Whenever a team in any tier of the football league is doing badly the popular refrain from the terraces is “You don’t know what you’re doing.”. It serves as a clear message to the manager and players that the long-suffering supporters have had enough of the dire performances.

I was reminded of this chant the other day when I read this article about investor sentiment. The article explains how US investors are currently optimistic about the outlook of major asset classes, including the S&P500 index, US government bonds, gold and the speculation-heavy cryptocurrency, Bitcoin. The article references a weekly survey by the website, the Association of American Individual Investors.

This piqued my interest. Can US investors accurately forecast the future direction of the stock market? Or, as I suspect, are their investment decisions subject to their own emotions and biases? Fortunately, the AAII website provides the survey data. By comparing the actual returns with proceeding market expectations we can find out how skilful (or not) investors are at predicting the future.

Hypothesis

As explained above, I don’t believe investors are good predictors of short-term market movements which makes it futile to try and time markets. I expect that in aggregate investors would make more incorrect calls than correct ones.

Methodology

The survey asks respondents to state their outlook for the S&P500, the stock market comprising the 500 largest US public companies, over the next 6 months. There are three options: bullish (expecting the market to rise), bearish (expecting the market to fall) or neutral. Running since 1987, that’s 35 years of data (1,897 weeks) of investor sentiment relative to actual returns.

Using the data, I took an aggregate score of net bullish or net bearish. In other words, by subtracting the number of bearish investors from those who are bullish to get an ‘Aggregate Bull’ or ‘Aggregate Bear’ output. Neutral investors who sat on the fence were excluded.

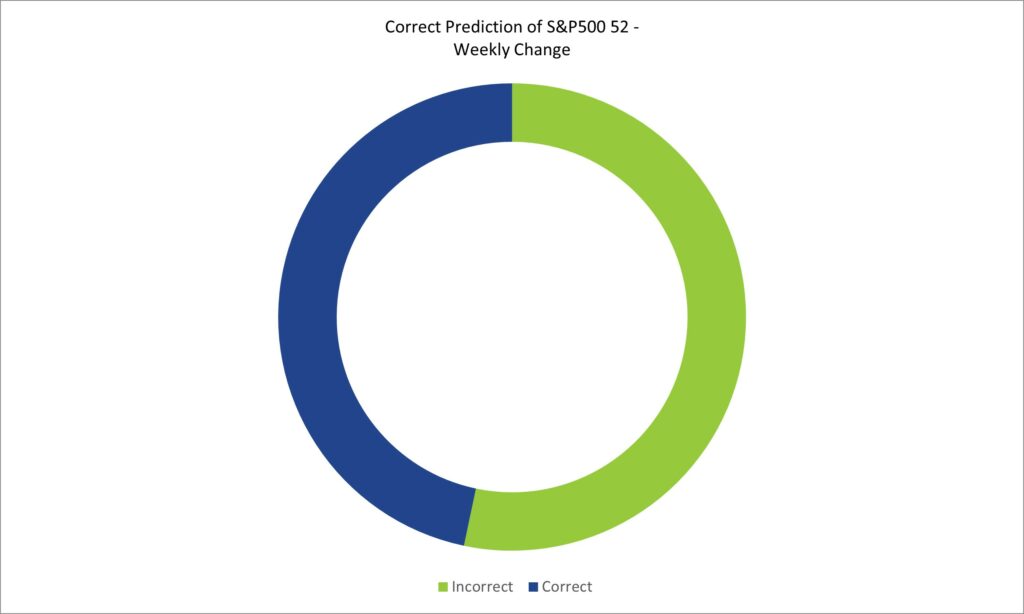

I then analysed the returns of the S&P over different subsequent periods: the following week, the following 4 weeks, 6 weeks, 8 weeks, 12 weeks, 26 weeks and 52 weeks. This enabled me to compare the short-term market direction (up or down) with whether investors made a correct or incorrect call; either bullish or bearish. In other words, if in the aggregate, investors were bullish they would be marked ‘correct’ if the future market direction was positive. They would be marked ‘incorrect’ if the future market movement was negative and vice-versa for aggregate bearish sentiment.

The Results

As per my hypothesis, there is no evidence to show investors can make accurate stock market forecasts. In fact, the opposite is true; investors don’t show any ability to correctly predict future market movements.

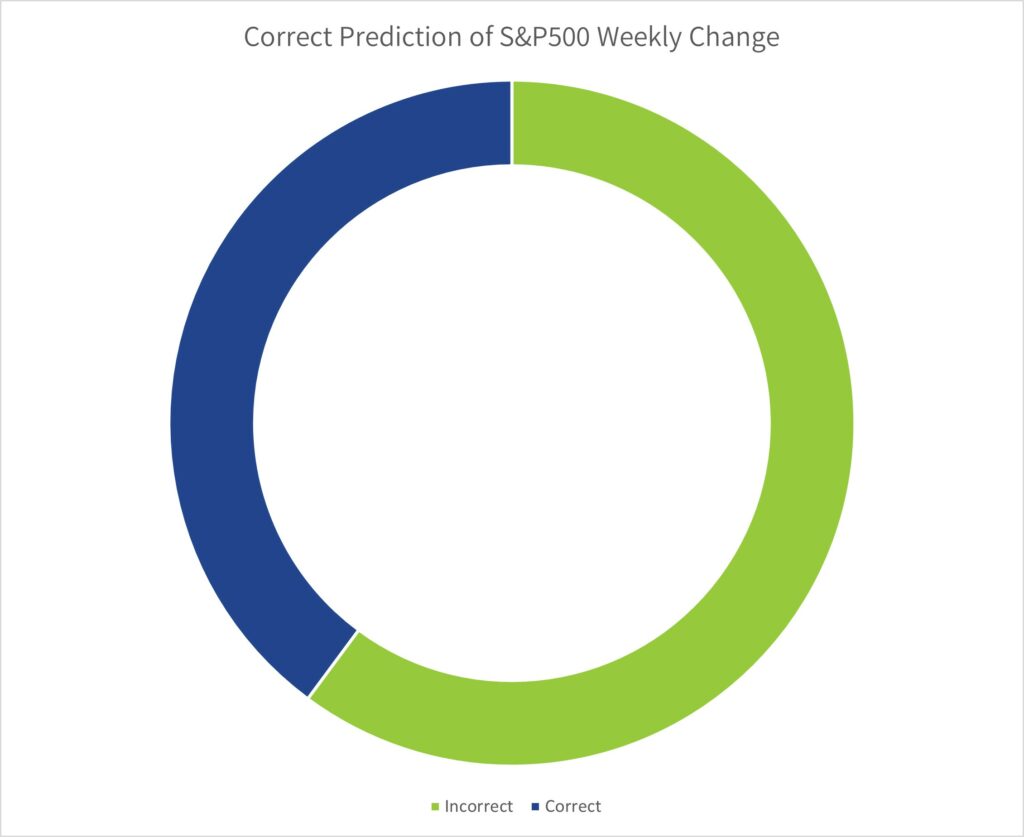

Over 1 week, 60% of respondents failed to correctly anticipate the direction of the S&P500.

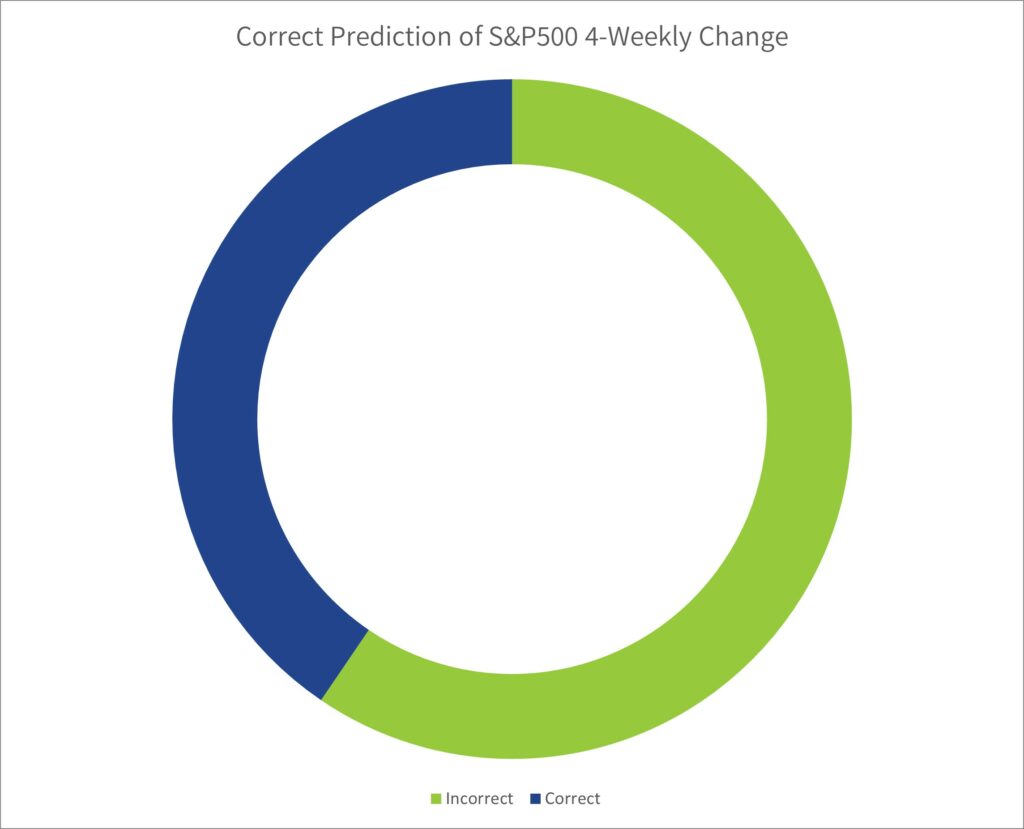

It was the same over 4 weeks…

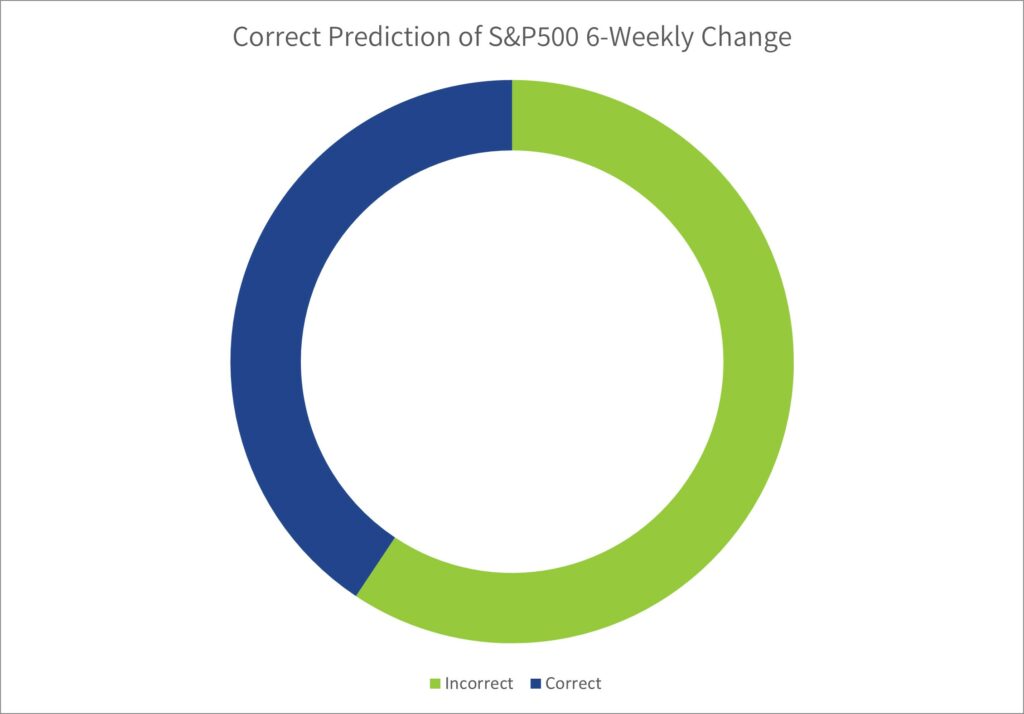

and over 6 weeks…

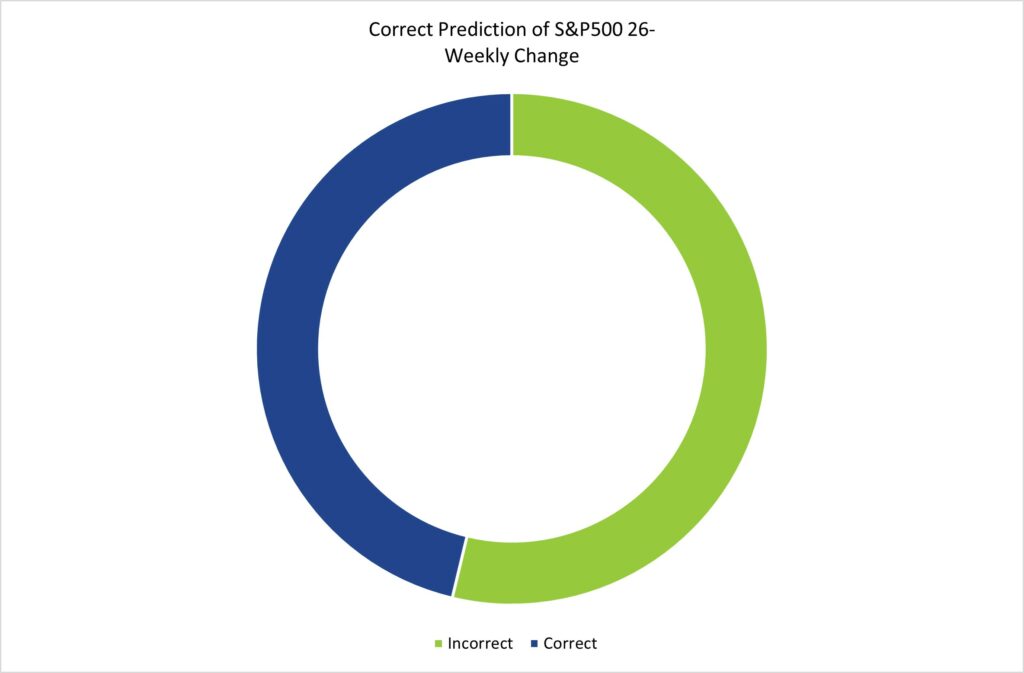

It was much the same over every period. Over 26 weeks there was a minor improvement in predictive powers but it was still less than 50%.

Successfully predicting whether the S&P would be higher or lower a year later was no better.

Making investment decisions on the outcome of a coin toss would be more reliable.

The sample data is based on US investor sentiment, but this isn’t intended to be a slight on them. I see no reason why UK investors, or investors from anywhere else in the world, would fare any better with their predictions.

The analysis also considers the average outcome of all survey respondents. Taken at an individual level it is likely the results are more stark; individual investors are more likely to make incorrect calls more often.

What’s The Point?

The point is, that trying to time markets is pointless. Successful investors are those who invest for the long term with patience and discipline. They know falling markets recover their upward trend sooner or later.

Photo by Anne Nygård on Unsplash