Is it possible to invest for investment returns while remaining true to your values?

The campaigning of individuals such as Sir David Attenborough and Greta Thunberg, and movements like Black Lives Matter and #MeToo has brought issues of climate action and equality to the fore. Even going back to 2009 and the Great Financial Crash the Reclaim the Streets protests brought the issue of corporate power and mismanagement to the attention of millions across the globe.

Alongside this willingness for people to vote with their feet there has also been a sector of the community who have also wanted to vote with their wallets, or at the very least know that their money isn’t being used in a way that was juxtaposed to their values.

The first ethical fund was launched in 1971 by a group of Methodists in the USA opposed to funding the Vietnam war and the opportunities to invest ‘ethically’ have grown since.

However, as the sector has evolved there has never been a consistent definition as to what ‘ethical investing’ is or isn’t and different terms are used, often interchangeably. There is Ethical, Socially Responsible Investing (SRI) and Impact investing to name a few.

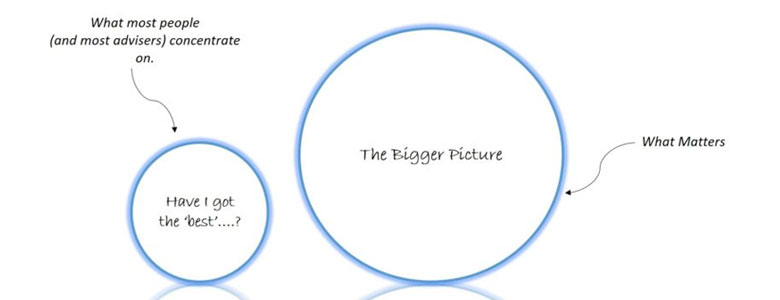

Furthermore, ethical investing has tended to be to the detriment of investment returns; because the cost of ethical funds tended to be greater (certainly compared to index funds) and because there is a smaller universe of qualifying companies the concomitant benefits of diversification are reduced. The result tended to be lower potential returns and greater risk.

ESG (Environmental, Social, Governance)

An area of ethical investing that has grown is ESG investing, especially over the past few years. Rather than apply screening filters exclusively (to avoid companies involved in particular sectors or to only invest in companies involved in specific sectors), ESG investing takes a broader approach to ensure selected companies are making a positive and measurable difference while at the same time providing investment return potential.

The selection criteria for a stock to be bought might be a combination:

- traditional exclusion based,

- that the company is a leader in its industry on ESG principles,

- that their practices are in line with the UN’s Sustainable Development Goals or,

- it aims to make a meaningful and positive impact through its practices and processes.

Growing Opportunities

As a result of growing demand by institutional and personal investors the opportunity to invest in line with your values has increased and not necessarily to the detriment of returns. Particularly, as there are now a growing number of low cost ‘passive’ funds that have been launched over the past few years.

Doing Well By Doing Good

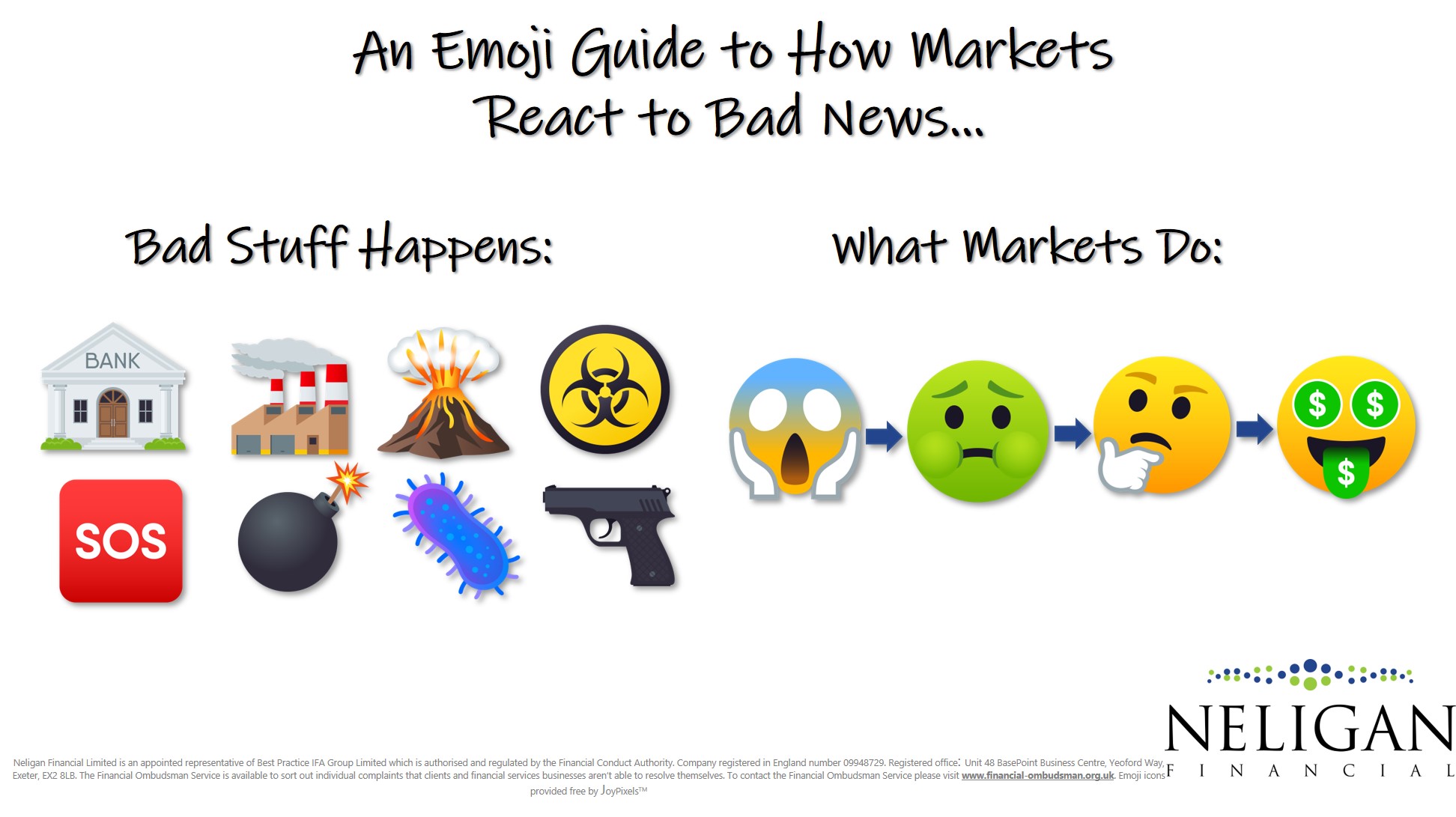

Interestingly, from a financial performance perspective, companies engaged in positive practices tend to demonstrate greater financial returns than their ‘non-ethical’ equivalents.

There have been a number of research studies done over the years that provide evidence to the fact companies that are run with positive practices do better. In fact, a study by Morningstar compared the performance of ESG related indices during the COVID outbreak and found that 89% (51/57) outperformed the main-market equivalent.

It is certainly logical that a company that considers its environmental impact, provides equal opportunities, fair pay, and is transparent in its practices should have more engaged staff, supportive stakeholders and loyal customers. All of which adds up to a greater financial performance.

‘Ponoby’s Nerfect’

In a perfect world you would be doing no harm with your money and you would be benefiting from strong investment returns. The problem is we don’t live in a perfect world.

Looking at some of the top holding in ESG rated funds you will see the likes of Facebook, Procter & Gamble, Nestle, Amazon and Google.

Each one of those companies will be there by right because they are making demonstrable positive changes to the way they operate and the how they affect the wider world. However, none of them are without their critics:

- Facebook have been dogged with data privacy issues, unethical consumer targetting and promotion of hate.

- Procter & Gamble produce products that contain palm oil, a major factor in rainforest destruction.

- Nestle’s sweets contribute to the obesity crisis.

- Amazon encourages consumerisation, credit card debt, and has been accused of unethical tax avoidance.

- Google have also been hit by unethical tax avoidance claims.

But, with ESG investing you have the chance to be part of the solution, not the problem. It’s acknowledging that it is very hard to be perfect but by at least allocating more of your money to the organisations that are at least trying to do their bit you can invest in line with your values too.

No Guarantees

There are very few guarantees in investing (and anyone who guarantees you a particular return should be treated skeptically) and so too with ESG investing. There is always the chance that so-called ‘sin stocks’ outperform ESG related stocks in the future but now that the explicit and implicit costs of values-based investing have come down the opportunity to invest in line with your conscience has increased.

If you want to understand more about how you can use your money for good, please do get in touch.

*Do Sustainable Funds Beat Their Rivals, Morningstar, June 2020