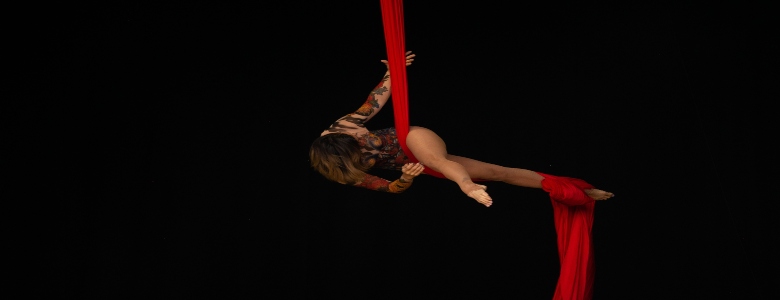

Full disclosure: I’ve never been a trapeze artist and I never will. But I can guess how you learn to be one. I imagine when you are learning you have a safety net to catch you when you fall. But there comes a time when you have to trust that you will be OK. At that point, you let go of the trapeze and fly with nothing to catch you if it goes wrong.

This is analogous to how parents help their young adult children financially as they make their way in the world.

I know that parents want to be able to help their children but it comes with a dilemma; how much is the right amount to give them?

Too little and they struggle to gain any financial foothold in an increasingly expensive world. Without parental support, it is hard to get on to the property ladder or take acceptable risks with their career choices at a time when mistakes can be made and recovered from.

Too much and they may either not value it, waste it or not have the opportunity or motivation to learn for themselves by making their own financial mistakes.

The other part of the conundrum is that parents may wish to keep more of their wealth in case it is needed. Later life care costs often being cited as a reason to hang on to money.

The balancing act then is to give your children the freedom and confidence to go into the world and try things out. To experiment with their careers to see what works for them and what doesn’t. To invest for themselves and in themselves but knowing if it goes wrong there is a safety net to catch them if they fall.

It also requires conversations. Conversations about where the money has come from, what it means to you and to them and how it works. They should also know when the safety net will be taken away for them to make the leap knowing they can make it on their own.

Photo by Robin Battison on Unsplash