This latest Emoji Guide looks at active vs passive investing and comes at a time that one of the UK’s star fund managers has hit the headlines for the wrong reasons.

A Fallen Star?

Neil Woodford was the darling of the fund management world during the noughties and up until the past few years. He was seen as a star fund manager and one of the greatest in the business who attracted billions of pounds into his funds due to his (perceived) skill at generating higher returns for his investors. Private and institutional investors alike poured billions of pounds into his funds expectant of marketing leading returns. He was lauded over by large wealth management firms who had his funds on their top buy lists.

However, last week he announced that he has had to temporarily close his fund due to unprecedented levels of redemptions (investors wanting their money back). It is not uncommon for funds to close to prevent further sales when redemptions are high. When it does happen it is usually by property funds that need to have time to sell properties to generate cash to return to investors. Equity funds tend to be more liquid but, due to high requests by investors to get their money back and the investment by Woodford in less liquid assets, this uncommon approach has been taken.

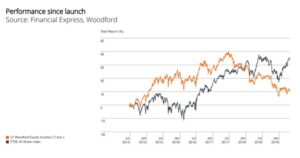

The reason for the high level of redemptions from his Equity Income fund was a downturn in the performance following some investment decisions didn’t work out as he expected most notably Provident Financial, Capita and the AA. The chart below (click to enlarge) shows the fund’s returns since it’s 2014 launch. The early years saw investors enjoying great returns only for recent performance to fall well below the FTSE All-Share Index he was trying to beat.

What Can We Learn From This: Active vs Passive Investing?

What Can We Learn From This: Active vs Passive Investing?

My point in highlighting the fall from grace of Neil Woodford is not to criticise him specifically; he did a very good job for investors when he was a fund manager at Invesco Perpetual and he might well turn the performance around again.

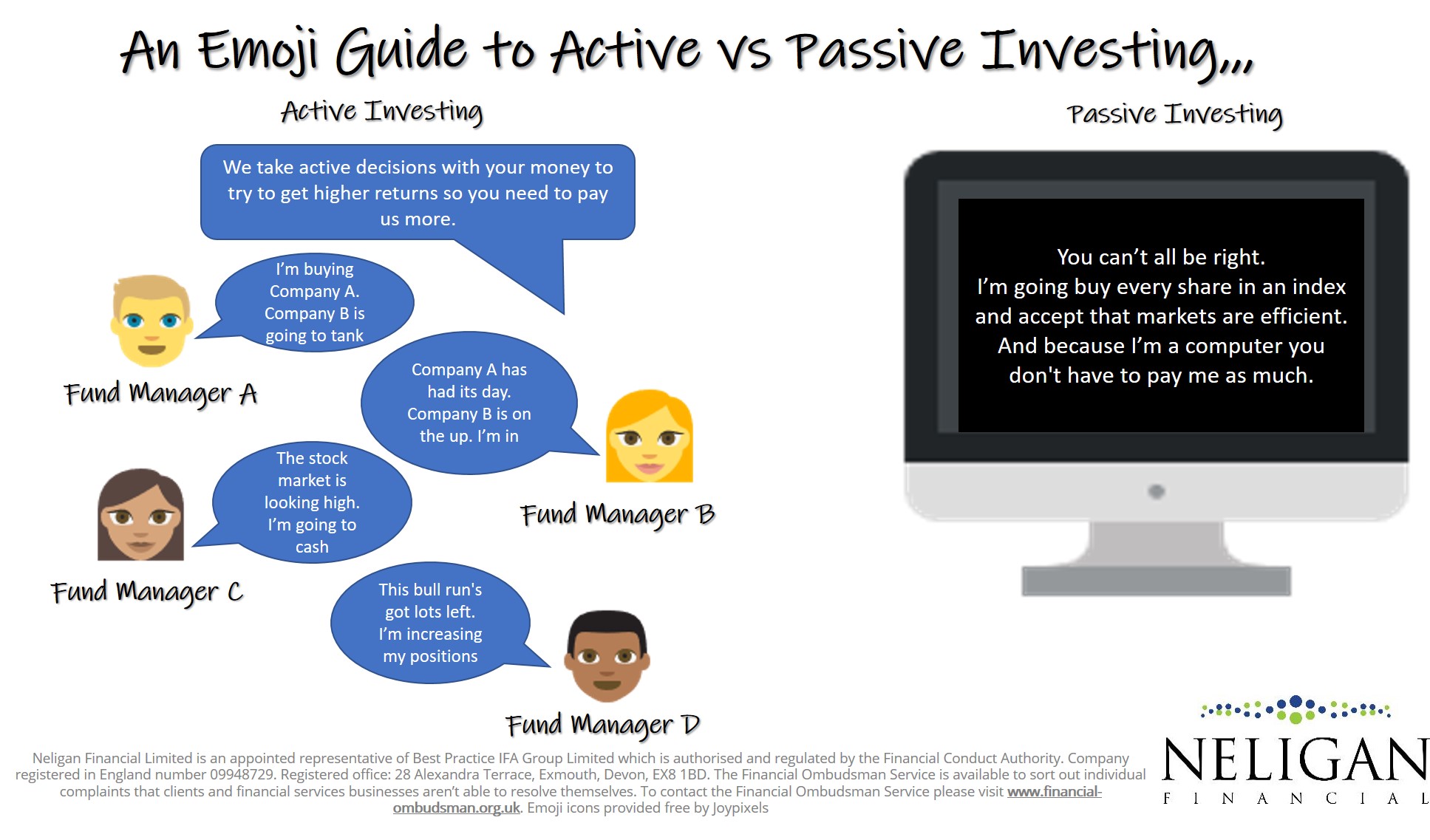

To bring it to the point of this emoji guide is the difference in active vs passive investing. Active investors like Neil Woodford believe that they have the skill and expertise to provide investors in their funds greater returns compared to the market (the FTSE All-Share Index) for example. They say they can find opportunities that others miss to invest in shares that will grow, sell shares in companies that are about to fall in value or even increase or decrease the amount they allocate to any particular asset class based upon their expectations of the future.

Active fund managers say that, because they are providing their expertise and experience to generate higher returns, they deserve to be paid more in fees.

Passive investors, on the other hand, say that it is not possible for active fund managers to consistently outperform an index or their peers, especially after accounting for fees. They look at examples like Neil Woodford and cite academic research that has shown skillful fund managers are few and far between. This research suggests that less than 2% of fund managers can rightfully be labelled as skilful, the rest who have periods of outperformance are just enjoying a period of luck which sooner or later runs out as returns revert to the average (or less than the average after charges).

Passive investments (also known as index funds) track an index like the FTSE All-Share and accept that they will not beat the market but also understand that stock markets are efficient: the value of the stock market on any given day is the combined knowledge of all investors across the globe. The value of the stock market is determined by the perceived aggregate value of the shares of all companies within the index which, in turn, is determined by investor’s expectations of the future performance of a company’s share price (and whether investors will be rewarded by risking capital to own shares in the company).

“You Might As Well Just Own the Haystack”

Such is the open access to information these days, passive advocates argue that it is not possible for any single investor to have access to more information that anyone (unless they are insider trading which is highly illegal). Therefore it is very hard, if not impossible, for anyone to gain an opportunity that will have sufficient long-term reward to justify higher fees.

Furthermore, investing is a zero-sum game. What that means is for someone to win, somebody else has to lose. If Investor A thinks Company Z’s share price is going to fall and wants to sell it he needs to find a willing buyer for there to be a market. If Investor B thinks Company Z’s is going to rise in value she will buy it from Investor A. They both can’t be right in their prognosis of Company Z.

This doesn’t mean that active investors can never beat the index or their peers. Some must do based upon the zero-sum game principle. The important point, though, is that short-term success is very hard to repeat unless a fund manager is one of the 2% who is skillful and not just lucky. They are like finding a needle in a haystack so, in which case, to quote the late index investing pioneer, Jack Bogle:

you may as well just own the haystack.

If you would like help understanding how you can most effectively and efficiently invest your money please do get in contact.