It’s common for people to get in touch with me looking for advice on whether to combine their pensions. They’ve got to the stage in their careers that they have moved jobs a number of times and in that time accumulated different pension pots, all of them with differing values and with different providers.

This has led to uncertainty over what they have, what each one is worth and what income it all might provide in retirement. It’s not uncommon for there to be a vague recollection of a pension from a job many years ago but no details of who the pension provider is. In such instances, the pension tracing service can be of help.

As I have written in this article, comparing pensions based on how they performed can be misleading but there can still be reasons to consolidate them all into one pot:

- It provides clarity on your pension saving. You can more readily identify how much you have accrued towards your retirement savings to get a sense if it is likely to be enough, Or, if you have been a diligent pension saver, have enjoyed periods of high earnings or received generous employer contributions you can gauge whether you are likely to breach the Lifetime Allowance (LTA). The LTA is the total pension value anyone can have before they have to pay a charge on the excess. The LTA is currently £1,055,000 and increases in line with annual increases in CPI each April.

- A more appropriate investment approach. Many older pensions can be left in funds that are no longer fit for purpose. The performance may be below average, the risk profile inconsistent with your needs and the charges high. It is an unfortunate reality that many older pension funds are ‘dead’ funds with little incentive to outperform their peer group.

- High Charges. The older the pension contract the higher the chance that the charging structure is complex and costly. Pre-2001 pension contracts would often have varying costs: admin charges, annual policy fees, fund management costs, increased charges when regular contributions ceased and a cut taken every time a contribution was invested (known as the bid/offer spread). The introduction of Stakeholder pensions with their single charge requirements and a price-cap redressed the balance to the benefit of the policyholder but anyone with older funds may find that their funds are being held back by high charges.

- Enhanced Transfer Values. Sometimes the incumbent pension fund may be offering a higher transfer value compared to the actual value of the fund. This is typically because the fund is invested in With-Profits and, due to the prevailing market conditions at the time, there is a final or terminal bonus applying to plan. These final bonuses are not guaranteed and could be higher or lower in the future so you would need to decide if taking the bonus on offer is right for you.

- Taking an income. In 2015 the then Chancellor, George Osborne, announced sweeping changes to the rules surrounding access to pension funds. This increased the flexibility of when and how pension savers could draw an income from their accrued pots. If you have got to the stage when you are ready and in need of drawing some income a consolidation of the pots may make this an easier exercise, particularly if older pension contracts do not enable flexible income to be taken.

- Better death benefits. At the same time as increasing the income flexibility of pensions, the way they are treated on death also improved. Previously only spouses and other financial dependents could inherit a pension fund otherwise they were lost on death. This meant decades of purposeful saving and diligent management could go to waste if a pension holder died soon into retirement or managed not to deplete their fund by the end of their life. Now it is possible to pass the accrued funds down to future generations thereby potentially increasing the longevity of the pension by many decades and, in so doing, boosting the financial security of spouses, children and even grandchildren.

However, whilst there are many reasons to consolidate your pension pots there are also reasons why it might not be a good idea.

The Arguments Against Consolidation

- Lower charges. Whilst it is true that some older contracts are higher charged others can be particularly competitive in terms of their cost. This is particularly the case if you have worked for a large employer that may have negotiated a good deal from the pension provider on behalf of its employees. As a rule of thumb, a total annual charge (often referred to as the Ongoing Charge Figure or OCF) of less than 0.7% represents a competitive price.

- Enhanced Tax-free Lump Sums. A benefit of pension funds compared to less tax-advantaged investments is the ability to take 25% of the fund as a tax-free lump sum at retirement. This is also known as the Tax-free Cash (TFC) or Pension Commencement Lump Sum (PCLS). All pension funds are entitled to this benefit but some older ones may have a protected tax-free lump sum greater than 25% which would be lost if it was transferred to a new plan. Transferring won’t lose the ability to take the 25% tax-free but the additional amount means you may end up paying more in income tax when the pension fund is accessed.

- Transfer penalties. Some older pension contracts also have penalties that apply on transfer to another pension fund. This will be for one of two principal reasons. Either the pension is invested in a With Profits fund of the incumbent provider and there is a Market Value Reduction (MVR) or Market Value Adjustment (MVA) (essentially the same thing) which reduces the value of the fund due to stock market losses. Or, the contract has a charging structure that applies higher charges to initial units in the fund that have not been taken in full throughout the expected term of the contract so are levied when the fund is transferred.

- Guaranteed growth rates. With-Profits funds sometimes have a guaranteed growth rate, usually in the range of 4-5% pa that would be impossible to achieve without taking a degree of investment risk. Depending upon your appetite for investment risk and return, timeframes and investment objectives these guarantees may well be worth hanging on to.

- Guaranteed annuity rates. Another type of guarantee that was a feature of older style pensions are guaranteed annuity rates (GARs). If you hear an alarm bell going off in your head it might be because it was these GARs that was the undoing of Equitable Life. However, since the demise of Equitable Life more stringent capital adequacy rules apply to make sure pension providers can match these types of commitment. An annuity is an income payment for life which is paid for with the accrued pension fund at retirement. All annuities are guaranteed once in payment but some contracts offer the guarantee of rates that are much higher (possibly two to three times higher) than would be available with current annuity rates. Having a guarantee of an annuity that is much higher than is available with current rates may be a way of meeting your essential expenditure in retirement without the need to take undue investment risk.

A Word on Defined Benefit (Final Salary) Pensions

The above comparison assumes that pensions are the type that received contributions and are invested in the stock markets by the pension holder and the accrued fund will be used to provide an income and/or be passed to future generations. Defined Benefit (or Final Salary pensions as they are also known) are the very attractive employer-sponsored pensions that provide a guaranteed, inflation-linked income for life with all the cost and risk borne by the company.

It is possible to transfer the capital value of these funds to a private pension but as I explain in this article, there are many risks in doing so and for most people the downside of giving up a guaranteed income that will be payable for many decades is much greater than the benefit of taking the capital value on offer.

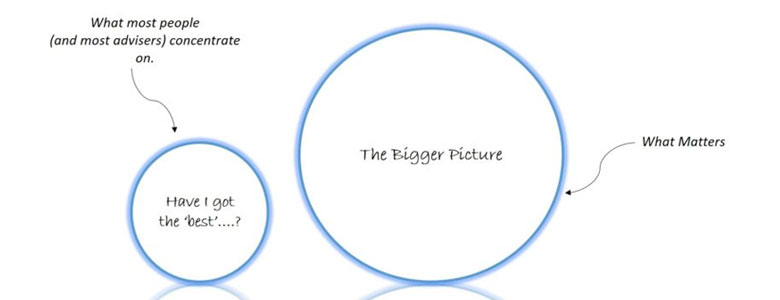

If you are thinking about transferring any pensions none of the above factors should be taken in isolation. A thorough review of the advantages and disadvantage of transferring your pensions should be carried out and done in unison with a planning exercise to determine whether you are even on course to have enough retirement income when you need it by. Deciding to transfer your pensions without the context of knowing how much is enough is like moving the deckchairs around the Titanic: it may feel like you are doing something useful but it is ultimately futile.

If you would like to consider your pension strategy contact me here: www.neliganfinancial.co.uk/contact-us.

Photo by Louis Hansel on Unsplash