Sometimes difficult concepts are easier to understand by way of analogies and, for many, the stock markets are things of mystery where the innocent go to lose their money. Hopefully, the following analogy will demystify them for you.

In truth, stock markets are much more accessible and easy to understand than people expect. Whilst they will never be mastered (they are too fickle for that), a basic comprehension will provide an important stepping stone on the path to financial clarity and independence.

It may help to understand them in the context of the football Premier League, something that is much more familiar to many.

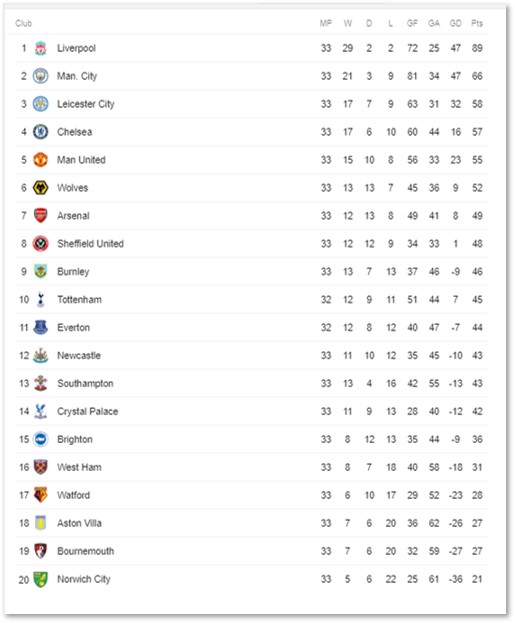

The Premier League is a snapshot in time of the most successful English football clubs. At present (and, as a lifelong Man Utd fan, it pains me to write this) Liverpool are the top of the league and have just been crowned champions for the first time in 30 years.

This is the current table with 5 games remaining in the 19/20 season:

Most football clubs are privately owned these days but, because it is sitting at the top, if Liverpool was a company listed on a stock market it would be the most valuable, followed by Manchester City and then Leicester. Norwich, Bournemouth and Aston Villa would all be one of the least valuable in the league.

In the UK, the equivalent of the Premier League in stock market terms is the FTSE 100 which represents the 100 largest companies by market capitalisation. The Market Cap is another way of saying the value and is measured by multiplying the share price on any given day by number of available shares in that company. Unilever is the most valuable company in the UK currently at approximately £113bn.

Notably, however, to be listed in the FTSE100 a company doesn’t have to be based or even derive most of its earnings from within the UK. A number of foreign companies including banks, pharmaceuticals and miners are all listed on the FTSE100.

Winning & Losing

As a football club’s position in the league rises and falls depending upon results on the pitch, the position of a company in the FTSE100 will rise on fall based upon its financial performance.

The big difference, however, is that a club’s position in the Premier League will be based upon actual performance, but a company’s position in the FTSE100 will be based upon the expected trading performance. Stock market investors want to get the best return for their money and so look ahead and try to understand what factors will have a positive or negative influence on a company’s performance.

If trading conditions are positive and a company is well-run investors might expect a company to make greater profits. This positive outlook will increase the demand for the shares thereby pushing their share price (and therefore value) up making them and the company more valuable. Conversely, if there is any reason why investors might be pessimistic about a company’s fortunes (Coronavirus being a good example), the demand for shares will fall making the company worth less (or worthless if they fall to zero).

Another difference here is that football is a zero-sum game; there are only so many points on offer in a season so they are distributed between each of the 19 clubs based on the results over a 38 game season; in any fixture a team will get 3 points for a win, 1 for draw or 0 for a loss. In a stock market, the value of all constituent companies can rise and fall based upon the overall demand for shares; one company can do well or poorly regardless of other companies and all companies can do well or poorly in unison depending upon stock market conditions.

During bull markets, share prices rise because investors are positive on prospects, often regardless of reality. Likewise, during crashes, investors sell shares en masse because they are pessimistic on the outlook, often regardless of reality (companies like Apple and Amazon don’t become bad companies overnight).

Relegation & Promotion

As football clubs get relegated out of and promoted into the Premier League, so do companies get relegated and promoted into the FTSE100. Every quarter the FTSE is reconstituted to allow for changes in the market capitalisation of companies during the previous three months (doing so more regularly would be overly complex and cause mayhem for investment funds that invest based upon the weightings of the index).

For some companies, it might be a brief period of time in the ‘top-flight’ whilst for others it might signal a terminal decline.

The hierarchy of the football leagues below the Premier League is the Championship, League One and League Two. For the stock markets, below the FTSE100 is the FTSE 250, FTSE All Share and the Alternative Investment Market (AIM) for small companies.

Long-Term Changes

Over time, the fortunes of both football clubs and companies change for better and worse. Some once-great teams and companies fade away to be replaced by new kids on the block.

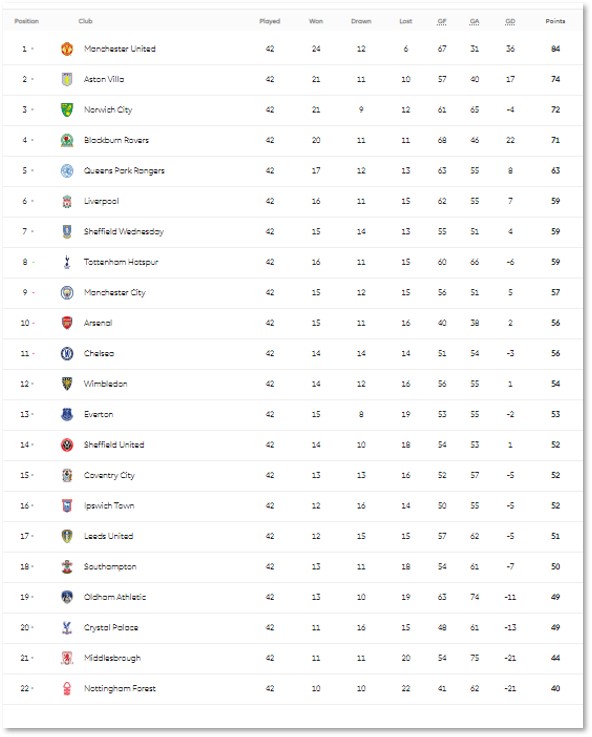

Here is the final table for the inaugural Premier League in 1992:

Notice how Aston Villa was second and Norwich, third but both are currently fighting relegation. Teams such as Wimbledon (went bust), Oldham Athletic (struggling in League Two) and Coventry City (top of League One) were all in the Premier League, as were Leeds, Nottingham Forest, Middlesborough.

Compare this to the FTSE 100 and the changing fortunes of the companies that are still part of the original index when it launched in 1984. Of the 100, only 28 still remain including BP, British American Tobacco, GlaxoSmithKline, Lloyds Bank, Rio Tinto, Tesco and Unilever. Some of the once-great companies to fall by the wayside include BHS, Burton Group, Magnet and House of Fraser. The rise of the internet and tech behemoths sounded the death knell for some and the globalisation of finance and trade, the end for others.

Foreign Leagues

The Premier League might be the greatest league in the world, but the FTSE 100 is not the leading stock market in the world. That title goes to the S&P500 in the US which is made up of the largest 500 companies by market cap. The constituents of the index are some of the most recognisable and profitable companies in the world: Apple, Microsoft, Amazon and Google to name just some of them.

The total value of all the companies in the S&P500 is approximately $28trn (£22trn) whereas the total value of the FTSE100 is £1.84trn. Allowing for the fact that there are 5 times as many companies in the S&P500 the market cap is still over 3 times a great.

No Fixed Seasons

The big difference between football and stock market investing is that with the stock market there are no fixed seasons, they go through cycles but there is no point where companies get to start again from zero.

Hopefully, this analogy has helped bring some understanding of how stock markets work.

If you liked this, you might also like this article on using cricket batting averages to explain investment returns or this one which uses betting exchanges and the Rugby World Cup to explain how share prices change.

If you would like to talk about how you might benefit from investing, please do get in touch.

Photo by Thomas Serer on Unsplash