Recently, my Twitter feed has pushed two promotions to me from a well known direct-to-consumer investment platform. Both were relating to “rumoured” IPOs from two well-known brands: Wolverhampton Wanderers and Centre Parcs.

Apart from the arguably cynical ploy to obtain consumers’ details for further direct advertising and the questionable practice from a trusted brand which, from a behavioural psychology perspective could be deemed as advice by other means, is it wise to invest in the shares of well-known brands when they IPO?

What is an IPO?

Let’s start with some background, an IPO stands for Initial Public Offering (also known as a floatation) and happens when a company wishes to raise capital beyond what is available through its day-to-day profits and cashflow. It, therefore, decides to change from a private company whose shares are owned by a handful of people to a public company where the shares are owned by investors the world over.

It becomes a public company by listing on a stock market index such as the FTSE100 here in the UK or the S&P in the US. Depending upon the value of the company at outset it may list on different markets. For example, in the UK the largest firms are listed on the FTSE100 whereas smaller companies are listed on AIM (the Alternative Investment Market).

IPOs tend to happen to more fanfare in the US than over here and often with very different levels of success*.

A Well Known Brand Does Not Equal A Good Investment

When I was young, Manchester United floated on the stock market. As an avid fan, my parents wondered if it would make a good investment. Rightly or wrongly they were advised against it by their bank manager but the thought process illustrates an important point.

Psychologists refer to the Halo Effect, which is the tendency to apply positive assumptions to all aspects of a brand or person simply because they are regarded positively for one particular aspect.

For example, I am more likely to trust George Clooney because he is an attractive person and famous actor than somewhere I bump into in the street.

We see it in advertising as well, by using famous people to endorse their products, regardless of any natural association, companies expect consumers to have a positive perception of a product or service. For example, I don’t know what Jessica Ennis, Rory McIlroy or Jenson Button know about banking but having them endorse Santander in their advertising infers positive perceptions for the bank.

But, as I commented in the Tweet mentioned at the start of this post; just because our children love Centre Parcs, and just because we love that our kids love Centre Parcs, it does not mean that investing in Centre Parcs is a good use of my hard-earned money.

So Should You Buy Shares At IPO?

When Margaret Thatcher’s government privatised the utility companies and other major institutions, private investors were offered the opportunity to buy the shares. Many did so, particularly following successful advertising campaigns. Many of whom still own the various privatised shares now and will have enjoyed an attractive long-term return from some, but not all, of them.

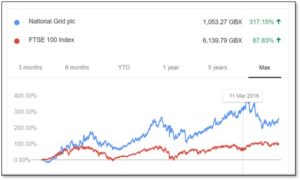

National Grid**, for example, has comfortably outperformed the FTSE100 index since it privatised in 1995.

BT, on the other hand, enjoyed a meteoric rise to the turn of the millennium but fell sharply thereafter and has failed to reach the same level again…

It wasn’t a privatisation event but I was working at Standard Life when they floated in 2006 and the shares have been volatile ever since (nothing to do with me I hasten to add!). They have ultimately underperformed the index over the 13 years since they launched…

It’s not that shares in newly listed companies won’t do well but the risk of them losing money from the outset or overtime is too great relative to the potential return. BP is a great example following the Deep Water Horizon tragedy.

Spread The Risk

As your parents would have told you when you are young, don’t put all your eggs in one basket. If you want to enjoy the higher potential returns from shares it is far better to invest in a large number of the great companies of today and tomorrow by owning the whole index. That way, you won’t get burnt by the good company that goes bad but can still enjoy the uplift of the stock market darlings that deliver above-market returns. I Don’t believe you can consistently find the stars and avoid the duds. You can’t. Nobody can.

Moreover, it’s not just that you might lose money on the investment, there is also an opportunity cost. By making one investment decision you are choosing not to invest your money elsewhere. The benefit of investing globally is the opportunity to have a higher potential return for lower overall risk because you are removing the unsystematic risk of a single company share but accepting the inevitable systematic risk of global stock markets in the knowledge that over the long-term, the patient and disciplined investor gets the rewards.

All that said, I’m not against money that you don’t mind losing being used for a bit of a punt. Just don’t think it will bring you all the answers to your financial needs.

If you would like to talk about investing your money sensibly please do get in touch. www.neliganfinancial.co.uk/contact-us.

*the content of this website is for information only. It is not connected with Neligan Financial in any way and the opinions or content does not automatically reflect the opinions of Neligan Financial.

**All charts are taken from Google Finance.