Our mind plays tricks on us.

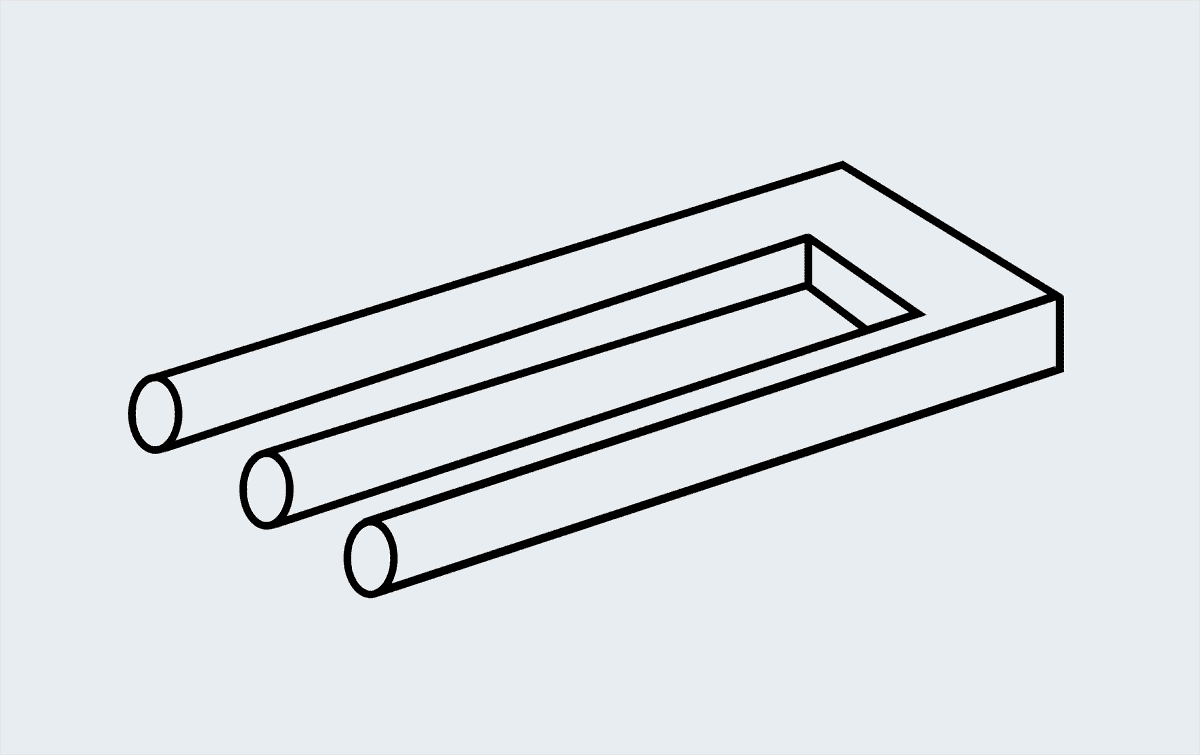

We use mental shortcuts to help us make quick decisions. Daniel Kahneman, in his book ‘Thinking Fast & Slow’, refers to it as System 1 thinking. It is useful for day-to-day decision making but it can trip us up. The famous ‘impossible trident’ is evidence of this.

The decisions we make with our money can be subject to these heuristics. When there is either complex information to process or outcomes that might be harder to visualize we use system 1 thinking to guide us.

While that can help us get through the day, applying it to something as important as our financial decisions can have more significant consequences.

A classic example is the value we put on having a lump sum now rather than an income for life. Most people would opt for a lump sum even if the regular income is likely to provide a greater benefit over the long term. Or, as a minimum, require less decision-making. The thousands of final salary pension members who decided to give up the security of their annual income to be able to transfer the capital value to a private pension attest to that.

But the opposite can also be true.

The baby boomers enjoying their gold-plated final salary pensions each year in retirement are the envy of the current working population; no risk, no cost just an inflation-linked income for life (and 1/2 for a surviving spouse too, thank you very much). But ask someone if they would like to swap the value of the private pension pot for an annuity (an income payable for life with the option to provide for a spouse and have it increasing each year) and you’ll be given short shrift. “I’d prefer to keep control of the capital thanks!”

They are both the product of a long career but the perceived difference is that the private pension was a result of personal contributions that produced a capital value. The focus is on what is given up not on what is gained.

Or what about our understanding and perceptions of risk?

The cautious investor fears what a stock market crash will do to his money, preferring instead the sanctuary of a savings account or Premium Bonds (yes, winning the jackpot is possible but it is not likely), all the while blissfully ignorant of the much more malignant long-term effects of inflation.

And the DIY investor who conflates activity with proactivity? Like the novice fisherman who constantly reels in his line to check the bait is still on the hook, the novice investor believes the highest returns come from regular trading and finding the ‘best’ funds. Conversely, like the successful fisherman, the secret to successful investing is patience.

Once we are aware of these subconscious biases we can make more thoughtful, informed decisions without the overriding filter of emotion to derive better outcomes.