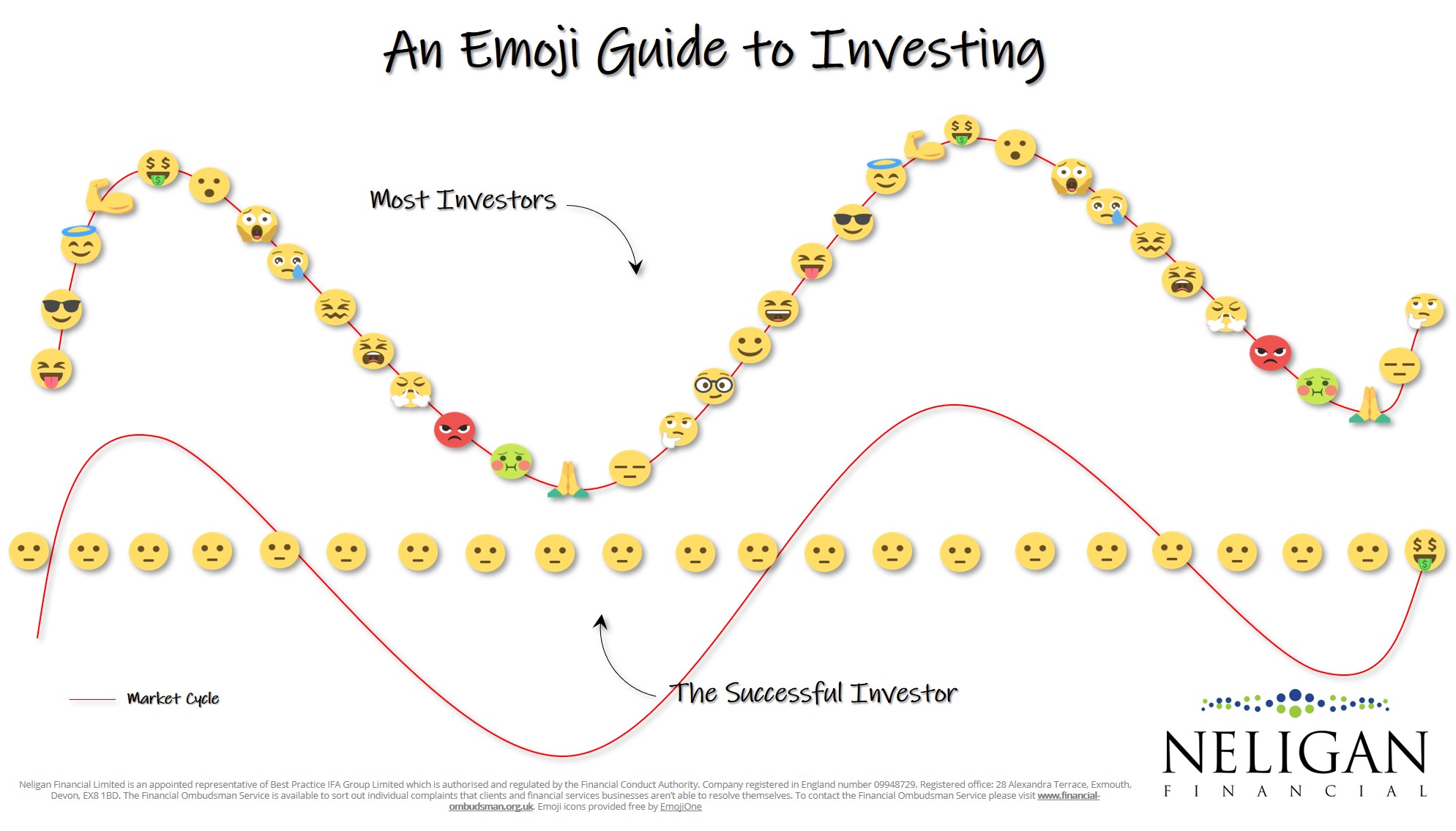

It is said that fear and greed are the primary drivers of stock markets; fear when markets are falling and greed when they are rising.

However, despite it being tempting to avoid the crashes and make the most of the gains, it is extremely hard to do with any success. You might get lucky once but if you come out of the markets on time you need to know when to come back in and vice versa. The mass media have a penchant for gloomy headlines which means the market timer will find the courage to re-enter the stock markets long after the recovery has begun.

Evidence shows there is a significant investment return drag on the portfolios of those who believe they can successfully time the markets. Lower investment returns mean less wealth which means fewer choices around what you can do with your money and when.

The successful investor has the patience and discipline to take the stock market rough with the smooth. She remains stoic in the presence of market highs and markets lows and, as a result, is more likely to enjoy the freedom and financial security sooner than the masses.