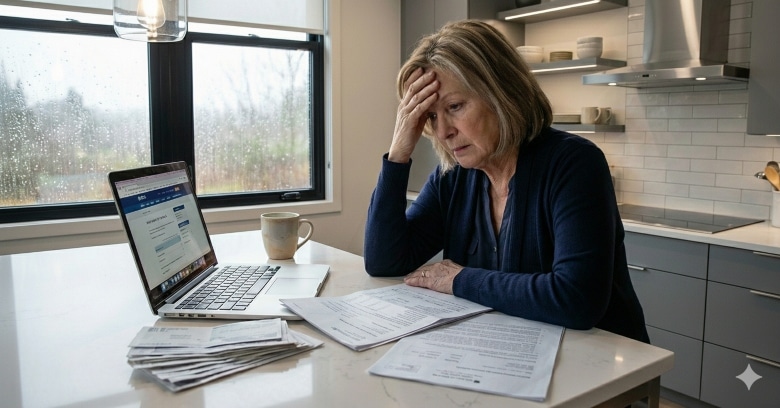

If you are confused about all this talk about government bonds and the havoc in the markets read on. 👇

When governments need to raise money they have two options: raise taxes (not a vote winner) or they can borrow money.

Loans by the government are known as government bonds (aka gilts in the UK and treasuries in the US).

Think of it like you or I borrowing money for our needs: a home, a car loan, money to start a business or any other large expenditure we can’t meet from our income (in government parlance it is referred to as the budget deficit).

Governments borrow money for capital projects to get the economy growing. Such as building roads, schools and hospitals etc, to fund benefit payments and other commitments, and to pay for extreme events like COVID and wars.

The current level of UK government debt is around £2,365,400,000,000 (£2.4trn). That’s a big number. A very big number. Over 99% of GDP in fact.

Who loans the money to governments?

Investors around the world lend money to governments. If you have a pension or Share ISA it is likely you own government debt.

Like you or I, when governments want to borrow money they have to pay it back at the end of a pre-agreed term and pay interest during that term.

Also like you or I different governments will have to borrow at different rates depending on their credit worthiness; the British and US governments are deemed to be very safe so the interest rates they pay are much lower than countries like Venezuela and Argentina who have both been bankrupt in the recent past.

When inflation is low the cost of borrowing is cheap but as interest rates increases to slow the rising inflation so does the cost of borrowing (again, think of the rising cost of your mortgage if you aren’t on a fixed term).

This means that when governments want to borrow more money they do so at higher rates. As an investor in government bonds the current interest you are receiving doesn’t look so appealing compared to new interest rates. As a result, demand for them falls. And if demand falls so does the price. Ergo, the value of your pension and/or ISA falls.

So what caused all the panic in the markets over the past couple of weeks?

When Kwasi Kwarteng announced his mini budget a couple of weeks ago it caused two things to happened:

- expected tax receipts fell in line with the tax cuts, requiring the government to borrow more to fund the deficit. About £100bn between making up for lost tax and funding the energy crisis.

- inflation was expected to rise even further due to the extra disposable income created by the tax cuts (if you have more money in your pocket you tend to spend it. More spending leads to rising inflation).

The ratings agencies that assess the creditworthiness of governments and large companies didn’t like it so downgraded UK government debt. Essentially their credit score fell. Worse credit score = higher interest payments.

This meant that the £ billions in government bonds owned by large pension funds, overseas investors and private investors like you and I suddenly became worth less because interest rates on new borrowing were expected to rise (due to the fall in credit rating and expected rise in inflation).

This was a very big problem for the large pension funds that have to own government bonds to meet their commitments to current and future retirees. If they couldn’t afford to pay retirees because they didn’t have enough capital, the risk of the pension funds collapsing was a very real possibility.

Then What Happened?

In stepped the Bank of England to buy government bonds to calm the markets (it has been doing that since the 2008 Financial Crash). In effect, they were creating demand for the bonds thereby restoring their value and protecting the large pension funds.

The lesson for any future Chancellor? Think through the potential ramifications of any budget plans and at least give the markets a heads up so they don’t get too spooked.

I hope that has made the issue a little clearer for you. If it has, why not subscribe to my weekly newsletter for more insights about your money and retirement? Click the button below.

Photo by Jim Wilson on Unsplash