Our obsession with gold has been around since it was first discovered thousands of years ago. Initially, it was used to make decorative objectives or for religious purposes, reportedly first by Eastern European tribes around 4000 BC. It wasn’t until the ancient Egyptians used it to make coins around 1500 BC that it became a store of value and a currency.

Since then we have been adorant of not only its glister but its value too, with cultures around the world using it as a means of exchange. Alchemists would claim they could create it from worthless base metals while imperialistic empires from the Spanish Conquistadors to the Romans and Nazis would make it a primary target of their plundering.

Gold also captures our imagination on screen and in books from stories such as Rumplestilskin to the gold-covered victim of Goldfinger in the eponymously entitled James Bond film and the comic version in Austin Powers’ Goldmember.

Currency Controls

It used to be that the value of many global currencies, including sterling and the US dollar, were pegged to the gold price through the Gold Standard; Britain was the first nation to adopt the pricing mechanism in 1821 but left it in 1931.

In the US in 1933, fearing a run on banks in the aftermath of the Depression and in order to create money supply, President Roosevelt ordered by law that all private gold owners hand it over in return for a fixed price of $20.67/ounce. Later, in 1934, by artificially inflating the price to $35/ounce the Federal Reserve were able to create even more money supply (because more dollars were needed to buy one ounce of gold).

The price of gold was held at $35/ounce by the US government until 1971 when Richard Nixon abandoned the gold standard and returned physical gold to private owners, in a stroke increasing demand on a limited (but now liquid) supply.

But does this make gold a suitable investment?

At a macro level by holding gold reserves, governments and central banks have a store of value and are able to diversify their holdings. In the vaults of the Bank of England, there are 5,500 tonnes of gold at a market price of $180bn*, which is second only to the US Federal Reserve in quantity, although, much of the gold stored is owned by other governments, sovereignties or central banks; If you need to store your gold somewhere safe it makes sense to do so in a country you can trust. Interestingly, this was the case when Britain shipped its entire gold holdings to Canada during WWII should we succumb to Nazi conquest.

But, while it might make sense for government and central banks to hold gold reserves, what about private investors like you or me?

In modern times its value has not just been in its attractiveness but also in its scarcity making it a popular investment during times of economic crisis and uncertainty.

If stock markets are crashing the go-to ‘safe haven’ assets are fiat currencies of the US dollar, Swiss Franc and sterling, and also gold. The price of these assets tend to be negatively correlated to the stock markets, so when markets crash, because demand for safe assets increases, so does their price.

It is helpful, however, to take a step back and consider what we do with the money we don’t spend.

The Role of Our Money

Our surplus money has two primary roles: to provide for us in the future when we no longer wish to work and to act as a buffer should we need it in the short-term (the rainy day fund as it is commonly referred to).

In an ideal world, we would get a high return on our money with little or no risk that it would fall in value. Unfortunately, we don’t live in an ideal world so must accept that the higher the return we wish to receive on our money the more risk we need to take with it (or conversely, if we can’t risk seeing it lose value, we have to accept low returns.)

While risk and return are inextricably linked, we can try to maximise the return we get for any given level of risk. If two investments offer the same return potential, logically you would choose the one that takes less risk in achieving those returns.

Risk in this context is measured in volatility or, from what you may remember from your school days as being referred to as standard deviation. Simply, how much the returns vary relative to the average of those returns. The greater the standard deviation the greater the range of potential returns, and therefore risk. In other words, it is more volatile.

Gold Is Neither One Thing Nor Another

The problem I have with gold is that it is neither one nor the other; it does not offer the short-term security of cash nor the long-term investment returns of the global stock markets.

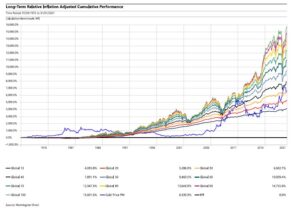

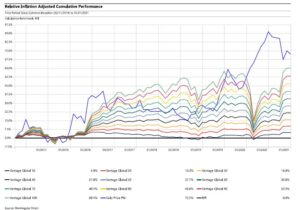

The returns are not guaranteed to beat any major equity markets and the volatility can be considerably higher. By way of comparison, the charts below** are an analysis of gold relative to portfolios invested in global stock markets and bonds in 10% increments (i.e Global 10 is 10% stock markets and 90% government bonds) and relative to inflation.

Long term relative performance:

Looking at the long-term returns the gold price has a return like that of a 30% equity portfolio but with volatility greater than 100% global equities (over a timeframe that includes the 73/74 oil price crash, 3 major wars, the tech bubble bursting, the war on terror, a major global financial crisis and a global pandemic).

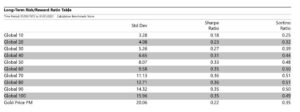

The table below compares the returns using different risk metrics; Sharpe Ratio and Sortino Ratios measure the risk-adjusted return (i.e is the risk you are taking given you any additional extra return?). The higher the number the better.

You can see that on any measure, investing in gold involves taking more risk in terms of volatility (standard deviation) than any stock market investment portfolio and with risk-adjusted returns only better than lower equity stock market portfolios.

Short-term performance:

The second chart below shows that over a shorter time frame (since 1st December 2014) gold has provided a better return (due to the rush to gold in the pandemic) but at much greater price volatility (standard deviation of 16.04 compared to 13.71 for the 100% global equity portfolio).

So, when considered in this context it raises the question of why you would hold gold in a portfolio unless you are a government, central bank or large financial institution. You are better off keeping the money you don’t want to lose or can’t afford to lose in savings and investing the long-term money into a globally diversified stock market portfolio.

Any gold you own can then be decorative rather than speculative.

*Source: ‘Value(s)’, Mark Carney, William Collins Publishing, 2021.

** Charts provided by EBI Portfolios Ltd

Photo by Rafael Souza on Unsplash