“Annual income 20 pounds, annual expenditure 19 pounds 19 shillings and six pence, result happiness. Annual income 20 pounds, annual expenditure 20 pounds ought and six, result misery.” From David Copperfield by Charles Dickens.

Rich and wealthy aren’t the same thing. I might have a large income which makes me appear rich, but if I have the lifestyle to match I will always be reliant upon that income, which is a problem if I always have to work for that income.

I don’t want that sort of rich.

If, however, I have sufficient means that I can do what I want, when I want without having to be at anyone’s beck and call, then I can call myself wealthy.

I want that sort of wealth.

And the amounts of money don’t matter as long as I can live MY ideal lifestyle. If I have the earnings of a professional footballer but the lifestyle to match then I will need a whole lot more wealth than someone who has little but needs less.

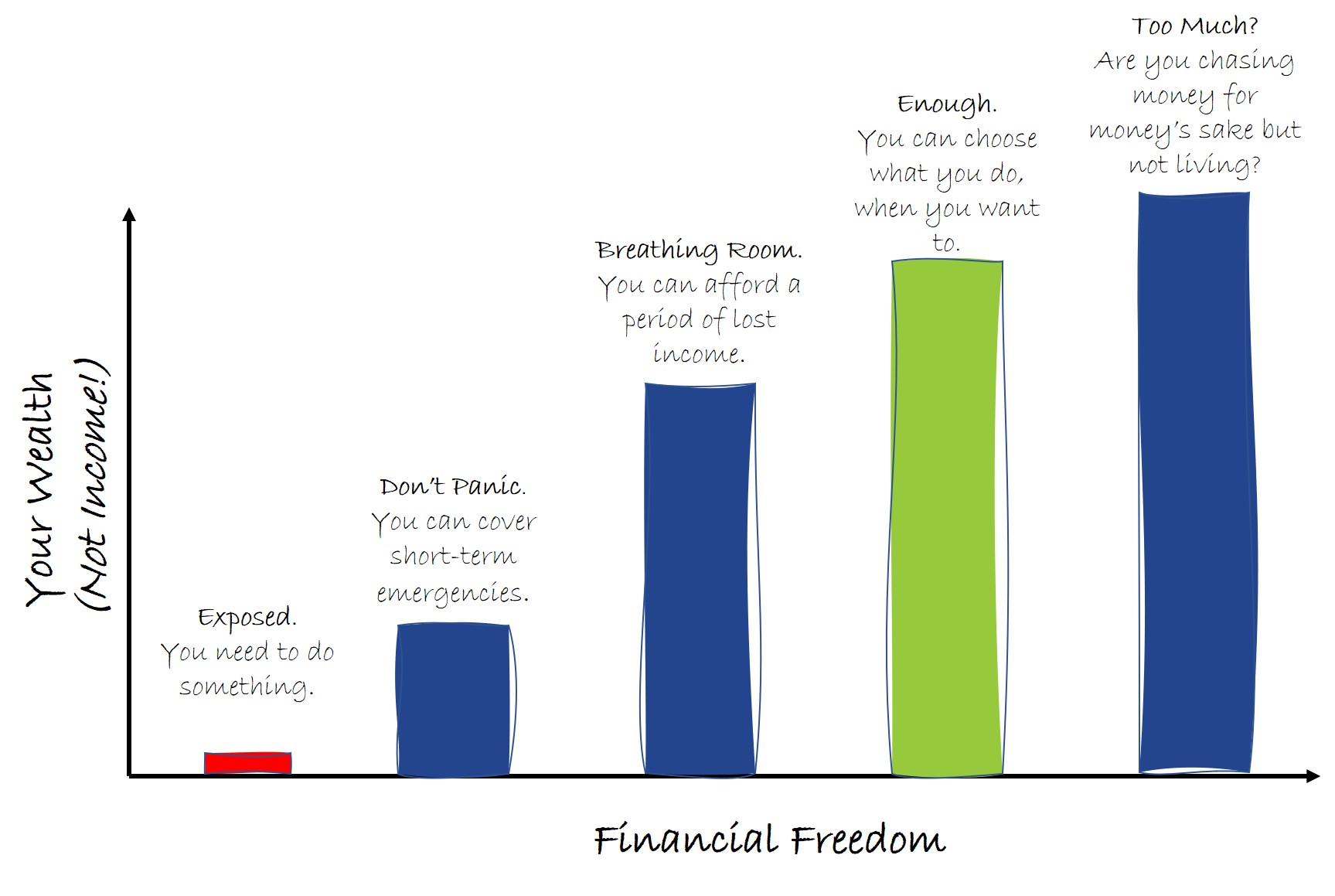

Exposed

The route to financial freedom is via stepping stones. The person who spends all they have with little saved is exposed with little financial resilience. Even a temporary loss of income or unexpected bill will leave him scrambling to make ends meet. It may require costly debt to get out of a hole, which further reduces the financial resilience.

Don’t Panic

The person who at least has some savings tucked away in case of an emergency should at least be able to cover short-term bills and unwanted financial surprises.

Breathing Room

The person who knows they have enough to take a prolonged period of time off work, either forced because of an accident, illness or redundancy or through choice because they are reviewing career options or taking a sabbatical, has given themselves some breathing room. It might be that they have more in savings and investments, a passive income or they have passed the risk of lost income on to a life assurance company.

Enough

But the person who knows that, come what may, they have enough money to survive any financial shock and are living their ideal lifestyle is truly blessed.

Through their own thrift and forward-thinking, they made sure they were setting enough aside so that their future self wasn’t at the mercy of the extravagance of their current self.

These people can sleep easily in the knowledge of financial security and financial freedom.

Too Much?

And what of those who have more money than they will ever need?

Are they chasing the next paycheck in the simple pursuit of more because they don’t know how much is enough?

Do they have their nose to the grindstone because they believe they have to? Because they haven’t had time to consider how much is enough?

Or worse, not given consideration to what it is that makes them happy (and it won’t be available in any shop)?

Do you know where you are on the journey to financial freedom? Perhaps you already have enough but are continuing to work needlessly.

If you want help finding out, get in touch.