From time to time a new client comes to me with an existing ISA or pension portfolio they want reviewing which is made up of many different funds, often a dozen or more. Worryingly, these portfolios are sometimes put together by their incumbent adviser.

When it is a portfolio constructed by the investor themselves, I can understand their logic, even if it is flawed; as children, we were taught not to put all our eggs in one basket. Psychologically, we are more sensitive to losses than we are to gains so our primary motivation is to protect against them; investing in a large number of funds spreads the risk of losses.

Or, a bulging portfolio may result from paying too much attention to the money pages of the broadsheet newspapers and following their fund picks, leading to a gradual accumulation of funds over time. Journalists aren’t financial advisers and their paymasters have different priorities to you so their pages shouldn’t be treated as the oracle.

You Wouldn’t Bet On Every Horse in a Race (Would You?)

The problem is that over-diversifying your portfolio is like betting on every horse in a race. You are guaranteed a winner but your profit will be limited by the stake you placed on all the runners; you may even make a loss if the winnings are lower than the total stake.

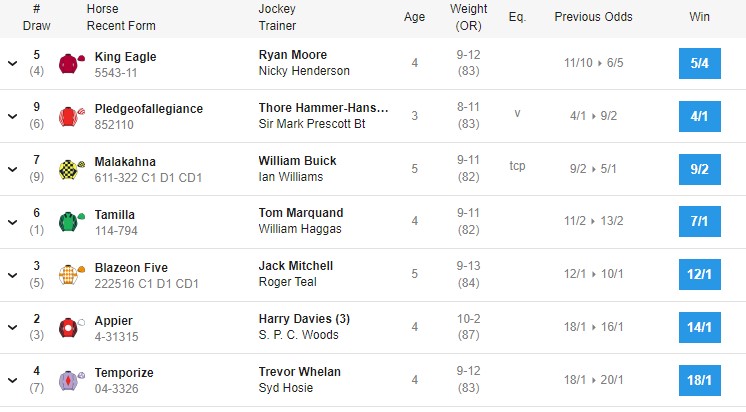

Here is a race card from Betfair for a race at Ascot.

If I put £10 on every horse my total stake is £70. I might win as much as £180 if Temporize wins but I lose money if any of the top 3 win and only breakeven if Tamila wins at 7/1. Ignoring form, betting each way or an accumulator, there is a 57% probability of losing money.

With a pension or investment portfolio, unless I buy individual company shares that become worthless, by choosing funds that themselves invest in a broad range of shares I’m not going to lose all my money but my returns are limited.

Spreading Risk Is Still Important

It is appropriate to have some diversification by investing in different asset classes around the globe, but by over-diversifying you are more likely to get below-average returns because the constituent funds are competing against each other too much. This is particularly so if you buy actively managed funds; your portfolio performs like an index tracker due to a large number of underlying holdings but with the higher charges associated with active funds. The more you pay in charges the lower your returns.

Every fund in a portfolio should have a job to do; it may be to reduce risk (volatility), it may be to invest in a particular global stock market, to invest in companies with particular characteristics or because you want to invest in line with your values. This can be achieved with a more concentrated portfolio when there is sufficient spread in the number of shares you ultimately invest in (via the funds). It is at this level where diversification is needed, but it can be achieved with just one or two funds which themselves invest in a range of global asset classes. Many index-tracking funds provide this level of diversity.

An appropriate strategy for your pension or ISA portfolio is one that will generate the necessary returns based on your investing objectives, how long you are investing, the level of risk you need to take and whether you can withstand temporary falls in the value of your portfolio. The more time you have and the less reliant you are on the money in the short term the greater level of investment risk you can take. If you have less time or are likely to need the money soon investing in global markets may not be appropriate.

If you want to discuss an appropriate investment strategy for your priorities please do get in touch. I can’t provide betting tips though!

Photo by Jeff Griffith on Unsplash