Claudio Ranieri is most famous in this country for guiding Leicester City to a shock Premier League title in 2016. Until then, he was remembered for managing Chelsea at the turn of the century, during which time he earned the moniker, ‘The Tinkerman’.

The nickname resulted from the constant rotations of his team. The constant tinkering prevented any cohesion and consistency from the players and despite improved performances in the 2003/04 season, he was sacked once Roman Abramovich’s Russian Revolution started.

Of course, managing a Premier League football team is a complex task with many different challenges but the point is constantly making tweaks is unlikely to be a winning formula for any plan. It’s the same with your pension and investment portfolio.

Investors who make a habit of regularly checking their portfolios are prone to want to make changes. It can be tempting to want to change a holding that doesn’t seem to be performing or buy one that appears to be in favour to keep your money growing. You feel like you should be doing something because passivity is a hard strategy to follow.

When it comes to investing (and many things), patience is the key. Or as Warren Buffet once explained in a letter to his shareholders:

“Lethargy bordering on sloth remains the cornerstone of our investment style”

Constant tinkering with a portfolio is unadvisable for three reasons:

The more you buy and sell holdings the more you pay in transaction fees.

The more you pay in fees the lower your returns will be. And, while returns can’t be guaranteed, lower charges can be.

You can’t predict which market will provide the highest returns from one year to the next.

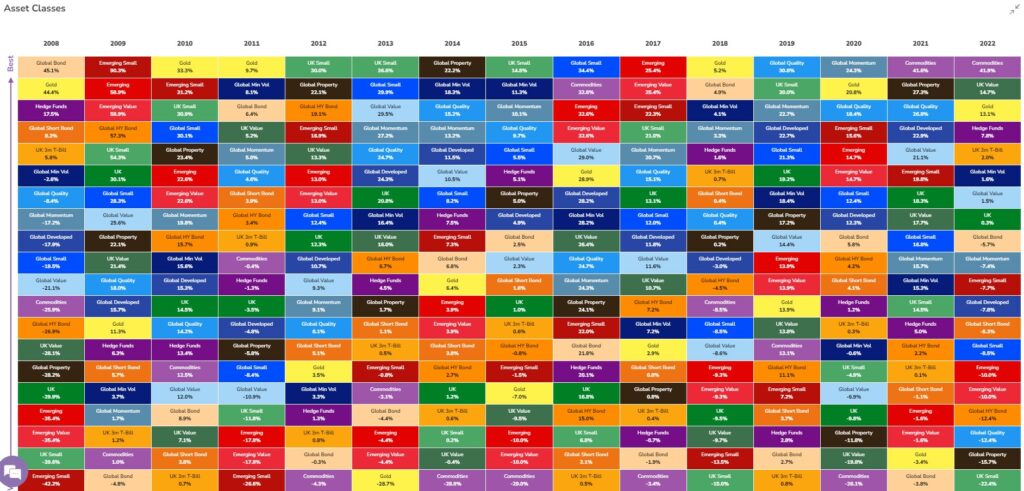

Despite what you may believe or what so-called ‘experts’ will tell you, markets are unpredictable. The chart below* shows how random returns can be. It shows how the major asset classes are ranked from highest performing to lowest each year from 2008. The patchwork quilt effect shows there is no pattern that can be interpreted from it. Click the image to enlarge.

Take gold for example. An asset class loved by the financial press and speculators alike for its defensive nature during stock market crashes. “When markets are falling money moves to safe-haven assets like gold” is the argument. But look at the chart below which plots the ranking of gold since 2008. For those who covet gold due to its defensive nature, that is some rollercoaster ride they are going on. Click the image to enlarge.

And, because nobody can predict the future and because investors tend to follow the herd, we can be confident that most ‘gold bugs’ will buy at the top and sell at the bottom with heavy losses. As I have said before, gold should be for decoration, not speculation.

You’ve got to get out of compound interest’s way.

Compound interest works best when it is left to do its thing. It takes time to enjoy the full effects of compound returns but it is worth the patience and discipline. Tinker with your portfolio because you believe something better has come along or because you fear losses and you will miss out on these long-term rewards.

Investing is simple when you block out the noise. Active fund managers will tell you that their experience and expertise are worth paying extra for, but this is rarely the case. Invest your pension or investment portfolio in a global spread of low-cost, index funds that are left for long enough and you are more likely to meet your needs better than any tinkering you feel you need to do.

If you want to discuss how you can invest for your needs, get in touch.

*Source: EBI Portfolios Ltd

Photo by Jametlene Reskp on Unsplash