Ever since humans have roamed the planet there have been risks to our survival. 200,000 years ago, if it wasn’t wild animals that had the potential to decimate our developing species, it was polar winters, famines and pestilence. We are the dominant and thriving species on the planet due to our ability to adapt to change.

But existential threats have existed in the modern era too, many (all?) of which are our own creations. Every generation has worried that an epoch-making event will end civilisation as we know it. Today is no different.

But what does that mean for our money? Should we just hide our money under the bed? Or does it not matter if we are all doomed anyway?

Conflicts

The First World War involved over 30 countries and killed over 16 million people. Not only was it devastating on its own, it was the trigger that led to a chain of events of ever-increasing severity. Germany’s defeat in WWI led to the fall of the Weimar Republic, hyperinflation, Hitler and the birth of Nazism and, ultimately, World War II.

Imagine how our grandparents’ and great-grandparents’ generations were feeling about their futures and that of humanity during these grave conflicts.

The division of post-WWII Germany between the Allies and Russia led to the ideological rift between democracy and communism, capitalism and socialism. Coupled with the development of nuclear capabilities during and after the war, the Cold War was the first time rival nations could instantly and savagely destroy entire populations.

We have lived with this threat ever since as more nations have developed their own nuclear capability but the Cuban Missile Crisis must have been an extremely troubling period to live through.

Contagions

It is not only from conflicts that humanity has coalesced to threaten its own demise. Exploration, imperialism and global trade all have enabled the spread of infectious diseases to catastrophic consequences. On separate occasions, the Roman Empire was decimated by the Antonine, the Cyprian and Justinian plagues. The latter of which is estimated to have killed 26% of the world’s population*. The Spanish conquistadors of 500 years ago brought smallpox into South America wiping out both the Inca and Aztec populations, whilst the Bubonic Plague of the 14th Century is estimated to have killed 30%-60% of Europe.

But these contagions were small relative to the spread of HIV in the 1980s and the Spanish Flu in 1918 which claimed the lives of 32 million and 50 million lives respectively*. COVID-19 has claimed 6.9m lives as of 5th July 23** and, although we are back to normal now, during the height of the pandemic the future looked very bleak indeed.

Crashes

During times of financial hardship, the future always looks bleak. Ever since nations and Empires have traded there have been occasions when we have faced financial ruin. The Great Depression had its epicentre in the US but its effects were felt globally for a decade; the Great Financial Crash of 2008 wiped out banks but very nearly governments and whole economies too.

We will never know whether economic measures such as historic low-interest rates, Quantitative Easing and Austerity were better or worse than alternative solutions to save global economies from collapse but the knock-on effects are still being felt today. Many argue that economic policies to restore national balance sheets and promote economic recovery are, in part, a cause of the inflation crisis the global economy has been living through since 2022.

The Future?

As we look to the future we may worry about the risks we face. The most significant of which are:

- The continued threat of nuclear war, especially with the capabilities of ideologically opposed regimes of North Korea, Russia and Iran.

- The climate crisis passing the tipping point destroying not only the polar ice caps and biodiversity but impacting extreme weather events and our ability to meet global food demand from failed agriculture.

- Repeated and more severe pandemics from uncontrolled experimentation, the evolution of drug-resistant viruses or biological warfare.

- Out-of-control Artificial Intelligence in which, like the sorcerer’s apprentice, we lose control of the systems we created.

- A change in the world order in which China usurps the US as the leading superpower creating tensions on a global scale not seen before.

This Is Actually A Positive Article

Despite what I have written so far in the post, the point of this article is a positive one. From conflicts to contagions to crises, we have always faced existential threats and found reasons to worry.

Normally, I don’t see the benefit in worrying, but when considering the fate of humanity I do. If enough people are worrying about issues that have very grave consequences guardrails must be put in place to prevent them from happening.

On the threat of nuclear war, I believe the existence of nuclear threats is a deterrent in itself. No leader, however despotic is going to push a button that will lead to their ultimate demise.

On the climate crisis, we are at a tipping point and action must be taken. But I believe the solutions will come from the innovators and capital markets rather than politicians and protestors.

On repeated and more severe pandemics, I believe the response to COVID-19 has fast-tracked scientific discoveries and governments have learnt the hard way how to prepare and respond to the next outbreak.

On out-of-control Artificial Intelligence, I believe this is more Hollywood-inspired hype than an unintended consequence. However, in the wrong hands, AI could be used to devastating effect which is why our global leaders are not ignoring the threat.

This rebuttal to the threats may seem pollyannaish; I don’t deny their existence but lean towards optimism over pessimism in our ability to counter them. History has shown us that the future is better than the past. There is no generation I would rather live through than today’s; for all the wealth of industrialists like Rockefeller, the Vanderbilts and Carnegie, I would choose today’s comforts over what their extreme wealth afforded them.

So What Does This Mean For Your Money?

The point of this article is what should you do with your money in the light of existential crises. If you believe we are doomed and we are slowly destroying ourselves, fearful of the capital markets failing and banks falling like a house of cards, you would probably feel that under the mattress is the safest place for your money.

But, if you believe the future is going to be better than the past and humanity will continue to adapt and find solutions to the world’s problems, investing in the global investment markets is the only way to protect and grow your wealth.

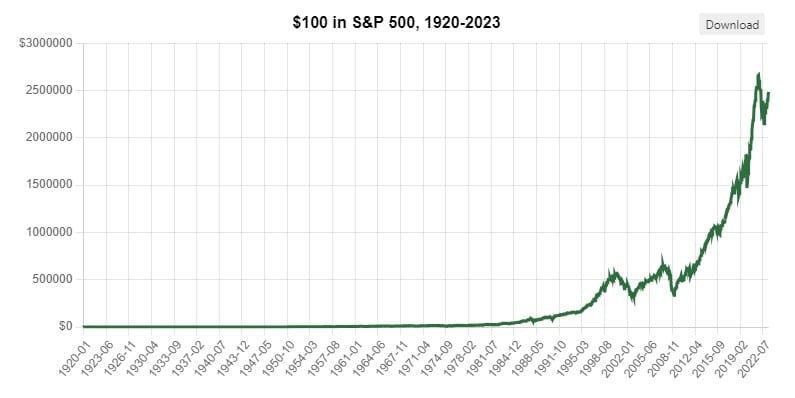

To sign off with a piece of evidence (and accepting the past is not a guide to the future), the chart*** below shows the total return of the S&P500 since before the Great Depression. That’s a return after inflation of 7.42% every year in spite of all the conflicts, contagions and crises we have lived through as a species.

That’s a return after inflation of 7.42% every year in spite of all the conflicts, contagions and crises we have lived through as a species.

Past performance is not a guide to the future.

*Source: https://www.news-medical.net/health/History-of-Infectious-Diseases.aspx

**Source: https://covid19.who.int/

***Source: https://www.officialdata.org/us/stocks/s-p-500/1920

Photo by Greg Rakozy on Unsplash