Sometimes life can be cruel and throw us curve balls that we’re not expecting or prepared for. Another term for it is ‘sh*t happens’. The most catastrophic would likely be the death or serious illness of ourselves or a loved one. We have all probably been affected by the death or serious illness of someone close to us; my wife had a childhood friend who collapsed from an asthma attack, went into a coma and died just two weeks later, leaving behind a husband and two young boys. Tragic beyond words.

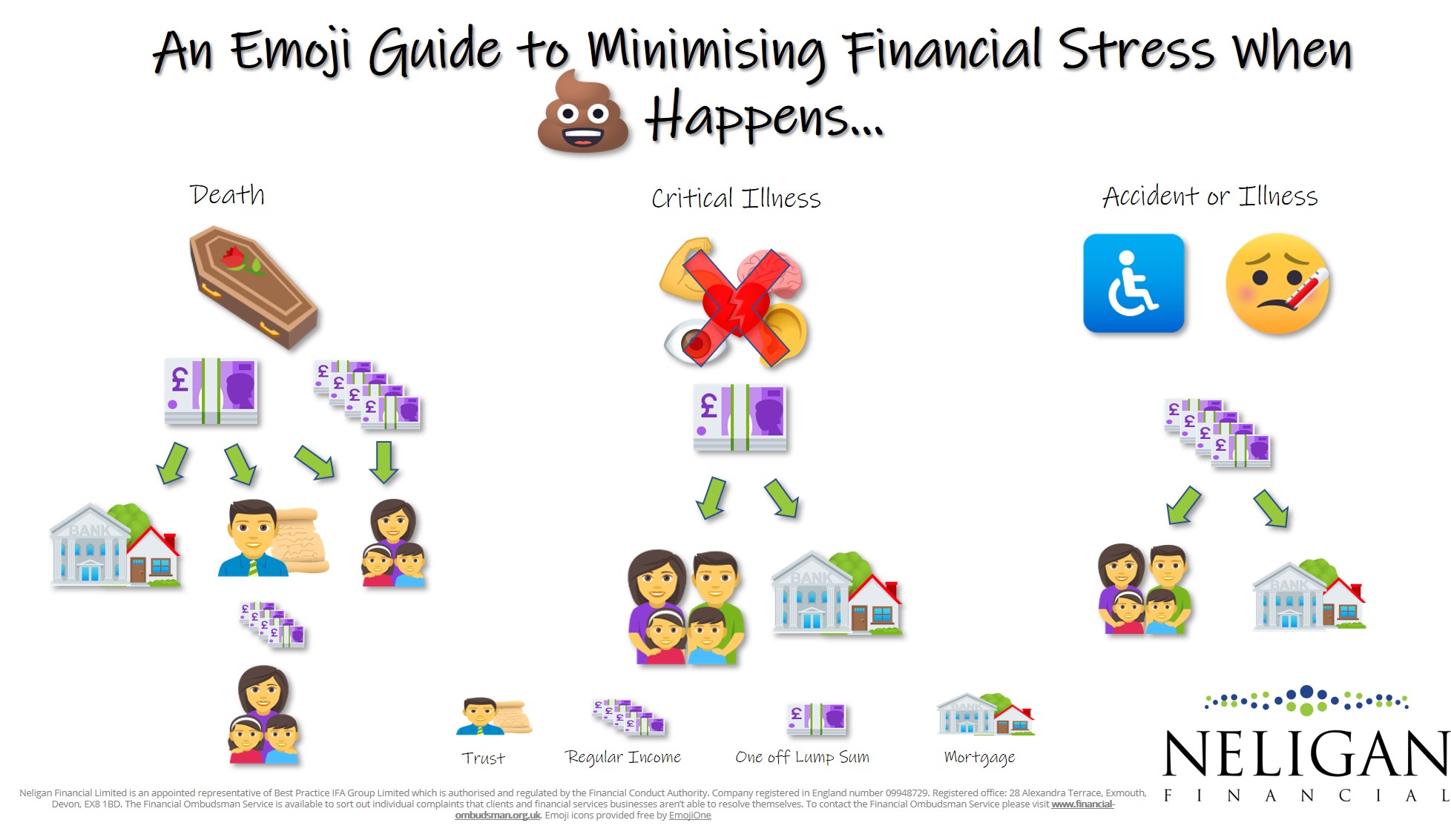

Money is a cause of stress for many as it is, when added to grief it can be overwhelming. Whilst we don’t know what tomorrow will bring and we can’t avoid the grief that death, serious accident or illness causes we can at least minimise the financial stress that we or those we leave behind may feel.

This is where life assurance can be so valuable. By knowing we can afford to maintain our lifestyle, pay off a mortgage or know our loved ones will be financially secure it provides some peace of mind at difficult times.

There are a number of ways we can do this: we can take out life assurance policies that pay a lump sum or income on death or the diagnosis of a critical illness. Or, if an accident or illness prevents us from working for a period of time we can make sure we have a temporary replacement income until we are able to return to work.

Even as you approach retirement the effect that death or critical illness has can seriously derail previous plans:

- How will the survivor cope with a loss of income?

- Is there enough liquid capital to pay off the mortgage?

- Can children still be provided with deposits for houses or have weddings funded?

- Is there enough capital in pension and investment portfolios to maintain desired lifestyles?

- Do adjustments need to be made to the house to make it more habitable following a life-changing accident?

It may be that those we leave behind were financially dependent upon us and are not emotionally mature enough (though they might be adults) to make wise decisions with the benefits from a life assurance claim. In such situations, the benefits can be paid into a trust, with the trustees directing who receives the money and when.

Life assurance policies that are written into trust also have a potential benefit of preventing a large capital sum being paid into the deceased’s estate and therefore potentially pay inheritance tax at 40%. It also ensures the funds are received sooner.

Many people see life assurance as an additional cost in their already expensive lives but the experience of those who have suffered death, serious illness or have just been unable to work is starkly different for those who had a life assurance policy to claim against compared to those who didn’t.

If you want to understand how you can minimise financial stress for you and your loved one when sh*t happens, get in touch.

Emoji icons provided free by EmojiOne