If I asked you if you would like to buy an annuity with your pension fund, if you are like most UK consumers, my guess would be you would answer negatively.

However, if I asked you if you would like a guaranteed income for the rest of your life, along with the option of including a continuing income for your spouse on death you might be more positive in your response. After all, in retirement, when the earned income stops the thought of knowing that you will still receive a regular income each and every month until you and die, and then for your surviving husband, wife or partner for the rest of their life sounds pretty appealing, doesn’t it?

The irony, however, is that both questions are asking the same thing and has been the subject of various studies over the years. An annuity is a guaranteed income for life that is paid for with a retiree’s pension fund that has been accrued over their working life. They also have the option to include a spouse’s benefit, a guaranteed period during which time the original payments continue and also have it rising in line with inflation too.

In 2015, George Osborne announced that nobody would be forced to buy an annuity ever again and with it, pension savers and many within financial services breathed a collective sigh of relief (except the annuity providers who saw their share prices plummet in an afternoon!). Why then, if the security of a defined benefit pension is so appealing, is an annuity so unattractive to the majority of UK retirees?

Could it be that annuities are the sheep in wolves’ clothing? In other words, are they look worse than they actually are?

The Case for Annuities

What turns many people off the idea of an annuity is that the capital that has taken so long to build up is given away to an annuity provider which, on early death, is lost. This is true but the cross-subsidy of some annuitants dying sooner than expected cancels out those who live longer than expected. Contrary to the opinion of some, annuity providers don’t look for ways to rip off retirees, their aim is to make sure they can continue to make payments for as long as all their annuitants live whilst making some profit.

It is important to consider what is possible compared to what is probable. Yes, you might well die earlier than expected but if you are in good health you probably will not. If you are in poor health or have lifestyle factors that reduce your life expectancy then this is accounted for in higher annuity rates.

The alternative to purchasing an annuity is to keep the fund invested and draw an income from it (this is known as Flexi-Access Drawdown or Uncrystallised Pension Fund Lump Sum). The downside to this approach is the exposure to investment risk; during a phase in life when tolerance for investment risk and the ability to withstand investment losses tends to reduce, a lower risk approach might be preferable.

If your willingness to take investment risk is low and you don’t wish to invest too much of the fund in the stock market; if you invest in shares and you panic and sell at the first downturn that comes along, or, if the level of income you are withdrawing from the fund is such that it can’t be maintained by investment growth, there is a very good chance that the pension pot will be eroded in your lifetime. At which time you may wish you accepted the loss of the capital in exchange for a guaranteed income for the remainder of your life.

On this basis, a guaranteed income may increase financial security and with it, peace of mind. A feeling that can’t be understated during the retirement years.

Annuity rates vary according to a number of variables, the most significant of which are:

• government bond yields (which annuity providers use to match the income payments they need to make),

• the age at the point of purchase,

• health and lifestyle and,

• the options you wish to include on the annuity. Like a car the more options you add on the more expensive it becomes which, in annuity terms, means a lower starting income.

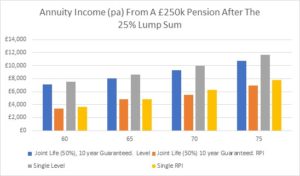

The chart below shows the different starting incomes receivable from the leading annuity providers based on current terms*. You can see the older the annuitant at the point of purchase the higher the income but also that inflation-linked (RPI) annuities have a much lower starting income.

The Case Against Annuities

There are three predominant reasons why annuities have become less popular over time:

Firstly, the rates offered have got worse over the past 10-15 years. This is mainly down to the fact that we are living longer so the payments are being made for longer but also because the yield from government bonds are at historic lows. As mentioned above, annuity providers use government bond yields to match their income liabilities. If the investment return they receive is lower the income they can pay has to be lower otherwise they risk paying out more than they receive. If this happens the annuity market risks breaking down and the UK’s annuity owners lose their retirement income.

Another reason why annuities are unpopular is because of the inflation conundrum. Retirements span multiple decades during which time the cost of living increases significantly; according to the Bank of England, an item costing £1,000 thirty years ago now costs £2,619. Having a static income for thirty years is going to bring significant limitations on a retiree’s purchasing power over time.

It is possible to purchase an annuity that rises in line with inflation but the downside to that is a severely reduced starting income (as shown in the chart above). The chart below shows the breakeven point for inflation-linked annuities assuming inflation rates of 2% pa and 3% pa. You can see it takes 26 and 37 years respectively for the annual income payments to match the higher level annuity payments. An early death can, therefore, be really costly for someone with an inflation-linked annuity but, even if life expectancy is met or even exceeded the higher costs in retirement tend to be in the first half when a retiree is fitter, more active and therefore has higher lifestyle costs.

The third reason why annuities are less popular is due to the loss of death benefits mentioned early on. Other than the option to continue income payments for a spouse or partner the annuity is lost on death. With a drawdown product, the residual fund can be passed on in full to a surviving spouse or partner and then on their death to the next generation. This can increase the longevity of a hard-earned pension across generations. However, this does assume the pension fund is large enough and appropriately managed to survive many decades. Based on the average-sized pension fund in the UK, most retirees may not leave much to beneficiaries if they live a long retirement.

So What’s The Best Approach?

There can be no one size fits all approach to retirement planning. It’s necessary to consider what is best in the context of your unique situation and priorities.

Someone with a lot of liquid wealth, multiple sources of income and a desire to help their children may well prefer to keep their pension fund invested. On the other hand, someone with limited financial means may decide that the financial security of a guaranteed annuity income is preferable.

For others a mix of the two may be appealing: committing part of the pension fund to an annuity to cover essential expenditure and keeping the rest invested to provide some inflation proofing and with the option to pass any residual fund to future generations.

If you would like help deciding on how to fund your retirement lifestyle please do get in contact: www.neliganfinancial.co.uk/contact-us.

*Source: Assureweb.

Photo by Michael Mazzone on Unsplash