I previously wrote about how gold should be for decoration, not speculation, and now gold is back in the headlines I thought it worthwhile providing an updated article.

As uncertainty surrounding global politics and economics rises, inflation proves stickier than expected, investors have been flocking to gold as a safe haven. Its recent strong performance, combined with the post-Liberation Day crash in stock markets, bond prices and the value of the dollar, creates a classic case of herd mentality and fear of missing out.

Yet looking beyond cumulative returns suggests that such emotions can be costly. Gold’s glister hides contextual nuance, where timing has made all the difference between success and disappointment.

Gold Looks Good — But Timing Skews the Story

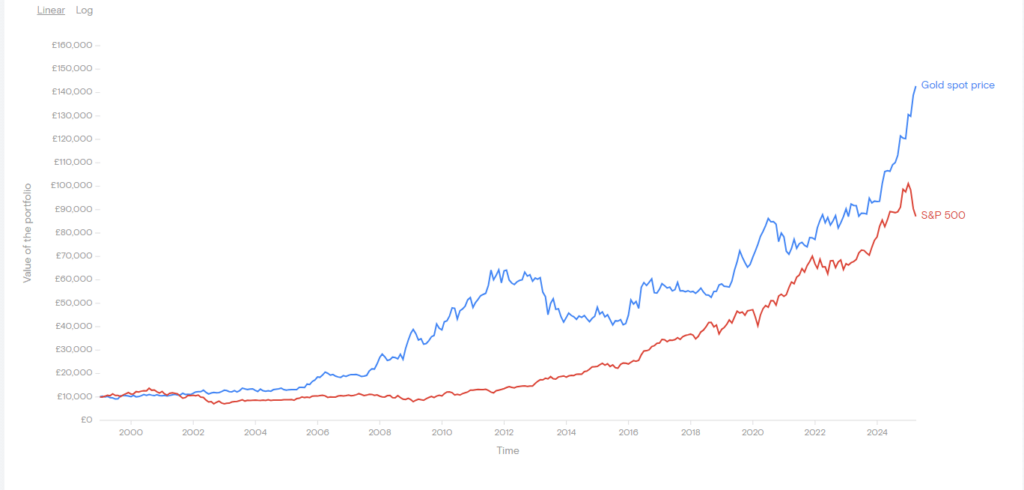

If you had invested £10,000 in gold in 1999, you would have enjoyed impressive growth over the past 25 years. On the surface, this makes gold look like an obvious winner, outperforming the world’s largest stock market, the S&P500 (image from Curvo.eu).

But appearances can be deceptive. The starting date of 1999 captures a period when gold was near historic lows, just before a series of economic and financial crises that pushed its price upwards:

-

The bursting of the dot-com bubble (2000–2002)

-

The Global Financial Crisis (2008–2009)

-

The European debt crisis (2011–2012)

-

The COVID-19 pandemic (2020)

-

The Ukraine Crisis and ensuing inflation peak (2022)

-

The Trump-induced geopolitical tensions and inflation fears (2025)

Each of these episodes triggered a surge in gold prices, but between these moments gold has often stalled or declined. Choosing 1999 as the starting point flatters gold’s long-term return, but not everyone invested at precisely the right moment. Most certainly wouldn’t have held on for a quarter of a century either.

Why Fixed Time Comparisons Are Misleading

Comparing investment returns from a single starting point (like 1999) gives an incomplete and often misleading picture. Investors who bought gold just a few years earlier or later would have seen very different outcomes. Rolling returns provide a more thorough analysis.

What Are Rolling Returns?

Rolling returns show how an investment performs across multiple overlapping periods. Rather than picking a single start and end date, rolling returns calculate the outcome of investing over rolling time windows, such as every 5-year or 10-year period.

This approach gives a much clearer view of how consistent an investment’s returns have been, helping investors understand what they might realistically experience depending on when they invest.

5-Year Rolling Annualised Returns

The chart below shows 5-year rolling returns for gold, global stocks (S&P 500), and a 60/40 portfolio of global stocks and bonds: Click to enlarge.

What We See:

-

Gold delivered some extraordinary 5-year returns, particularly after crises, but also experienced periods of near-zero or negative returns.

-

The S&P 500 produced strong growth over many 5-year periods but endured painful drops following the dot-com collapse, the Global Financial Crisis and COVID.

-

The 60/40 portfolio remained consistently positive through most periods, delivering steadier returns with far less drama.

For investors making decisions every 5 years, gold offered both the highest highs and the lowest lows. A dangerous combination for anyone prone to reacting emotionally.

10-Year Rolling Annualised Returns

Examining 10-year rolling returns provides a more meaningful long-term perspective: Click to enlarge.

The Longer-Term Picture:

-

Gold’s 10-year returns remained highly variable. While some periods delivered strong growth, others offered minimal or even negative real returns.

-

The S&P 500, though cyclical, rewarded patient investors who stayed invested over full 10-year periods.

-

The 60/40 portfolio demonstrated remarkable consistency, rarely experiencing negative 10-year returns, even through major crises.

For long-term investors focused on retirement, it is this kind of consistency that helps protect wealth and provides peace of mind.

What Changes Over 10 Years?

-

Gold’s extreme ups and downs smooth out somewhat, but wide variations remain depending on the start date.

-

The S&P 500 continues to reward patience, delivering solid long-term returns after periods of volatility.

-

The 60/40 portfolio demonstrates remarkable consistency, avoiding both severe losses and extreme gains.

For long-term investors, particularly those investing for retirement, consistency matters more than occasional bursts of performance. The steadier the journey, the less temptation there is to make emotionally driven decisions that destroy wealth.

The Core Problem With Gold as a Long-Term Investment

Gold’s strength lies in its role as a hedge during times of economic stress and uncertainty. It can provide protection when markets fall sharply, but offers no ongoing income or organic growth. Outside of crisis periods, its returns are driven purely by shifts in investor sentiment and macroeconomic conditions.

This makes gold a poor candidate as a core long-term investment. Its volatility, combined with investors’ tendency to chase performance, exposes many to the Behaviour Gap.

Coined by financial adviser Carl Richards, the Behaviour Gap refers to the costly difference between the returns markets deliver and the returns investors actually receive. Investors tend to buy after assets have done well and sell after they have fallen, locking in losses and missing subsequent recoveries.

Gold’s speculative nature makes it especially prone to this problem. Investors rarely buy gold during quiet, stable periods. They buy when fear is high and prices are rising, usually just before prices peak.

By contrast, a diversified portfolio of global equities and bonds provides growth during expansions, stability during downturns, and the kind of consistent returns that reduce the temptation to tinker.

Market Timing Rarely Works

The worst outcomes in investing often come not from poor investments but from poor timing. Jumping into gold after recent gains risks repeating the cycle where investors enter too late and exit too early, widening the Behaviour Gap.

A better approach focuses on building portfolios that work across different economic conditions, not just during crises. Global equities provide growth; bonds offer stability; together they form a balanced foundation that can weather many types of markets without the wild swings that invite panic.

Investing Is About Staying Invested

The temptation to chase recent winners like gold is natural, especially when headlines scream about record highs. But successful investing is not about guessing what will rise next. It is about building portfolios that work across market cycles and, most importantly, sticking with them.

Avoiding the Behaviour Gap, staying invested, and focusing on long-term consistency will serve investors far better than chasing the next glittering trend.

Photo by Jingming Pan on Unsplash

Data provided by Curvo.backtest.

ChatGPT was used to analyse data.