The Roman Empire lasted 500 years and reached as far as Northern England, the Middle East and North Africa.

The Mongol Empire lasted 160 years and was the largest continuous land empire in history, stretching across Asia to Eastern Europe and the fringes of the Arctic.

It was boasted that the “sun never set on the British Empire”, reaching, at its period of greatest power, from North America across Asia to Australia and New Zealand until its break up in the mid-20th Century.

Sir Alex Ferguson led Manchester United to dominance in English football during the 1990s and 2000s until his retirement in 2013.

At their height, it would have been impossible to see how these empires could be usurped, their power and influence lost. History, however, has shown that empires don’t last forever.

Corporate Empires

It is the same with companies. History is littered with stock market favourites who dominated the, often many and varied, industries they operated in. At their height, they provided the owners of their shares with substantial dividends and huge profits.

The Dutch East India Company was the first public limited company; it exerted a huge influence on global trade. Founded in 1602 it enjoyed monopolistic power over the trading of goods in Asia which brought the luxuries of the East to the markets of the West.

JD Rockefeller’s Standard Oil company was one of the largest companies in the world in the late 19th and early 20th Century. Such was the company’s success (it owned 90% of all oil in the US), Rockefeller was one of the richest men to have ever lived.

More Recent Corporate Empires

But we don’t need to look back as far as the 19th Century for examples of business empires. Jack Welch presided over General Electric which became the ‘poster boy’ for operational efficiency and market influence in a diverse range of industries from aviation to kitchen appliances; air conditioning to healthcare. Its demise came about after Jack Welch stepped down, leaving in his wake large debts, accounting scandals and terminal strategic errors.

As the chart from Google Finance below shows, at its peak before Jack Welch’s retirement, the shares were trading at $330, today they are worth less than half of that.

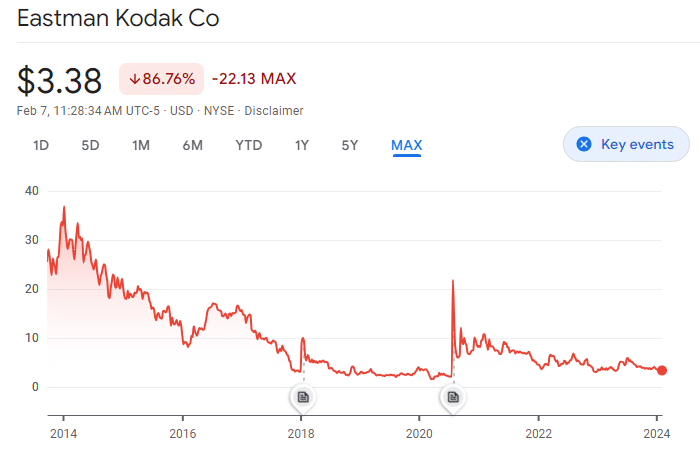

Remember too, Kodak, whose dominant position in the photography market led to hubris and, to protect its film manufacturing operation, an unwillingness to enter the nascent digital world. Shares in Eastman Kodak were $90 in the 1990s, they are now trading for around $3.

Lehman Brothers became synonymous with corporate greed and excessive risk-taking during the Credit Crunch, when the scale of the subprime mortgage book it heavily invested in became clear. Overnight it went from one of the largest and most well-known and respected investment banks in the world to bankruptcy. Its fall had repercussions felt across the world as governments and central banks fought to control the financial contagion it and other banks created.

What’s the Lesson for Investors?

The point of this history lesson is to show that companies may look like they can do no wrong; they are the golden geese that keep on giving to investors, but as we learnt from the likes of GE, Eastman Kodak and Lehman Brothers, even the largest companies fall. Often with the greatest amount of damage due to the amount of money they attract from investors all wanting a piece of the action. As my rugby coach used to say “The bigger they are the harder they fall.”

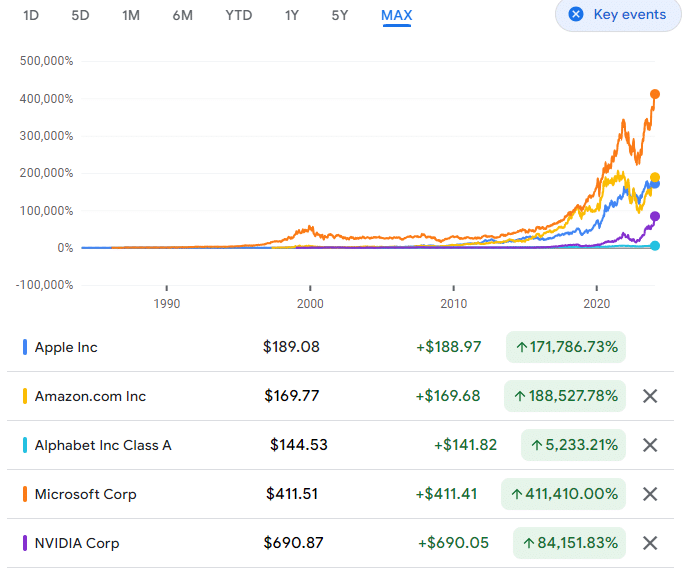

Consider the ‘Magnificent 7’ of Apple, Alphabet, Amazon, Meta, Nvidia, Tesla and Microsoft.

These corporate behemoths are dominating the US stock market; the demand for their shares on the wave of the tech and AI revolution has delighted institutional and private investors alike. Their fall from grace is hard to see.

But one thing is certain, there will come a time when they are no longer the greatest companies in the world. When that point will be and whether the trigger is a single event or a slow decline is unknown but many of today’s happy investors will be left nursing losses.

How Does The Succesful Investor Do It?

The successful investor knows not to put too much into a single company. Sure, they are enjoying the dramatic rise of these share prices but in a controlled way. They are part of a broad spread of shares made up of index funds invested globally.

They may not be enjoying the meteoric rise in their portfolios compared to other investors who are taking an ‘all-in’ approach, naively confident they will get out when the time is right, but these successful investors know the losses won’t be as painful and, by investing broadly, they are also in place to enjoy the rise of tomorrow’s great companies.

On a similar theme, you can read about Neligan Financial’s Investment Philosophy here.