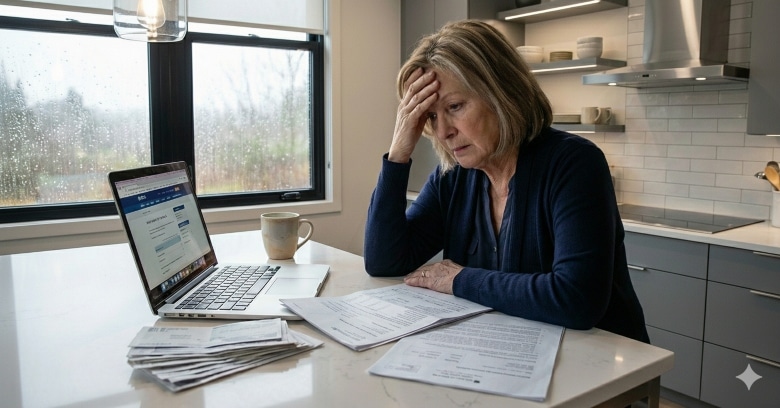

Mary (not her real name) faced additional stress and hassle after losing her husband because she couldn’t access their financial information. She didn’t know how to get into their joint bank accounts or retrieve vital information stored on his computer. She found herself essentially locked out of their financial life, with few options available to her.

What money did they have? How could she ensure she received her husband’s pension income? How would she pay the bills?

In the end, after countless hours of trying, she and her daughter managed to unlock everything and start over but his ordeal added an unnecessary burden to an already difficult time.

Technology has made our lives easier and more comfortable in countless ways, but when it fails us, the consequences can be overwhelming, making us miss the simpler pre-digital era.

Today, so much of our information is stored (hopefully securely) online. This means that when we die, as Mary discovered, our loved ones may struggle to find or access the essential information they need for their financial security and comfort.

Even if there are hard copies of information, do your spouse, children, or other family members know where to find it all?

- Who do they contact to ensure the pension income doesn’t stop?

- How do they access savings accounts in your name?

- What life assurance policies need to be claimed?

- What websites will they need to manage accounts?

- Where is the will stored?

- What information will they need to complete probate?

When grieving, they won’t want the added stress and complication of being unable to access your money and other important information.

With this in mind, I have created a template that you can complete to provide your loved ones with all the information they need. Of course, to ensure they know where it is, you’ll need to share it with them and not keep it hidden in the depths of your computer, protected by a password only you know! If you use cloud platforms like OneDrive, Google Docs, or Dropbox, you can give access to other people while keeping the master document secure.

It would also be sensible to update it at least annually so that when they need to access the information, it isn’t out of date. Regular updates will ensure that all the information remains accurate and useful, easing the burden on your loved ones during a difficult time.