As a financial planner advising clients on the investment of their ISA, pensions and General Investment Accounts it is incumbent upon me that I review the ongoing suitability of any recommendations I make. In this post I am evidencing why I continue to recommend EBI Portfolios Ltd and its Earth portfolios to my clients.

Appropriate Comparison.

I asked EBI to run a comparison against an appropriate competitor to see if their returns stack up. For this, I chose Vanguard’s Life Strategies range.

Vanguard is the world’s leading provider of low-cost index funds and its Life Strategies range offers a diversified portfolio of index funds at different risk levels. Therefore, as the lowest cost equivalent, it is a good benchmark to check that EBI is providing value. Otherwise, investors are as well opting for the cheapest option and simply investing in the indices.

To provide a fair comparison across risk profiles, I chose a direct comparison of the funds that invest in 80% shares and 20% government & corporate bonds; 60% shares and 40% bonds and 40% shares, 60% bonds. These three portfolios make up the bulk of where clients are invested.

80% Shares

The chart below shows the comparative returns of the 80% shares, and 20% bond funds. The green line is the EBI Earth portfolio, the red line is the Vanguard portfolio. Simulated data is used for periods prior to the launch of the Earth portfolios in 2021.

Notably, you can see the strong outperformance of the Earth portfolio over time. This is evidence that EBI’s investment philosophy and factor-based investing approach is adding value after charges.

What is more, they have taken less risk and experienced less volatility in doing so. This is demonstrated in the Ratios table which shows a similar Standard Deviation figure (a measure of volatility) and higher scores for the Sharpe and Sortino Ratios, both of which measure how much risk is taken to deliver the returns. A higher score is better.

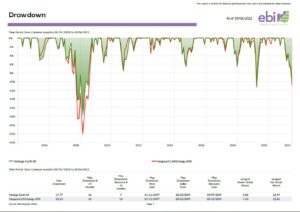

The management of risk is also shown in the Drawdown chart below.

The chart shows the periods when the portfolios have experienced losses; the extent and duration of them. You can see the red line for Vanguard’s portfolio has typically been worse than EBI’s earth portfolio.

60% Shares

The same analysis for the portfolios that invest in 60% shares and 40% government bonds shows a similar story

The portfolio has outperformed, although not as significantly as the 80% shares fund. But the portfolio has still taken less risk and experienced less dramatic falls in value.

40% Shares

The story is a little bit different for the portfolios that invest in 40% shares and 60% government bonds. The table below shows that the Vanguard equivalent has outperformed.

But that doesn’t show the whole story. Note how much more volatile the Vanguard portfolio has been (the Standard Deviation measure). And, as per the Drawdown table below, how great the falls in value have been for Vanguard investors. Not ideal for cautious investors who don’t like or can’t afford the uncertainty.

Not All Bonds Are Created Equal

The main reason for the difference in risk experienced is the type of government and corporate bonds used in the portfolios.

When governments and corporations borrow money from investors they do so over different terms. At the end of the term, the principal is paid back to the lender. In general, the longer a bond’s term the higher its duration. Duration risk is the sensitivity of a bond’s price to changes in interest rates. Bonds have an inverse relationship to interest rates; when the cost of borrowing rises (when interest rates rise), bond prices usually fall, and vice-versa.

The longer the term the longer the duration, the higher the interest payment or discounted price investors like you and I expect for handing over our capital for longer. Just like a mortgage company does when we borrow money. One key risk with investing in longer-duration bonds is that if central banks raise interest rates the value of existing bonds falls. If the value of something falls so does the price. This correlation is intuitive, if base rates rise so does the cost of borrowing. That is true whether you are a government or mortgage customer.

If you hold a bond with an interest rate of 1.5% but following an increase in the base rate new bonds are issued at 2.5%, your interest rate doesn’t look so appealing. So, the price that you can sell the bond for falls. It’s simple supply and demand economics.

Therefore, the longer the duration, the greater the sensitivity to interest rate rises and the greater the price volatility.

And herein lies the difference between EBI’s and Vanguard’s portfolios. EBI take the view that bonds are in a portfolio to reduce volatility, not to generate higher returns. If you want higher returns you are better to increase the exposure to shares. Vanguard on the other hand has a higher allocation to longer-duration bonds. This difference explains why Vanguard have generated higher returns over the medium to long term but has had greater volatility and worse short-term performance.

The question then for cautious investors is whether it is preferable to have higher returns or less uncertainty.

For a fuller explanation of Government Bonds read this article or watch this video.

What About The Impact?

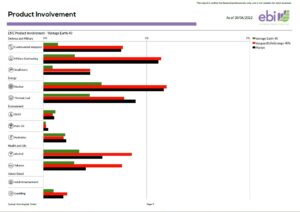

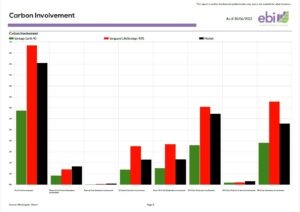

Another central tenant of EBI’s evidenced-based philosophy is to invest in companies that take a more responsible and sustainable approach to their operations and processes. Collectively known as ESG investing it filters companies on how they perform from an environmental, social and governance standpoint.

As the two tables below show, not only have the portfolios been performing well, they are doing so with a much lower carbon footprint and lower, or zero, involvement in controversial sectors.

In Summary

So, in summary, I am happy that EBI Portfolios Ltd continues to do a good job for its advisers and clients. They provide portfolios with competitive returns, without taking undue risks and with a lower impact on the world.

This post is for clients of Neligan Financial and should not be relied upon as investment advice. EBI Portfolios Ltd is an outsourced investment manager offering managed portfolios to the clients of UK financial planners.