I’ll start the diet tomorrow.

I’ll get fit tomorrow.

I’ll do those tasks tomorrow.

I’ll sort out my finances tomorrow.

Mañana. Mañana.

We know doing certain things are good for us but it is easy to put them off until the future. We put them in the important but not urgent file until they become important AND urgent.

The problem is the future has a nasty habit of turning into the present. At which time it is either too late for those important jobs or just harder or more expensive to get them done.

Immediate rewards are simply more compelling than future ones. I know that a pasty is not good for me but my brain is screaming “Yummy! One pasty won’t hurt and you can exercise tomorrow to burn it off.”

Logically, I know that exercising will make me feel better, look better and keep the doctor away but not doing it now is easier. I don’t have to experience the lung burn, the tired legs, or the miserable British winter weather.

The same too for our money.

Anyone of sound mind knows that it is sensible to keep on top of their finances and make sure they have enough squirreled away for the future. But so many of us put off doing so.

In my experience it comes down to several reasons:

- You are too busy with work and/or raising a family.

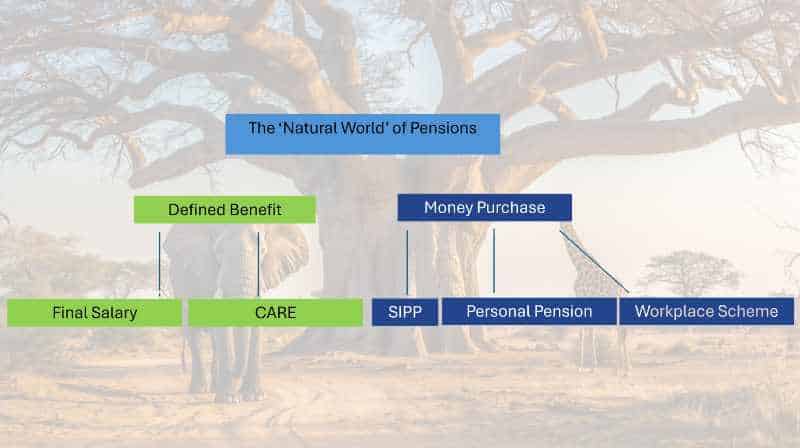

- You don’t know where to start.

- You don’t have the confidence to deal with money. You are not a ‘numbers’ person.

- You are worried that you’ll find out you don’t have enough. What you don’t know can’t hurt you.

- You don’t want to speak with a financial adviser and be made to feel stupid, inferior or embarrassed about your financial situation.

All are understandable concerns but not facing up to them will not improve your situation. The only way to lose weight is to get off the couch. The only way to get financially fit is to tackle the numbers and the paperwork (with or without the help of a financial adviser).

There will never be the perfect time to act. There will always be 101 reasons to put it off, but those people who are in control of their money and are making smart decisions are the ones who have taken the decision to act.

Present-Oriented vs Future-Oriented

It may be that the way your brain is wired gives you a more present-oriented outlook. Whether you are present-oriented or future-oriented stems from your experience as a child and the behaviours you learnt from people of influence in your life at that time.

Personally, I am more future-oriented which makes me more inclined to plan for my future security and independence than focus on today, which makes sense as a financial adviser. But being too future-oriented isn’t ideal either; I have to be more mindful of enjoying the present rather than having a “I’ll be happy when…” mindset.

If you are someone who is also more future focussed and has thoughts of “I’ll be happy when…” you are more likely to find that happiness is elusive. That future date will never come because there will always be the next thing you need to ensure your happiness: a bigger house, more money in the bank, longer holidays. Whatever it may be.

So, as with what you eat, how much you exercise or any other activities that are good for you, planning your financial future is all about balance. The balance between making the most of today and being prepared for tomorrow.

This article may have compelled you to act and sort out your finances. If you want help doing it contact me here today or tomorrow. But as the Polaris World advert used to say. “Maybe tomorrow. Better today.”

Photo by Brett Jordan on Unsplash