“When the facts change, I change my opinion, what do you do Sir?”

John Maynard Keynes

The World Cup has just reached its conclusion with Argentina claiming their third World Cup title after a dramatic final against reigning champions, France. It was a festival of football that also provides a useful example of how market pricing works.

Stock markets are a collection of companies owned by global investors who give up capital in exchange for shares with the expectation of benefiting from growth in the value of the shares. However, investing in company shares comes with risk; the risk of a fall in the value of the investment, and potentially a complete and permanent loss if the company becomes insolvent.

Perception is Reality

The value of a company’s shares is dictated by the aggregate perception of the future fortunes of the company as set by traders around the world.

Shares are traded on stock markets with their price based upon the demand for them; if more investors are positive about the future of the company (i.e. they believe it will be profitable) the price of the shares will rise.

On the other hand, if on balance investors are pessimistic about a company’s future success there will be more sellers than buyers of the shares. In any market, if there are more sellers than buyers the price will fall. This is what we experience during stock market losses.

The movement and total value of a stock market (also known as an index) is the sum of the value of the shares of all companies in that index. The S&P500 is the largest stock market in the world, comprising the largest 500 public companies in the US. The FTSE100 index is the largest 100 public companies in the UK.

The chart below shows how the FTSE100, the UK’s leading stock market comprising the largest 100 companies has performed over the long term as economic expansion has been interrupted by recessions, wars, pandemics, and banking crises.

You and I are affected by these changing perceptions; the value of our pensions and ISAs are invested to some extent in global stock markets so rise and fall in direct correlation to the changing perceptions over time.

Information is Key

Stock market traders ask themselves, with the information available right now, do I think that this company will be more or less profitable in the future? If it is the former they will buy shares, if it is the latter they will sell.

When new information becomes available the opinion will change, positively or negatively and the share price will change accordingly.

The same is true will gamblers on betting exchanges; gamblers ask themselves, with the information available right now is this team more likely to win or lose? And when new information becomes available the expectation of a result changes positively or negatively.

Betting Exchanges Are A Market Too

We can use a betting exchange* during the course of the World Cup to demonstrate this. After all, a betting exchange is also a public market; instead of hoping to benefit from the future fortunes of companies, gamblers are aiming to benefit from the future fortunes of sports teams; in this case national football teams.

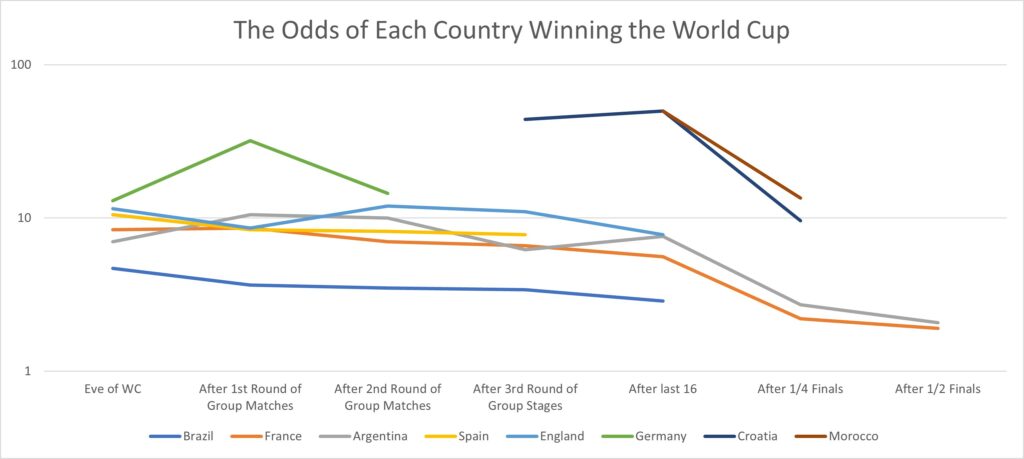

The chart below (click to open) shows how the price (odds) of selected countries’ chance of winning the World Cup changed as the tournament progressed. The lower the number the greater the expected chance of the nation winning and vice versa.

Note the rise and fall in the odds as each country progressed through the tournament and gamblers changed their expectation on the chance of each country’s success. In other words, with new information comes a change in the price (odds).

Key highlights to note are:

- Brazil (royal blue) started as strong favourites and their odds steadily fell during the tournament as they progressed but then came to a sudden stop when they were beaten by Croatia in the quarter-finals.

- Argentina (grey) were another pre-tournament favourite but their surprise loss to lowly-ranked Saudia Arabia saw their odds increase to 10.5. However, they fell again as they won their remaining group games. A scare against the Netherlands in the last 16 round saw the odds increase again as doubts surfaced about their chances, but fell again as they progressed all the way to the final.

- Germany’s (green) lacklustre performances in the group stage saw their odds lengthen and then came to an end after they failed to progress beyond the group stages.

- England’s (light blue) strong against Iran saw their odds of winning tumble only to rise slightly after an unconvincing performance against the US. However, a strong display against Wales saw their odds fall again then getting down to 7.8 having beaten Senegal in the last 16 until they lost to France in the quarter-finals.

- France’s (orange) consistent form throughout the tournament saw their odds fall all the way to the final.

- Surprise packages Croatia (dark blue) and Morocco (brown) progressed much further than most gamblers expected; their odds of winning reduced significantly as people literally bought into the belief they could ‘go all the way’ until they were both eventually knocked out in the semi-finals.

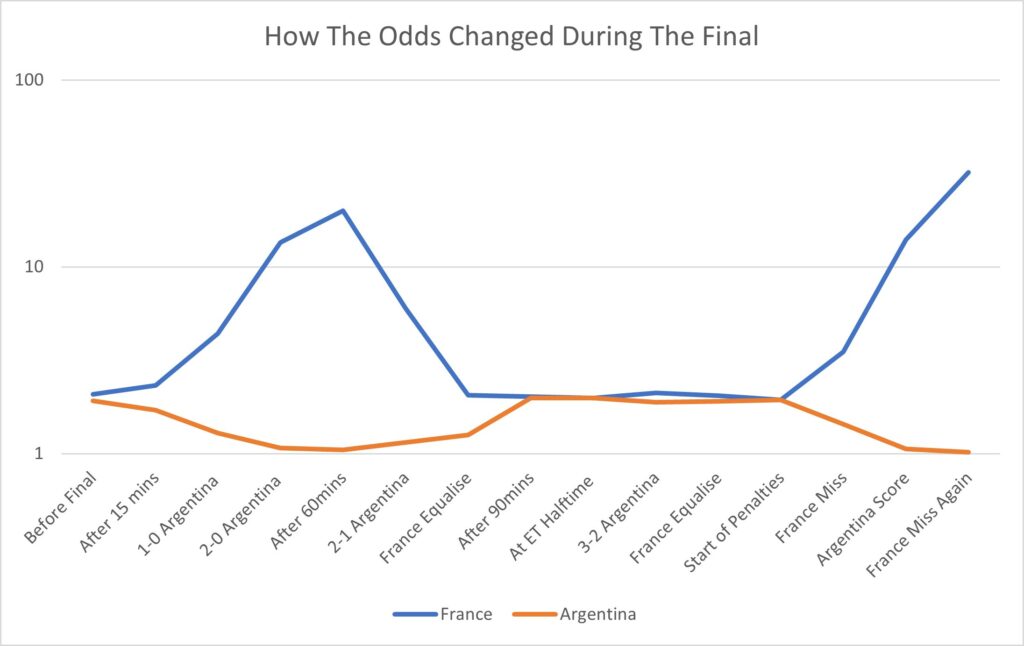

We can see how the odds of both France and Argentina winning the final changed as momentum see-sawed in the most dramatic of finals, as shown in the chart below (click to open). Again, information changed and the odds changed accordingly.

- Argentina started as slight favourites at the start of the final but the gap increased as Argentina started the stronger of the two sides. The market price shortened further as Argentina when one, then two up. Conversely, France’s odds of winning lengthend considerably having gone two down. After an hour their odds of winning went out to 20:1.

- Then France started their comeback; their odds shortened (and Argentina’s increased) as the score went to 2-1 and then 2-2 after Kylian Mbappe’s penalty then stunning equaliser.

- The odds of either side winning stayed close until Messi’s penalty gave Argentina a 3-2 lead in extra time, at which point their odds reduced and France’s increased.

- The odds reached near parity again when Mbappe scored his second penalty, and his third of the game, to equalise for the second time.

- The market was split on who would win the final as the penalty shoot-out started only for France’s odds to fall away after missing their second and third penalties.

- Conversely, the price of Argentina winning fell with France missing and they scored their corresponding penalties.

Hopefully, this post has provided insight into how stock markets work as information, positive and negative is received by investors. The difference between betting odds and share prices is that as the chance of success in gambling increases the price shortens, whereas share prices increase when companies perform better than expected.

Additionally, by investing broadly in the world’s stock markets (as opposed to single company shares), unlike with gambling, your money is unlikely to be lost entirely. In fact, over the long term, you can expect a positive return on your investment.

*odds sourced from the Bet Fair exchange.

Photo by Fauzan Saari on Unsplash