-essential but important’ and ‘non-essential and not important’ areas. Use this spreadsheet to help you and work out how much better off you might be if you had your money working harder for you.

Now think of the most important people in your life (including yourself). Whoever they may be, and I’m thinking husbands/wives/partners and children, you can double it because not only will you want to ensure their financial freedom and security in the present but you will also want to look after the future versions of them. And to do this means making sure you are putting enough money away so that it grows at least by annual inflation to maintain the purchasing power of your money over time.

When you think about the future it will be similar to your thoughts about today’s expenditure: how much will you need to cover the cost of future essential expenditure and also live your ideal future lifestyle too. There will be some costs that can be stripped out of future expenditure: mortgage repayments and commuting costs in retirement but other costs to add in: extra on holidays and probably higher fuel bills if you are at home more during the winter months.

If you have spent enough time considering your priorities and what is important to you, you will most likely begin to feel that you need to be putting more away than you currently are so that your future self is looked after as much as your current self.

Once you have done this you should hopefully realise that there will be part of your monthly and annual spending that is going on life’s luxuries that are truly, deep down, not that important to you and are going to be hard to maintain when the regular income stops. By re-purposing this element of your spending to saving for the future you are winning twice: building up a bigger pot to fund your truly desired future lifestyle whilst also reducing the cost of that future lifestyle by excluding the non-essential and non-important elements.

If you want to discuss how you can make sure your future self and those who are most important to you will be taken care of contact me for an initial, no obligation conversation. www.neliganfinancial.co.uk/contact-us.