Financial scams are continuing their rise in the UK, and they affect people from all walks of life. For those starting or in retirement, the risks are greater because losses have a direct impact on their security. Knowing how scams work and what steps you can take will help you protect your money and your peace of mind.

The Rise in Financial Scams

Fraud in the UK is growing both in number and sophistication. Recent figures reveal the scale of the problem:

-

In 2024, UK Finance recorded 3.31 million fraud cases, an increase of 12% compared with the previous year.

-

Losses remained high at £1.17 billion in 2024, showing that criminals are still stealing vast sums despite better controls. They evolve their practices as defences are tightened.

-

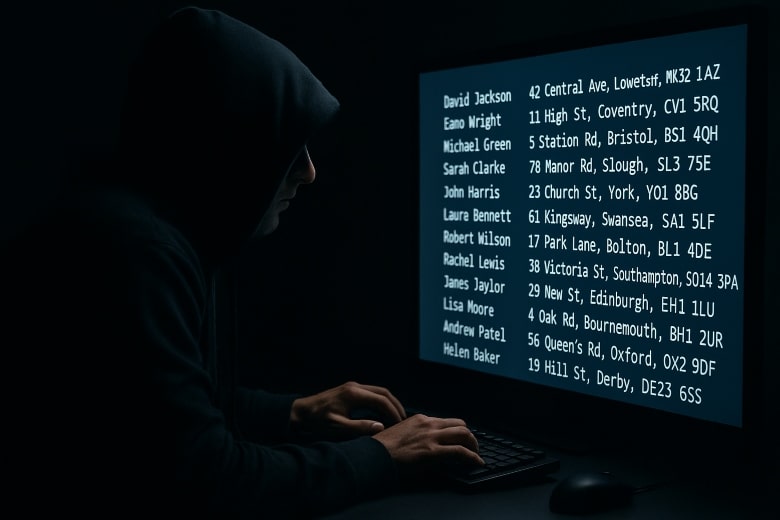

Identity fraud reached nearly 250,000 reported cases in 2024, up about 5% on 2023, and made up 59% of all fraud cases.

-

Scammers increasingly use mobile devices and social media to reach victims, while card fraud and “money mule” activity also rose.

-

“Authorised Push Payment” (APP) fraud, where criminals trick victims into sending money directly, continues to cause serious losses.

These numbers show two key facts: scams are widespread, and fraudsters adapt quickly when banks and regulators block old methods.

The Main Tricks Scammers Use

Fraudsters use many different approaches, but most rely on pressure, trust, or confusion to make victims act quickly. Here are the main ones:

| Scam Type | What They Do |

|---|---|

| Phishing, Smishing, Vishing | Send fake emails, texts, or phone calls that look like they come from your bank, HMRC, or another trusted organisation. |

| Impersonation Scams | Pretend to be someone you know or a company you trust. Some now use deepfake voices or images. |

| APP Fraud | Convince you to move money to a “safe” account or pay a fake supplier or investment. |

| Card Fraud | Use stolen card details or trick you into revealing them. |

| Gift Card / Voucher Scams | Ask you to pay using vouchers or gift cards, which are hard to trace. |

| Romance Scams | Build an online relationship and then invent emergencies to request money. |

| Investment Scams | Offer “too good to be true” returns through fake opportunities, often advertised on social media. |

| Identity Fraud | Use stolen details to open accounts, apply for loans, or take over existing accounts. |

Practical Steps to Avoid Scams

You can’t stop fraudsters from trying, but you can make it much harder for them to succeed. Here are steps you can take:

1. Treat Unsolicited Contact with Caution

Ignore emails, texts, or calls that arrive unexpectedly. If someone pressures you to act fast, stop and think. Contact the organisation yourself using an official number.

2. Verify Who You’re Dealing With

Check email addresses carefully and call companies back on a trusted line. If in doubt, ask a friend or family member for a second opinion.

3. Look for Red Flags

Scams often involve:

-

High returns with little or no risk

-

Requests for payment by vouchers, gift cards, or cryptocurrency

-

Urgent pressure to act immediately

-

Messages full of spelling mistakes or odd formatting.

- Email addresses often lack an official appearance, not ending in a recognised suffix like “.com” or “.co.uk”.

4. Protect Your Devices and Accounts

Keep software and apps updated, use strong, unique passwords, and set up two-factor authentication on important accounts. Multifactor Authentication and passkeys provide an additional layer of security to a standard password. Most websites that store your sensitive data offer them, so you should use them.

Don’t share sensitive details unless you’re certain about who you’re speaking with. Password managers such as LastPass and NordPass make it easier to create and maintain strong passwords without having to remember them.

5. Stay Alert Online

Use secure websites (look for “https://” and a padlock symbol). Avoid clicking links in ads or messages about investment opportunities. Before you invest, check if the Financial Conduct Authority authorises the company.

6. Monitor Your Accounts

Check your bank statements and online accounts regularly. Spotting a small problem early could prevent a bigger one.

7. Use Reporting Tools

Report suspicious messages or calls to Action Fraud. Campaigns like Take Five offer practical advice on stopping and thinking before you send money or share details.

8. Keep Learning and Share Knowledge

Criminals constantly change their methods. Stay updated through your bank or official organisations like the FCA. Talk to friends and family about scams so everyone benefits from shared knowledge.

9. Prepare a Safety Net

Keep your bank’s emergency number somewhere safe. Consider credit monitoring or identity protection services if your data has been compromised.

If You Think You’ve Been Scammed

Act quickly:

-

Contact your bank immediately. Quick action may help recover your money.

-

Report the fraud to Action Fraud.

-

If a scam involves a firm that claims to be regulated, report it to the FCA.

-

Change your passwords and set up two-factor authentication where possible.

-

Seek advice from Citizens Advice if you feel vulnerable or unsure what to do next.

Final Thoughts

Scams are a fact of life, but they don’t have to take your money or your confidence. By staying alert, questioning what you’re told, and following these steps, you can protect yourself and those close to you.

Your best defence is to pause, check, and never rush into sending money or sharing information.