Nobody likes uncertainty, we tend to be creatures of habit going through the same routines every day; getting up in the morning, the commute to work, the ebbs, and flow of the day, what you do of an evening. By and large, they take on the same look and feel. So, when something happens to upset that balance we feel unsettled by it. Change can leave us feeling discombobulated.

When we receive new information (news) that will have a positive or negative effect on our lives we react emotionally, positively or negatively. Happiness, joy or excitement on the one hand. Fear, worry and anxiety on the other hand.

Stock Markets Don’t Like Uncertainty Either

Investment markets react the same way to uncertainty. The value of a stock market on any given day is the aggregate view of the human participants within that market. So, when investors get jittery the response is seen within the markets in the form of losses, corrections and crashes. And, because we make decisions emotionally rather than logically, our responses (ergo the market response) are often overblown.

The greater the uncertainty in the world the more jittery and prone to mood swings the stock markets tend to be. The current Coronavirus situation being a great example; because the economic situation is changing every day the markets struggle to cope assimilating the news cycle and so daily changes in the price of stock markets are much higher than normal.

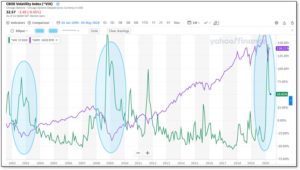

In investing parlance this is known as volatility, which if you think back to your school days, is how much any given metric varies against it’s average (read this article if you want to understand more). Take a look at the chart below to see this visually:

The chart from Yahoo Finance shows the Volatility Index (VIX) in green. The VIX measures the amount of fear or uncertainty in the market (specifically the S&P500). In this chart, it is measured against the S&P500 (purple line) since 2002. The blue ellipses show the spikes in volatility during major global events. The first ellipse coincides with the start of the second Iraq war, the second, the global financial crash, and the third, the current Coronavirus pandemic. Note how the increases in the levels of volatility also coincide with significant falls in the value of the S&P500.

In other words, bad stuff happens in the world, this creates uncertainty which we hate as humans so we react negatively and en-masse with our money and so investment markets fall and become more volatile.

The Investing Paradox

But, this, however, is where the great paradox of investing lies. As investors in global stock markets, we expect to receive a return on the investments we make within our pension and investment funds but, we can’t expect a high return without acknowledging the need for uncertainty.

When we invest we are, knowingly or not, saying that we are willing to buy this market/share at a particular price and expect to benefit from future profits in the market/company but, because we don’t know what the future looks like we want a discount for accepting this uncertainty.

The greater uncertainty is at any point in time (because, say, we are in the midst of a global pandemic) we want a greater discount on the price we pay at outset. Which takes us back to why stock markets fall when uncertainty increases. When there are more sellers than buyers, the price of any good falls.

Who Would Want to Run an Airline Right Now?

Take the share price of International Airlines Group (IAG) as a case in point. IAG owns British Airways and other global airlines and the future of air travel looks pretty bleak right now, to say the least. As a result, the share price for IAG shares has fallen a massive 70% since the start of the year, as per the chart below (source Yahoo Finance).

In other words, the market is saying, I don’t like the look of the future of air travel and so how will airlines make any money or even survive? Therefore, to be compensated for the risk of owning these shares and accepting uncertainty, I expect a greater discount on the price.

It is an irrefutable and unbreakable equation: Higher returns = Higher levels of risk. If you can’t tolerate uncertainty (and therefore risks) you have to accept the lower returns offered for less volatile investment or savings accounts. But this brings with it different types of risk.

The reality is though, uncertainty is an everpresent. Until crystal balls are available it will always be so.

Title image courtesy of @behaviorgap.