To non-financially minded people, it can be difficult to grasp how much you need to invest to grow a pot of capital for your future benefit. Perhaps reframing it to something more familiar may help.

Consider your weekly shopping bill: what you spend will depend on the number of mouths to feed and where you shop so let’s assume three different shopper’s habits: Linda Lidl, Timothy Tesco and Wendy Waitrose.

- Linda Lidl is a more frugal shopper and spends an average of £75 a week on her food and drink.

- Timothy Tesco is middle of the road spending £100 a week.

- Wendy Waitrose is less price conscious and spends £150 on her shopping bills.

Now let’s assume they save the monthly equivalent of their monthly shop into a personal pension. One of the major benefits of a personal pension is the free money provided by the Government in the form of tax relief; the Government adds on 20% directly into the pension for every contribution made (though limits do apply, they’re not that generous. But you already knew that).

So, the monthly contributions after tax relief for our three shoppers are:

- Linda Lidl – £375

- Timothy Tesco – £500

- Wendy Waitrose – £750.

The purpose of pension, as with any type of investment, is to get a higher return on your money than if you left it in the bank and an irrefutable fact about investing is that the greater return you want on your money the greater variation of returns you must accept. Investment professionals call this volatility and it is inherent when investing in shares.

If you are uncomfortable with a higher variation of returns you will have to accept lower long-term returns which means less money in the pot for you to use in the future. History shows us that over time, shares provide a greater return than any other asset class so accepting more volatility is the prudent approach for most people when the investing timeframe is greater than 5 years.

To keep it simple I’m going to assume that our three shoppers take the same amount of investment risk and invest in a portfolio that is 60% shares and 40% fixed interest securities. They, therefore, benefit from the same average annual growth rate which I’m assuming is 4.97% after charges.

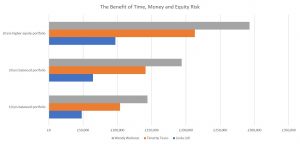

Let’s now assume they are all fifty and want to retire in ten years’ time. Inflation would have a role to play over the 10-year investment term, so if we assume an average annual inflation rate of 2.5%, over the decade their respective pots will grow to the following values:

- Linda Lidl – £48,000 (from a total spend of £36,000. A profit of £12,000)

- Timothy Tesco – £64,300 (from a total spend of £48,000. A profit of £16,300)

- Wendy Waitrose – £97,000 (from a total spend of £72,000. A profit of £25,000)

For the more visually minded of you, this is what it looks like:

If time is on their side and they have longer to invest the value of the respective pensions after 20 years (everything else remaining equal) would be:

- Linda Lidl – £104,000 (from a total spend of £72,000, so a profit of £32,000)

- Timothy Tesco – £141,000 (from a total spend of £96,000, so a profit of £45,000)

- Wendy Waitrose – £213,000 (from a total spend of £144,000, so a profit of £69,000)

So you can see how regular habits reward the investor over time through the wonder that is compound interest.

But what if, as well as investing for longer, they accepted more investment risk to generate higher returns?

With an annual growth rate of 7.97%, as opposed to 4.97%, the respective pots would grow to:

- Linda Lidl – £144,000 (a profit of £72,000)

- Timothy Tesco – £194,000 (a profit of £98,000)

- Wendy Waitrose – £293,000 (a profit of £149,000)

The combination of time, greater monthly contributions and equity returns, therefore, has a huge effect on one’s financial freedom and financial security.

The difference in accrued pension funds between Linda Lidl investing smaller amounts, with lower risk over 10 years and Wendy Waitrose taking more investment risk, with greater monthly contributions over a longer period of time is a whopping £245,000.

Having read this far, you might be thinking to yourself: ‘Hold on! If I invest what I normally spend on my shopping bill how am I going to eat?’

Of course, I’m not suggesting you starve yourself but perhaps you can find other areas of your expenditure that can be saved. As your shopping will contain a mix of proteins and fats (hopefully in the appropriate proportions), your expenditure will also be made up of the equivalent lifestyle fats and proteins, A review of your expenditure may show that you are spending money on items that you don’t truly value and could be used to pay your future self.

So, the overall message is, if you want to enjoy financial freedom whilst knowing you have financial security you need to start planning today.

If you would like to talk about your retirement planning contact me.

Photo by Simone Hutsch on Unsplash