For the first ten years of my life, I grew up near Dawlish, a small seaside town on the south Devon coast. It was unremarkable in many ways but what did stand out were the black swans that resided there.

As a young boy, therefore, black swans were intriguing but part of everyday life so it wasn’t until 2008 and the Great Financial Crash that the black swans took on a different meaning.

The term entered the lexicon following the publication of Naseem Taleb’s book, Black Swan Events which made the point that until black swans were discovered all swans were assumed to be white; if all you see is white swans why would you consider another colour might exist? But outliers can and do occur from time to time and on their discovery, it brings about a paradigm shift in our understanding and acceptance of what is possible and may happen.

Black Swans & Money

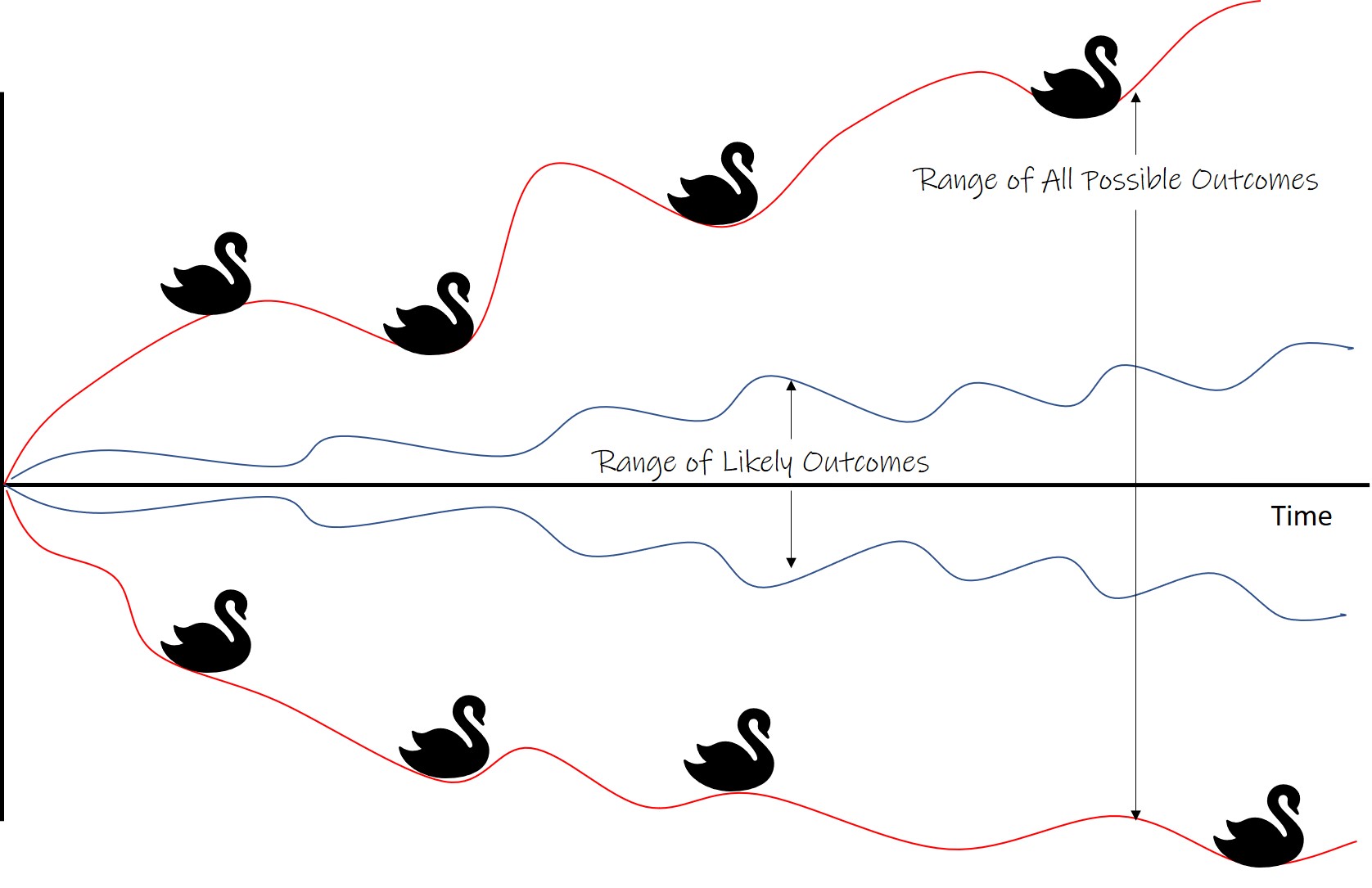

For every occurrence we experience there are millions of different possible iterations that could have, but didn’t happen (Sliding Doors moments as popularised by the film). Chaos Theory explains that small, imperceptible changes may make little difference in the short-term but extrapolated and compounded over time the difference in potential outcomes can be huge (a butterfly flapping its wings in the Pacific can cause a hurricane in Texas as the example goes).

The 2008 Financial Crash was a black swan event because nobody (or very few) saw the house of cards that was built on the shaky foundations of the highly indebted, poor credit backed US housing market. It took the perfect storm of clamour for homeownership, the willingness to offer cheap debt to those on low incomes, corporate innovation and greed and raising interest rates to bring the global financial markets to a grinding halt, and with it global banks and whole economies to their knees.

Looking back now through the lens of hindsight we can see why it was possible that it could happen (and could do so again).

Black Swans & Pandemics

We have witnessed pandemics take down countries and regions before (SARs, Bird Flu, Ebola etc) but until COVID-19 struck nobody imagined that a virus could have such a catastrophic effect on the whole world (as evidenced by universal unpreparedness). Particularly one that is believed to have originated from a bat.

Now we can see precisely why it can happen and what chaotic events can ensue from one seemingly benign origin.

Black Swans & Sport

And so too in the less consequential but globally popular world of sport. Watching my beloved Man Utd losing 6-1 at home to Spurs was surprising but when analysing the game the pundits could identify and speculate as to the reasons (the tactics were wrong, they were still unprepared three games into the season, Man United’s transfer strategy is non-existent, the players don’t care enough).

But, Liverpool, the reigning Premier League champions, world club champions and with three wins out of three so far in the season, would never lose to Aston Villa, a team who narrowly avoided relegation on the last day of the season only weeks ago. Surely not?

Except they did. And it wasn’t even a close game. Liverpool lost 7-2, which by any measure is a freak result.

There were millions of possible iterations to that game that could have played out. Had Villa not scored early they wouldn’t have had a surge in confidence. Had Liverpool’s first-choice goalkeeper not been injured fewer goals may have been conceded. Had their star striker not tested positive for COVID-19 Villa may have had to play more defensively. Had three of the shots not been deflected they may have been saved or missed rather than resulting in goals.

In some parallel universe the match may have had a different outcome but in our world the result of all those inputs and small iterations produced an unexpected result.

So what were the chances of Man Utd losing 6-1 and Liverpool losing 7-2 only hours apart? Funnily enough, I didn’t look at the odds of that before the games, I doubt anybody did because it was inconceivable. I would guess at 1000-1 if not longer.

A black swan event in a footballing context.

So how can we apply this to our money and our lives?

By understanding that outliers can and do happen regardless of what we expect we can at least be prepared for any eventuality.

We can’t predict what the event will be, when it will occur or what the trigger or effects will be but we can plan for the possibility.

We do this by making sure that we are taking only controlled risks and mitigating those risks as much as possible. This will include:

- Making sure we are making smart decisions with our money and in line with our priorities (because wasted money can’t be recovered).

- Keeping enough money in savings to cover short-term needs,

- Spreading our cash between banks so we don’t exceed the compensation limits if one fails,

- Investing for the long-term to protect the value of our money against inflation,

- Spreading our investments around the world, in different asset classes and in as many companies as we can.

- Passing the risk of loss of earnings, death or illness to life assurance companies.

- Investing in ourselves so that we maintain or increase our value to the marketplace.

If you want to make sure you are making the right decisions with your money, contact me.

This article is for information only. Please do not act based on anything you might read in this article.