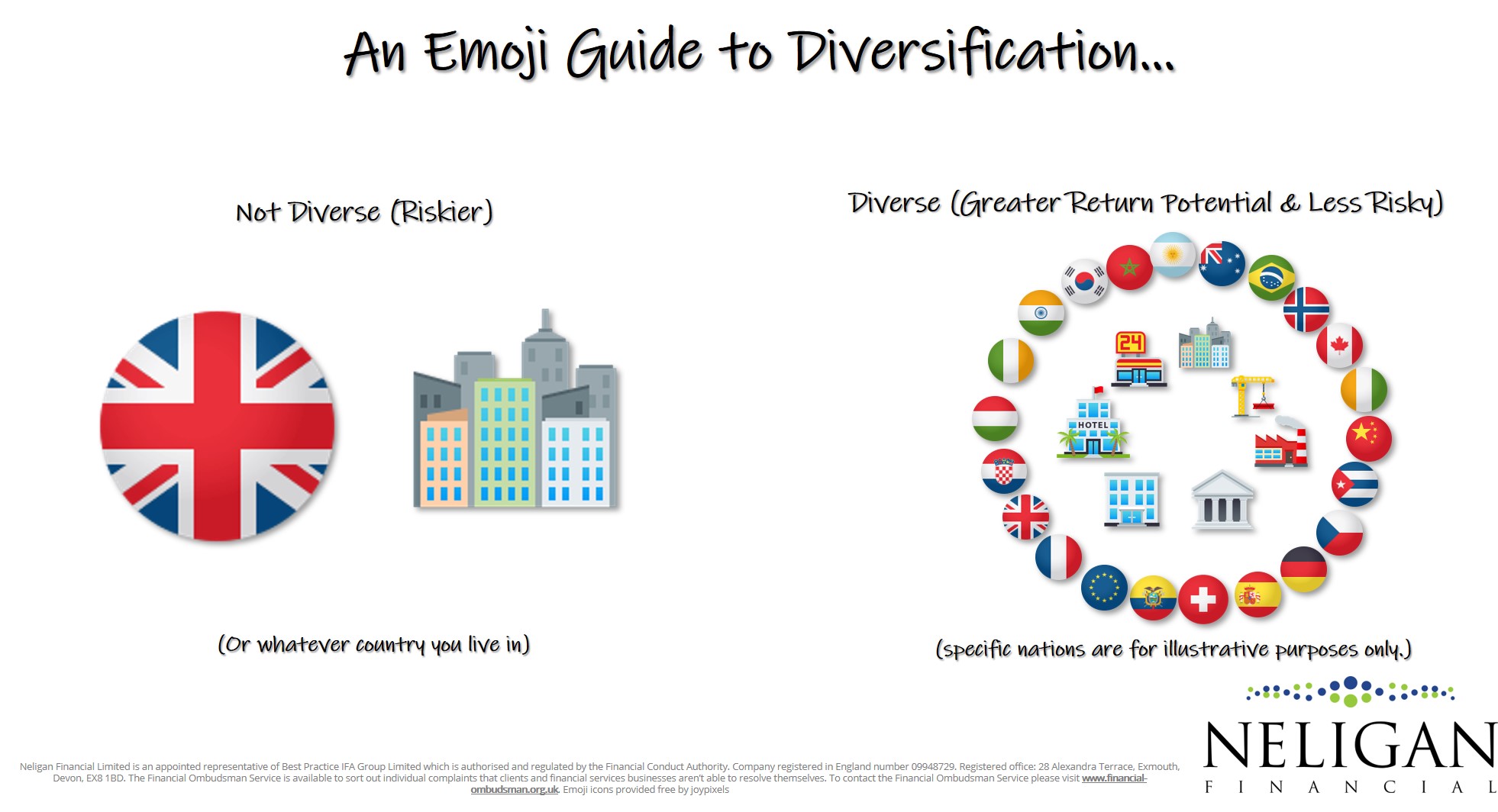

Whether they knew it or not, our mothers and grandmothers taught us one of the most important lessons of investing: not having all of your eggs in one basket. Yet, through naivety, many investors, make this mistake. In investing parlance it is referred to as having a lack of ‘diversification’.

The purpose of diversifying your investment and pension portfolios is to maximise returns for less risk. And, whilst there is no such thing as ‘risk-free’ (because there are many different forms of risk as I explain in this video) and neither can you have higher returns without higher risk, by spreading your portfolio across asset classes and around the globe, you avoid the risk of any single part of your portfolio having a greater impact on your overall wealth.

As investment writer Nick Murray says:

“You don’t want to have so much in one holding that you can make a killing in it or that you can be killed by it”

In my experience UK investors don’t diversify enough for two principal reasons:

- As a nation, we have an obsession with property ownership and many see buy-to-let property investing as the only way to invest. I believe this is primarily due to a lack of knowledge of the alternatives but, even though there is nothing inherently unsuitable with property investing, you are placing the quality of your future on the relative success of a single asset class in a single country (and often a single property in a single region of the country).

It’s not that you can’t or won’t generate a return with property but you may find that you are missing out on higher returns from other global asset classes or that the risks of property (as covered in this article) are too easily overlooked. Furthermore, the cost of buying and selling property now means the property investor starts someway behind the stock market investor at the outset.

2. Investors around the world, not just in the UK and not just private investors but many so-called ‘professionals’, also tend to invest too much in the UK stock markets (or their respective domestic stock market). This ‘home-bias’ is a result of the comfort of investing in what you know because it feels safer despite there being no real benefit of doing so.

It does, however, bring with it the idiosyncratic risks of the domestic economy exacerbating portfolio losses compared to a more globally diverse portfolio. Brexit is a prime current example. It doesn’t even have to be a 100% allocation to the UK stock markets; on a market capitalisation basis, the UK stock markets equate to 6% of the total stock market value globally yet UK investors may have 25% or more of their portfolios in the UK.

An investment or pension portfolio invested entirely in shares (equities) will always carry the risk of short-term falls in value; during extreme stock market events it is not unprecedented for the values to halve before recovering. However, a portfolio that is entirely invested in the stock market of a single country will be inherently more risky than a portfolio that invests in stock markets around the world. Yes, they can still fall in value but it is not overexposed to the trials and tribulations of a single economy.

What is more, a portfolio that is made up of different asset classes will experience fewer extremes than a portfolio that is invested entirely in the equity markets. This is due to the effect of correlation: stock markets tend to move in the same direction as each other but Government Bonds and stock markets tend to (but not always) move in opposite directions.

As explained in this video, diversifying across the different asset classes results in some parts of the portfolio going up in value whilst others go down in value but the net, long-term effect, should be positive returns without experiencing the larger extremes of investment returns.

However, it is possible to be too diversified. When prospective clients come to me looking for advice on their existing portfolios it is often the case that they are invested in a number of funds within the same sector or asset class. For example, they may have three or four UK equity funds.

I can understand their thinking behind this; they are heeding their mother’s advice not to have all of their eggs in one basket. But, being too diverse in a single sector means that all that is happening is they are holding the same underlying shares or holding every share in the respective market across the different investment funds. Which means, if they are invested in actively managed funds, they are paying the higher costs of active management with index-tracking type returns. In other words, they are diversifying away any chance of active fund manager value (if that is even possible) but still paying for it.

A properly diversified portfolio will, therefore, remove the unsystematic risk of a single company, sector or asset class destroying a portfolio whilst accepting the systemic risk that is inherent (and needed) when investing.

Putting it another way, there should always be part of your portfolio that is disappointing you because it is performing poorly. Assuming, that is, it was appropriate in the first instance! The strategy is then to sell the parts that have done well and buy more of the parts that have done poorly. It may sound counterintuitive but it is the “buy low, sell high” mantra in practice.

If you would like to discuss the appropriateness of your investment or pension portfolio you can get in touch here.