Did you ever own a Blackberry? In the early to mid 200s it was the must-have communication device for busy professionals.

And then it wasn’t.

As history shows, the Blackberry was ultimately replaced by Apple, specifically the iPhone. A device that has literally changed the world.

Blackberry’s growth actually continued to 2012 but in that year, Research in Motion, the name for the company at that time, reported it’s first loss and, having made 2,000 redundancies in 2011, laid off a further 5,000 in 2012**. Meanwhile, iPhone sales have grown from 1.39m in 2007 to 217m in 2018 (peaking at 231m in 2015)***.

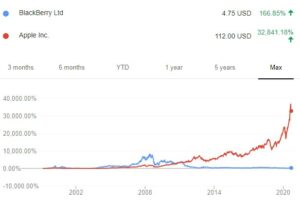

As a result of this huge global demand (and coupled with the sales of iPad and Mac computers), investors have been clambering over themselves to own Apple shares. The chart below* shows the relative returns of the share price of Blackberry and Apple. Apple surged from a low base in the early 2000s to a $112/share price whilst Blackberry has fallen from a peak in 2008 of $138 to $4.75 now.

And if you didn’t have a Blackberry, chances are you had a Nokia mobile phone. Note on the chart* below how the terminal decline of Nokia’s share price coincides with the launch of the iPhone.

At the height of their powers nobody would have dared suggest either Blackberry or Nokia would be usurped. It was not possible to see what might be coming up behind them but nothing lasts forever.

Apple, along with the likes of Amazon, Google and Netflix are the darlings of the stock markets now, but at some point they won’t be. As sure as night follows days, there will come a time when Apple goes the way of Blackberry, Nokia, and all of the other companies that once ruled the world and now don’t.

Think of it as the theory of evolution but for companies not nature, or the days of great empires and dynasties. Everything has a life cycle.

At this stage, we can’t guess at what the new kid on the block will be or even the event(s) that triggers the demise, but whether it is a new innovation like the iPhone, an accounting scandal (Enron), changing consumer trends (Ford), environmental (BP) or economic factors (Lehman Brothers), there is no reason to believe that Apple will be swim against the tide of change.

Which is why the smart investor owns every company, not just a select few ‘winners’ because they understand the theory of evolution and know that by owning a small part of every company they can put up with the duds and fallen angels because they know by default they will own today’s winners as well as tomorrow’s; the companies that aren’t even a twinkle in their founder’s eye yet.

If you want to understand more about sensible investing, click here.

*Source: Google Finance

** Source: Wikipedia

*** Source: Statista

Photo by Duncan Kidd on Unsplash