When investing, particularly as we approach or enjoy retirement, the aim isn’t to win a race against the markets. It’s to complete the course in good shape, financially confident and emotionally calm.

The Illusion of Outperformance

There will always be years when a particular market, sector, or strategy outperforms everything else. It’s tempting to look back and think, “If only I’d moved more into that last year…” These are the moments when market timing and tactical allocation appear to offer a shortcut to better returns.

But here’s the truth: consistently predicting which market will outperform next is virtually impossible. Even professional fund managers, with teams of analysts and vast resources, struggle to get it right year after year. For most investors, frequent tactical shifts can result in higher costs, increased stress, and, invariably, poorer long-term outcomes.

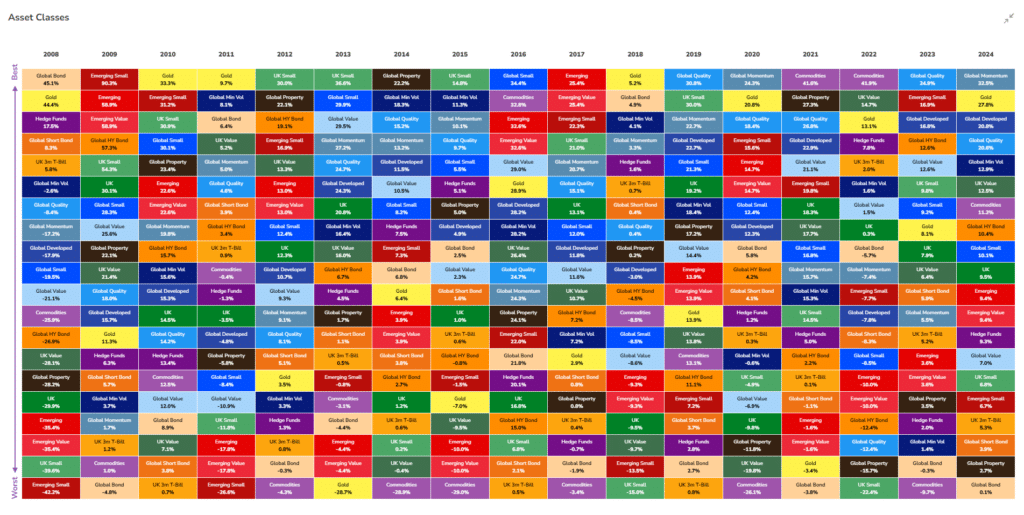

Take this graphic* for example (click to enlarge). It shows the ranking of major asset classes each year.

That you can’t discern any pattern is the point. How can you pick next year’s top-performing asset class out of that randomness? Investment markets are too complex and subject to numerous variables to accurately predict which markets will outperform.

Your Race, Your Pace

It’s easy to get distracted by what others are doing with their money, friends chasing hot stocks, headlines about a soaring market, or people making a killing with Bitcoin, or gold. But investing is deeply personal. Your financial goals, risk tolerance, and income needs in retirement are unique to you.

That’s why the focus shouldn’t be on beating someone else’s benchmark or making a killing. It’s about completing your own financial journey in a way that suits your lifestyle and priorities. Comparing your investment path to others is like comparing marathon times when everyone’s journey to the start line and aspirations for the event differ.

A Marathon Mindset

Think of your retirement plan as a marathon. The goal isn’t to sprint ahead at mile five only to burn out at mile twenty. Instead, it’s about maintaining a sustainable pace, adapting to the terrain, with enough energy to make it to the finish line.

We take a long-term view, focusing on consistent progress rather than trying to outsmart the market in any given year. This doesn’t mean your portfolio never changes; it evolves thoughtfully, in response to your life and the economic environment, not the latest headlines.

Staying in Financial Shape

Just as a good marathon runner trains with a mix of endurance, flexibility, and rest, a resilient investment portfolio balances risk and reward, adapts to changes, and keeps you mentally and financially prepared.

In the end, what matters isn’t whether your portfolio leads the pack in any given year but whether it supports living the life you want, retiring on your terms, and being secure and fulfilled.

So don’t try to win the race. Run it at the pace you need to achieve your ambitions.

*Source: EBI Portfolios Ltd

Photo by Miguel A Amutio on Unsplash