Risk-averse investors seek low-risk, cautiously invested portfolios for a reason; they don’t want to experience the periodic tumult of stock markets. Preferring instead to give up the gains for the comfort of knowing that they are protected from the lows.

So why have cautious investors seen double-digit falls in the value of their pension and ISA funds this year? (If you want a reminder of what bonds are read this article).

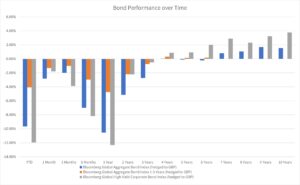

The chart below shows the performance over time of three global bond indices:

- The Bloomberg Global Aggregate Bond Index (which is made up of government and corporate bonds issued around the world with varying terms (payback periods)

- The Bloomberg Global Aggregate Bond Index (1-5 yrs) (which is made up of government and corporate bonds issued around the world with terms between 1 and 5 years)

- The Bloomberg Global High Yield Corporate Bond Index (which is made up of corporate bonds of less financially secure companies from around the world).

Using three different indices shows the performance based upon relative risk. More of which below…

Note how all three indices have lost value over the short-term but specifically over the past year. Particularly for the aggregate bond and high yield indices. If you were expecting a smooth ride you have been left very disappointed.

There is Always A Risk

But this is an important point, low risk portfolios are not without risk. Any investment can, and does, fall significantly in the short term. If you want to know the value of your money is secure cash is the only asset safe from short-term fluctuations in value (but that comes with a different form of risk as we are currently experiencing)

However, with cautious portfolios, it is reasonable to expect a smoother ride. The clue is in the title after all.

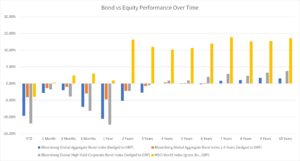

In normal conditions, we would expect to see much less price volatility (variation) in the bond market compared to equity markets, the cost of which is lower returns. But, as the chart below shows equity markets, while also having a torrid 2022, have fared better than bond markets AND have provided greater long-term returns too. Equity markets are represented in the chart by the MSCI World Index, a composite of global stock markets.

Why they are Falling?

The reason the bond markets have performed so poorly is the same reason that it costs more to heat up your home, do your weekly shop (£2 for a block of butter!) or fill up your car; Inflation!

When inflation rises, as we have seen, global central banks react to bring it under control. The mechanism they use to do this is the interest base rate. Rising interest rates push up borrowing costs resulting in less disposable income to buy goods and services. Lower demand lowers prices thereby curbing inflation. This applies to governments, corporations and individuals.

But What Has That Got to Do With Falling Bonds?

As an investor in bonds via our pension and investment portfolios we have lent money to governments to fund things like infrastructure projects, COVID recoveries, and presently to reduce the energy crises burden. Corporations borrow money too to fund projects they have.

When they borrow money, as you and I do if you have a mortgage, we have to pay an agreed rate of interest back to the lender for a defined period of time (the term). When base rates go up new bond issues have a higher rate of interest. So, as an investor, if we have a bond issue that has an interest rate of, say 1%, the value of your bond issue isn’t very attractive if new issues have an interest rate of, say, 2%.

You can hold onto it until the end of the term and continue to receive 1% pa or you might try to sell it on the bond markets. But the value of your bond in the market isn’t particularly attractive anymore. And, if something isn’t very attractive the price falls. Which is exactly what we have been seeing.

The simple rule is when interest rates go up bond prices fall. And vice versa.

But Why Have Some Indices Performed Worse?

As noted above, the different bond indices have performed worse. The reason for this is twofold.

Firstly, the high yield index is for bonds issued by companies that are deemed to be less financially secure. As with individuals, if a company isn’t as financially strong they have to pay a higher rate of interest to compensate investors for taking on the higher risk. In other words, they are higher yielding; yield being the interest rate as a percentage of the price of the bond.

And if interest rates go up, the ability of a company to repay debts reduces which reduces the attractiveness of holding the bond issue and therefore reduces the price.

The second reason for the difference between the relative performance of the bond indices is something called duration. Duration is the term of the bond issue. The longer the duration the greater the sensitivity to interest rate rises; if I am holding a bond for less than 5 years (short-dated bonds) and interest rates go up I don’t have to wait long before the bond redeems and I get my money back.

Whereas, if my bond duration is longer I have to wait longer to get my money back. I’m stuck receiving relatively lower interest payments than would be available to new issues for longer. Ergo a greater fall in the price compared to shorter duration bonds.

It’s Not Unprecedented

While this inversion of the risk/return relationship is not normal it is not unprecedented. Whenever there has been a period of interest rate rises bond markets have fallen; 1994 was such a period. Referred to as the Great Bond Massacre, the cause was the recovery following the global recession in the early 90s leading central banks, starting with the Federal Reserve, to raise interest rates to manage rising inflation. The result was similar to what has been experienced this year.

A Future Recovery?

The next direction of the bond markets is impossible to call but what history does show us is that when major asset classes fall they do recover. Often the strongest part of the recovery is immediately after the fall.

Now is certainly not the time to panic, sell your holdings and turn a fall in value into a real loss.

Source for market data: Dimensional Fund Advisers